And once again the Futures are up.

And once again the Futures are up.

As you can see from the S&P chart, we have had some massive gaps up in

the thinly traded open and then drifted down during real trading at the end of the day. This is like someone who works for the auction house shouting "100 Million Dollars" on the first bid for a painting to make sure the other suckers in the audience start bidding higher.

In the case of the markets, the Banksters buy up the Futures on thin trading (so it's very cheap to do) and cause the Retail Suckers to pour in and chase the momentum so the Banksters can dump their stocks all day long during real volume trading. This is how rich people exit the market – they create a buying atmosphere and they take their profits while poor people follow their advice – which doesn't actually apply to their own actions. You see the big brokerage houses doing that all the time, exiting positions while their analysts are pumping the Tesla stock.

.jpg) We had a good day yesterday shorting the Dow (/YM) Futures from our trade idea in the Morning Report and congratulations to all who played along. Our morning call for our Members was:

We had a good day yesterday shorting the Dow (/YM) Futures from our trade idea in the Morning Report and congratulations to all who played along. Our morning call for our Members was:

So we're sticking with our strategy of shorting the indexes (which didn't work yesterday) as we're likely to be rejected here (Dow (/YM) 28,100, S&P (/ES) 3,405, Nasdaq (/NQ) 11,475 and Russell (/RTY) 1,550) and, as usual, we can just short the laggards, which would be /ES crossing below 3,400 and /YM confirming below 28,000 – we should catch a quick ride down but the Fed goes tomorrow and that should give the marketsupport until they are disappointed by that so tight stops above!

As you can see, this wasn't rocket science, the pivot points on the Dow were 28,014 and 27,795 and we simply allowed for the pre-market BS pump job and took a stab at shorting early but once we confirmed the move below 28,000, it was a no-brained to jump in for the 200-point drop on the Dow (at $5 per point, per contract!). This morning we're back to 28,000 again but we have a Fed Meeting at 2pm so it's not a good day to play the futures – too volatile.

Speaking of volatile, as I predicted yesterday, Retail Sales in the US are not mirroring the success in yesterday's China Report – BECAUSE WE ARE NOT CHINA! The US has not beaten the virus, we have not put people back to work, we have not fully re-opened shops, restaurants and even movie theaters like China has and we certainly haven't gone a week without having new infections. So why would we have the same bounce in Retail Sales that China did?

Yet that was the expectation but the REALITY is that August Retail Sales were only up 0.6% vs 1% expected AND July was revised down 25%, from up 1.2% to up 0.9% – oops! In fact, the "Retail Sales Control Group," which filters out the more noisy elements like gasoline sales (which fluctuate more on price than demand), FELL 0.1% vs a 0.5% increase expected so, as usual, our leading Economorons are off by 120% yet they will ask these same clueless idiots to forecast Retail Sales next month as well.

Yet that was the expectation but the REALITY is that August Retail Sales were only up 0.6% vs 1% expected AND July was revised down 25%, from up 1.2% to up 0.9% – oops! In fact, the "Retail Sales Control Group," which filters out the more noisy elements like gasoline sales (which fluctuate more on price than demand), FELL 0.1% vs a 0.5% increase expected so, as usual, our leading Economorons are off by 120% yet they will ask these same clueless idiots to forecast Retail Sales next month as well.

It's all about the Fed today, though it's very doubtful they are going to do anything at all so it's really all about Powell's Press Conference at 2:30 and we'll see what he has to say and, of course, rumors are the stimulus bill is up to $1.5Tn but I've already said anything under $2Tn will ultimately be a disappointment but nobody listens to me…

In either case, we'll be shorting a little more aggressively as we adjust our portfolios this week but we have to wait for the Fed so we can see where things stand so it's going to be a very busy Thursday and Friday for us as we adjust our Member Portfolios.

