A death cross!

A death cross!

A death cross is, according to Investopedia:

The death cross is a technical chart pattern indicating the potential for a major selloff. The death cross appears on a chart when a stock’s short-term moving average crosses below its long-term moving average.

And it looks like THIS! That blue line is the 50-hour (1 week) moving average moving below the 200-hour (1 month) moving average and now we're going to test that range from below and, if 3,333 (the 50-hour) acts as strong resistance, it's a very bearish signal moving forward. The 200-hour moving average (3,350) will certainly be rejected at first (great shorting opportunity on /ES with tight stops over that line) and then we'll see if we get a strong or weak retracement from there but – if we don't even make it back to 3,350 – well that's also the 50-day moving average on the S&P 500 and failing that means, as we discussed last week, that we're very likely heading back to 3,100 – a 2.5% drop from here and the 200-day moving average.

The Futures have us up to 3,330 this morning and I will want to short that 3,333 line but with very tight stops but I don't see any really good reason for the Futures to be up 350 points on the Dow (1.3%) and 35 on the S&P (1%) other than it's another BS, manipulated, low-volume rally to start the week off so the Big Boys can sell to all the suckers as they liquidate ahead of the reckoning.

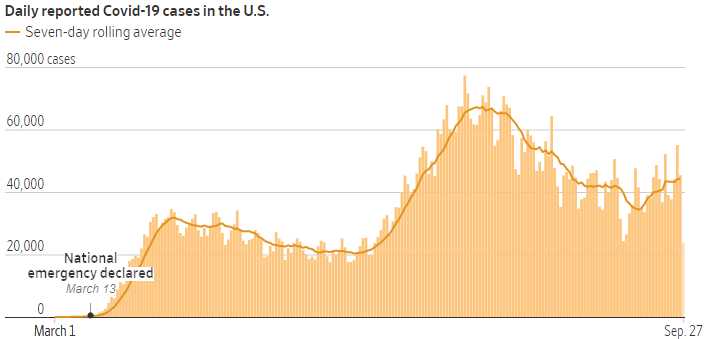

The US reported 36,919 new cases of corona virus yesterday but "only" 1,000 people a day are dying so why not open everything back up? Florida's idiot Governor DeSantis took his lips off Donald Trump's ass long enough to issue an order lifting ALL restrictions on businesses so come on down to Florida and get a lap dance folks!

The US reported 36,919 new cases of corona virus yesterday but "only" 1,000 people a day are dying so why not open everything back up? Florida's idiot Governor DeSantis took his lips off Donald Trump's ass long enough to issue an order lifting ALL restrictions on businesses so come on down to Florida and get a lap dance folks!

"Every business has the right to operate," DeSantis said. "Some of the locals can do reasonable regulations. But you can't just say no."

DeSantis also said his order would stop cities and counties from fining people for not wearing mandated face coverings. He said fines and other penalties imposed so far would be suspended. There are no restrictions on the number of people who can attend outdoor sporting events in Florida, according to the governor, who added the state hopes to host what he called "a full Super Bowl" in Tampa in February. And if the NFL has issues with insurance costs and potential liability, DeSantis said that "maybe we'll address that after the election here in Florida with the new Legislature."

Isn't Florida amazing?!?

Isn't Florida amazing?!?

What's really great about this "Super Spreader Bowl" idea is that Tampa Bay Stadium ACTUALLY has a skull and crossbones logo in each corner of the field – it's like they are already planning the scenes from the movie that document how America doomed itself through political incompetence and, in four short years, went from being a vibrant, prosperous nation to a country dominated by Depression and disease. Trump 2020!

India is joining the US in the 6M cases club though America has crossed 7M cases but we have less than 1/4 of India's population (1.35Bn) so we're still the GREATEST at getting infected. We are going to have to keep shutting down those virus restrictions though if we want to keep ahead of Brazil (population 210M) who are already at 4.7M cases, number 3 in the world.

If Biden is elected, and even if he isn't, we can expect a big push to get a vaccine ready and the leading contenders for that are, at the moment, Pfizer (PFE), AstraZeneca (AZN) and Moderna (MRNA) and MRNA is a newer company that has never made any money and has a $27Bn market cap while AZN has a $143Bn market cap and makes about $2Bn a year – so still expensive at 70x earnings but PFE made $16Bn last year and you can buy that whole company for $200Bn at $36 per share so just 12.5 times earnings.

While Pfizer may not ultimately "win" the vaccine race, they are a solid blue-chip pharmacuetical company who are clearly able to keep up with the BioTechs WHILE making a healthy profit. Isn't that the kind of company we like to invest in?

PFE pays a very nice $1.52 dividend (4.22%) so it's worth considering an ownership play. Here's one for an example: Let's say we were willing to own 36,000 worth of PFE at $36, so 1,000 shares. $36 is not a great price, we're up in the channel but it's a reasonable price. Rather than buying 1,000 shares for $36,000, we can instead buy 500 shares for $18,000 and PROMISE to buy 500 more for $33 in January of 2023 by selling the 2023 $33 puts for $5.50.

Since the put buyer is paying us now in exchange for our promise to buy PFE from them in 2023 (they may wish to set a floor on their stock), we collect $5.50 now and our net entry, if assigned, would be $27.50 – a 16.67% discount to the current price on our next 500 shares.

Meanwhile, we can also protect ourselves by selling a call option. Selling a call obligates us to turn over our stock to the call-holder at a set price. We can sell the 2023 $35 call for $5.30 and that's interesting as it's net $40.30 and we're buying the stock for $36, less the $5.50 for the short puts and less the $5.30 for the short calls so our net entry is just $25.20 and getting called away at $35 would be a $9.80 (38.88%) profit PLUS we're going to collect 1.52 in dividends each year, which is now 6% of our adjusted net entry!

