No, it's not a typo – I meant weak!

Last week we knew the Nasdaq was too toppy to hold 12,000 and, as hedges in our generally empty portfolio (since it's only two weeks old) we have been playing the Nasdaq Ultra-Long (TQQQ) short and you can see how quickly that spiked down from $175 all the way to $125 on what was actually a fairly minor correction (so far) for the indexes.

As we discussed back on Aug 21st, the TQQQ spread makes money two ways: We make money in the position in that our 10 March $125 puts get more valuable as TQQQ goes lower and they are now $31.50 ($31,500), up $6,500 from $26,000 at the time. We also make money on the premium decay as the 10 March $95 puts lose their value faster than the $125s and those are now $19 ($19,000) and we sold them for $15,000 so down $4,000 on those is net $2,500 (22.7%) gained on the $11,000 spread so far but the spread has the potential to return $30,000 below $95 – so it's still an excellent hedge.

Another hedge we placed was Tesla and our trade idea for them was:

Buy 1 TSLA March $2,000 puts for $413 ($41,300)

Sell 1 TSLA October $2,000 put for $227 ($22,700)

Tesla had a 5:1 stock split so now we have 5 March $400 puts at $97 ($48,500) and 5 short October $400 puts at $56 ($28,000) and that's already net $20,800 from our $18,000 investment for a $2,200 (12.2%) gain so far but time is really on our side on this one so it will be fun to track along the way.

Remember I said we would set up our hedges first since I called the Top in our Aug 22nd report as I wasn't going to initiate a portfolio buying longs if we thought the market was about to tank. What we have, so far, is a very minor correction, with the S&P 500, which finished the week at our 3,420 line, which is up 20% from 2,850, which is the "Must Hold Level" for the S&P to be bullish so we're still VERY BULLISH and only down 170 points (4.7%) from 3,590, which is our 5% Rule™ in action and, since we KNOW 3,420 is the 20% line, then actually 3,562 is the 25% line (as it's up 25% from 2,850, not 5% from 3,420), that's the real line to watch and the 30% line would be way up at 3,705 so we would count this failure as occuring at 3,562 and measuring from there.

Remember, the 5% Rule™ is not TA, TA is nonsense, the 5% Rule™ is MATH! Math is how we describe the universe – including the market universe. The math of the 5% Rule™ tells us that 25% (3,562) is just the 20% line (3,420) with an overshoot but now the key is how much of a pullback do we get? If the 20% line holds, then this could be bullish consolidation for a move up but, if it fails, then we can expect at least a 20% retrace of the 20% move up (-4%) and that would be 3,420-2,850 = 570 x 0.2 = 114. So 3,420 – 114 = 3,306 – that's the pullback line we need to keep an eye on. If that doesn't hold – then we may be in for a proper correction, probably back to the 10% line at 3,135, which will likely meet the 200-day moving average at that point.

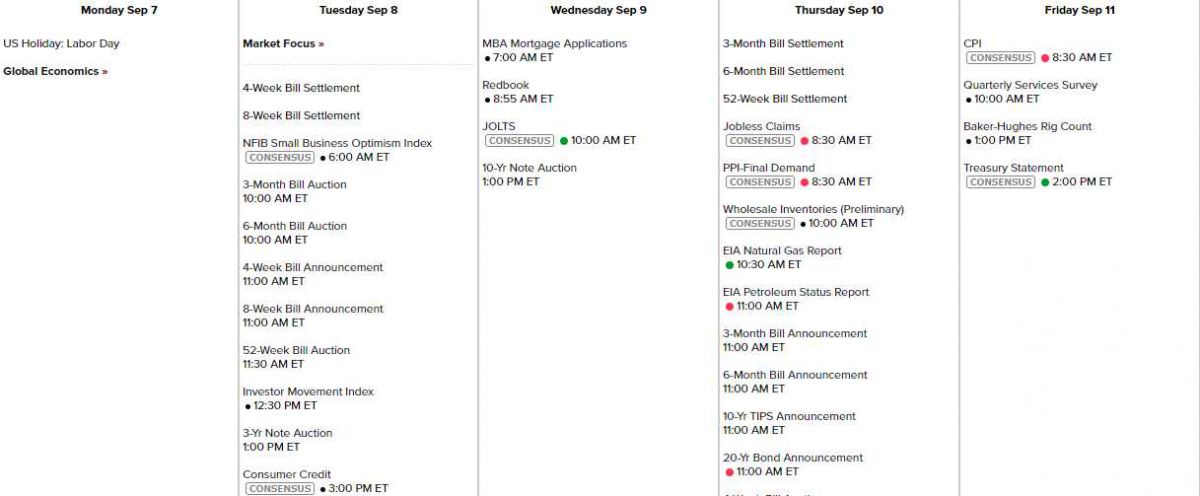

Meanwhile, next week is going to be a very low-volume affair and not much data due to the holidays, nothing expected to be market-moving and we did not have good momentum going in so it's not too likely to change without a positive catalyst and Congress is only just coming back, so it's not likely they'll have a stimulus deal and there's no pending virus cure that will be faster than Trump's November fantasy – so what good news will move the market?

There are some values out there and hopefully there will be more in the near future. We just featured Walgreens (WBA) for our Premium Subscribers and today I want to take a look at NetApp (NTAP), who are a cloud service company that is down about 25% for the year and closer to being down 50% from the 2018 highs despite making significantly more money in fiscal 2020 (ended 4/30) at $819M compared to just $116M in 2018. This year they are on a path to make about $700M but next year should be back around $800M and, while that isn't great growth – it is great earnings for a company you can buy for $10.3Bn at $46.40.

The recent volatility of the stock and the high VIX levels have driven the put prices high and we know the best way to buy a stock at a discount is get paid to buy it by a put seller. In the case of NTAP, we can collect a whopping $6 for primising to buy the stock for $35 between now and January of 2022 by selling the 2022 $35 puts for $6 – so let's do that:

- Sell 5 NTAP 2022 $35 puts for $6 ($3,000)

That puts $3,000 cash into our portfolio in exchange for promising to buy 500 shares of NTAP for $35. Since we are collecting $3,000, the net cost of each share for us would be $29 if assigned and that's $17.40 (37.5%) below the current price. If NTAP stays above $35, the option will expire worthless and we just keep the $3,000. Ordinary margin on those puts is just $1,168.54 so it's a very margin-efficient way to make $3,000 but even if you have an IRA and they require $14,500 in margin, $3,000 would still be a 20% return in 18 months – beats keeping money in the bank!

Another stock that's too cheap to ignore is Omnicom (OMC), who drop about $1.3Bn to the bottom line but, at $54, you can buy the whole company for $11.6Bn. It's a solid, predictable advertising business and the stock pays a 4.79% dividend. Like NTAP, we can just promise to buy them for net $41 by selling the April $45 puts for $4 and $41 is a $13 (24%) discount to the current price and $4 is of course, 10% to make against full margin in just over 7 months – a very nice return.

- Sell 5 OMC April $45 puts for $4 ($4,000)

So, we were already pretty bearish in our portfolio and now we're taking advantage of the sell-off to collect $7,000 in exchange for our promise to buy 2 stocks if they get 24-37% cheaper than they are now. This is making great use of our idle cash AND shifting the portfolio slightly more towards neutral to help lock in our quick gains of the first two weeks.