Try and try again.

More stimulus, more "exciting" vaccine news, more money being tossed around. This time it's M&A news with Oracle buying TikTok and NVidea (NVDA) buying ARM Holdings from Soft Bank (SFTBY) for $40Bn, giving both companies a nice boost. Oil (/CL) is up again on hurricane news but still pathetic under $37.50 but Natural Gas (/NG) is popping back to $2.40, ending the bear move that took it back to $2.25 from $2.70, which was a 16.66% correction.

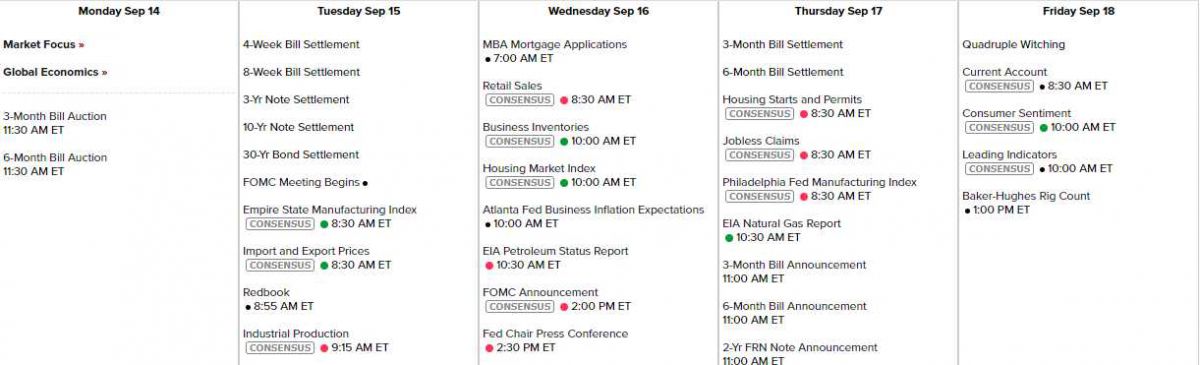

It's Quad Witching Week in the markets, when tock index futures, stock index options, stock options, and single stock futures expire simultaneously. So we can expect the unexpected this week – especially with a Fed Meeting on Wednesday along with Powell's speech at 2:30 that day. We also have Retail Sales on Wednesdy morning but, other than that, it's a pretty dull data week and I don't see what the Fed can do to help so I don't see this mornng's exuberance lasting, which means the Dow Futures (/YM) should be a good short at 27,750 when they cross below that line.

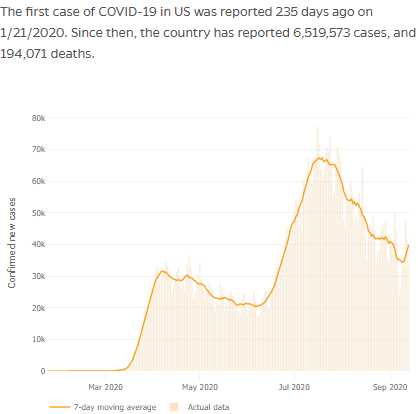

It's amazing to think that it's now September 15th and we are now beginning our 6th month in captivity since we finally began worrying about Covid on March 15th. There were about 80,000 cases, mostly in China at the time and now there are 29,030,058 this mornng with 6,520,606 in the US alone and, this week, we will pass 200,000 American deaths from Corona. 29M is 362 TIMES 80,000 and it's been 180 days so we've added 2 China's per day of victims since March and we are still growing at that pace and the complacency of the markets is stunning sine any of those 362 80,000 units of infected people are, very obviously, capable of infecting 29M more more people.

How much is 362 x 29M? 10.5Bn – that's more people than there are on the planet potentially affected in the next 6 months. Of course we are, theoretically, doing a better job of containing the spread but by "we", I certainly don't mean America, which is very likely to leap forward in cases by the end of the month as our elementary school incubators begin to do their jobs and re-infect the nation.

How much is 362 x 29M? 10.5Bn – that's more people than there are on the planet potentially affected in the next 6 months. Of course we are, theoretically, doing a better job of containing the spread but by "we", I certainly don't mean America, which is very likely to leap forward in cases by the end of the month as our elementary school incubators begin to do their jobs and re-infect the nation.

6.5M people is more than 1 out of 50 Americans with the virus. When we began our lockdowns only 1 in 100,000 of us had the virus, now it's 1 in 50 – that is not contained, is it? As you can see from the chart, 2/3 of the people in the US that have contracted Covid have done so in the past two months and our dip in new cases (if it's even real as Trump has blocked data-gathering) stopped higher than the previous high and you TA people know what that means for future growth, right?

Think about how hard is is to avoid coming in close contact with 50 people if you go out to shop or something. Now what happens if we have to avoid 25 people, 12 people, 6 people… This is the problem with this kind of virus – it spreads like a virus! We all know what happens when the kids come home with a cold and the whole house gets sick – and that is despite flu shots, which we've been working on for decades! This is not a problem that's going away "soon" and it's not likely we'll have anything like the robust economy the markets seem to be indicating.

Trade Workshop:

I still like our TQQQ hedge from our 8/22 Newletter, when I said:

While there are very good reasons that stocks like Apple (AAPL), Amazon (AMZN), Microsoft (MSFT) and Google (GOOG) are each trading over $1Tn (AAPL is $2Tn!) it's still kind of ridiculous and probably unsustainable so, as a proper hedge against the Nasdaq selling off between now and next year, I suggest the following hedge using TQQQ, which is a 3x Ultra-Short ETF on the Nasdaq. That means, when the Nasdaq goes 10% higher, TQQQ goes 30% higher but, conversely, when the Nasdaq drops 10%, TQQQ drops 30% and, since TQQQ is already insanely high, -30% becomes a very big number indeed.

See what happened to TQQQ in March? It fell from $120 to $40, a 66% drop when the market dropped 20%. Now it's up around $141 and even a 10% drop in the Nasdaq would knock it back 30% to $98.70. We can take advantage of this using put options as follows:

- Buy 10 March $125 puts for $26 ($26,000)

- Sell 10 March $95 puts for $15 ($15,000)

That's called a bear put spread and what we've done is we've bet that TQQQ will be lower than $125 in March but we've offset the cost of the bet by selling the $95 puts to someone else who is foolishly spending $15 in premium for a put that's $45 out of the money. No matter how low TQQQ goes, our puts will always be worth $30 more than the $95s but, above $125, both puts are worth nothing.

That net $11,000 is the cost of our insurance from now through March but we're most worried about the elections and the end of the year, so it's not likely we take a total loss and the spread pays back up to $30,000, $19,000 (172%) more than it costs so it's a good protector for a $100,000 portfolio that may lose 20% or so in a downturn.

TQQQ went up first (making for easy fills on our contracts) but now well under $140 and the March $125 puts are now $32 ($32,000) and the March $95 puts are $18.50 ($18,500) which is net $13,500 and up $2,500 (22.7%) from our initial entry. That's nice but the spread pays up to $30,000 so it's still goood for a potential gain of $16,500, which would be up another 122% from here so it still makes a nice hedge – especially as we now know we don't lose too much (net) as the Nasdaq goes higer so we have plenty of time to stop out with a relatively small loss if it looks like the Nasdaq will get back over 11,500 and hold it (now 11,250).

So small risk, big reward – that's the way we like to hedge!

Have a great week,

– Phil