Meanwhile, we can also protect ourselves by selling a call option. Selling a call obligates us to turn over our stock to the call-holder at a set price. We can sell the 2023 $35 call for $5.30 and that's interesting as it's net $40.30 and we're buying the stock for $36, less the $5.50 for the short puts and less the $5.30 for the short calls so our net entry is just $25.20 and getting called away at $35 would be a $9.80 (38.88%) profit PLUS we're going to collect 1.52 in dividends each year, which is now 6% of our adjusted net entry!

So we make 6% interest while waiting 2.25 years to make 38% so call it 50% anticipated profits overall if PFE can manage to hold $35, which is even lower than it is now. Aren't options fun? Since our net outlay is just 500 shares x $25.20 = $12,600, if we are assigned another 500 shares at $33 ($16,500), our total cost for 1,000 shares would be $29,100 so our WORST CASE is owning 1,000 shares of PFE for $29.10 per share, a $6.90 (19%) discount to the current price NOT including what we collect in dividends!

To summarize that play for our Newsletter Portfolio, it's:

- Buy 500 shares of PFE for $36 ($18,000)

- Sell 5 PFE 2023 $35 calls for $5.30 ($2,650)

- Sell 5 PFE 2023 $33 puts for $5.50 ($2,750)

That's net $12,600 out of pocket and, if called away at $35 ($17,500) we make $4,900 (39%) against the cash outlay but we will be charged margin against the short puts – it's not a free lunch. The dividends of $1.52 (0.38 per quarter) will pay us $190 per quarter while we wait, which is 1.5% PER QUARTER – way better than the bank!

A more aggressive way to play, by comparison, is to do what we call an Artificial Buy/Write where we don't actually own the stock. Since we are WILLING to own 500 to 1,000 shares at net $29 – selling the 2023 $35 puts for $6.60 is free money since it nets us in for $28.40. So we can be aggressive and sell 5 of those puts for $3,300 and use that money to buy 15 of the 2023 $30 calls for $8 and sell 15 of the 2023 $37 calls for $4.60 for net $3.40 ($5,100).

Why 15 and not 10, which would be net $100? Because it is my intent to sell short calls over time to create an income stream that will, hopefully, exceed the dividend flow from the other trade. It will be fun to compare the two's performance over time so we'll put them both in the portfolio and see which one performs best:

- Sell 5 PFE 2023 $35 puts for $6.60 ($3,300)

- Buy 15 PFE 2023 $30 calls for $8 ($12,000)

- Sell 15 PFE 2023 $37 calls for $4.60 ($6,900)

That's net $1,800 on the $10,500 spread so our upside potential is $8,700 (483%), which is substantially more than we expect to make on the straight stock play and our risk is owning 500 shares of PFE for $35 ($17,500) plus the $1,800 we're laying out (assuming we're wiped out on our longs), which would be net $38.60 – a bit higher than the current price.

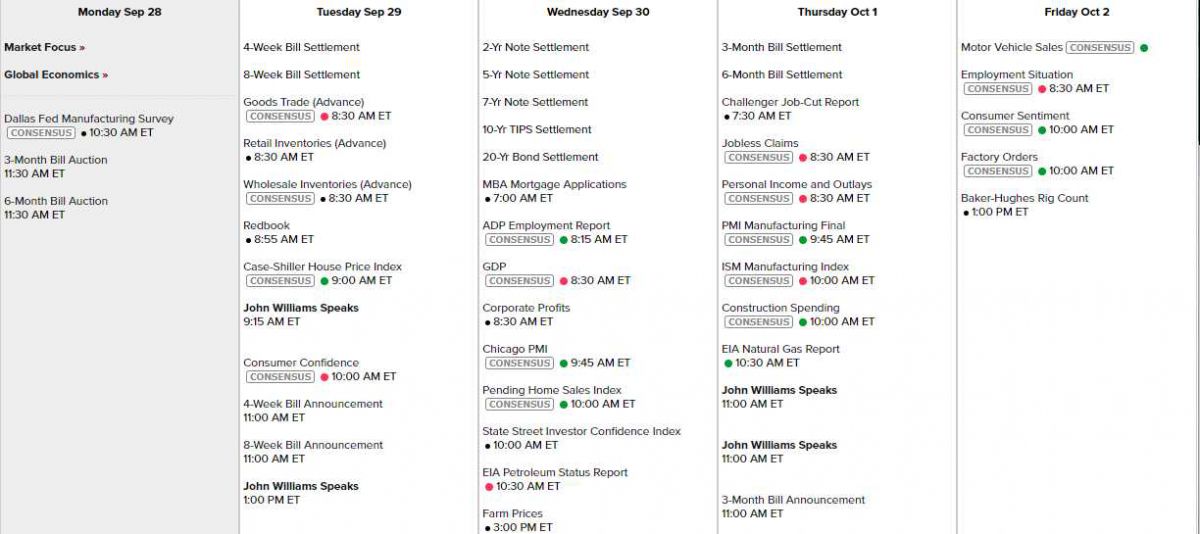

On the calendar this week, we have Non-Farm Payrolls on Friday so not much else matters. For some reason, the NY Fed's John Williams is speaking 3 times in 3 days and Williams is very doveish and willing to let inflation run wild so he's good for the markets. Other than that, we've got Retail Sales and Housing on Tuesday, a revised Q2 GDP estimate on Wednesday along with Chicago PMI and Investor Confidence. PMI, ISM, Personal Income and Outlays make for a big Thursday and Factory Orders, Non-Farm Payroll and Consumer Sentiment finish off a big data week.

We'll see what sticks from this morning's rally but Monday's are basically meaningless – just another chance to short the high-flyers, I think.

Have a great week,

– Phil