I'm liking LNG today as Abu Dahbi took a $615M stake in the company (5.1%) and Natural Gas (/NG) prices should rise as we have a busy hurricane season in progress. $48 is a $12.5Bn market cap for LNG and the company made $1.2Bn last year so 10x earnings is very fair.

My timing on LNG is based on possible supply disruption as well as accelerating global warming and President Biden will be anxious to do something about that, as will other World leaders as the IMMINENT collapse of the Pine Island and Thwaites Glaciers has already caused a 5% rise in sea levels with the potential to push the oceans 10 FEET HIGHER when (not if) they completely melt down. This is now happening much faster than sceintists thought – mostly because they thought we would do SOMETHING but, of course, we have not only done NOTHING but Ex-President Trump has reversed what little progress we had made.

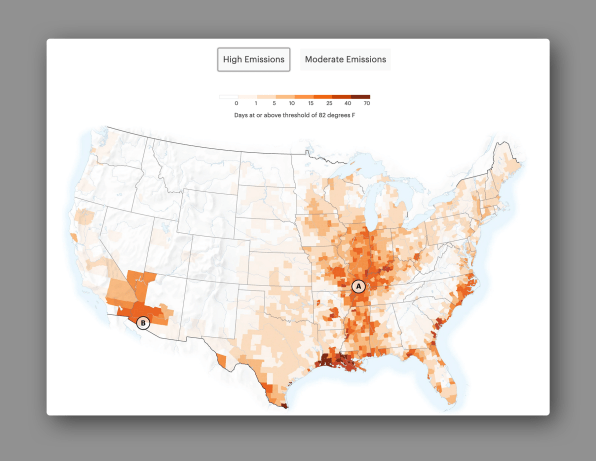

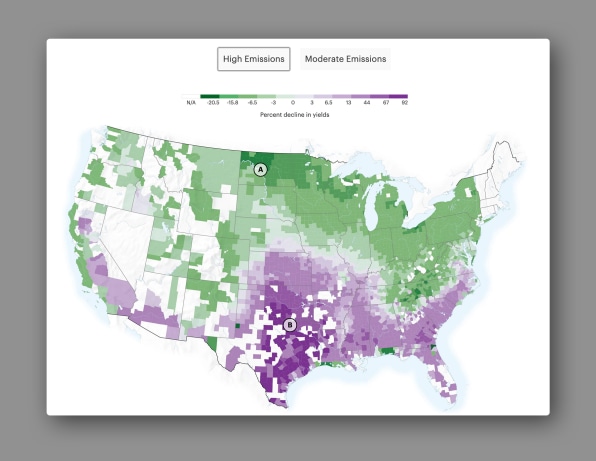

Fortunately, we have some handy maps like these to plan your next move:

This is where you can die from just being outside in the heat:

This is where your house will be under water at high tide:

A is where I live….

Purple is where farming will no longer be viable:

4 MORE YEARS!!! Right?

Anyway, so if we have a global climate emergency then Natural Gas is one of our fastest ways to switch to alternative fuels and cut down on emissions so I think LNG will do very well over the next decade so let's do the following play in our Future is Now Portfolio:

- Sell 5 LNG 2022 $40 puts for $5 ($2,000)

- Buy 10 LNG 2022 $40 calls for $14.50 ($14,500)

- Sell 10 LNG 2022 $55 calls for $7.20 ($7,200)

That's net $5,300 on the $15,000 spread that's $8,500 in the money to start. The upside potential is $9,700 (183%) in 18 months and the 5 short puts have an ordinary margin requirement of just $1,183 so it's a very margin-efficient play and the worst case is you are assigned 500 shares at $40 ($20,000) plus you lose all $5,300 so your net would be $50.60 – just a bit over where it's trading now.

In our Long-Term Portfolio, we're just going to sell 20 of the 2022 $47.50 puts for $8.50 ($17,000) and that gives us a net $39 entry, which is 18.7% off the current price against the promise to own 2,000 shares for $78,000 yet the margin on that is just $5,778 – so also nice and efficient!