No wonder Trump got sick – the old "Dog ate my leadership" doesn't work as well with voters as the sympathy vote. The President needs something to turn his campaign around and it's a mix of opinions as to whether the President is faking Covid to gain sympathy or whether he is so psychotic that he imeriled the lives of his driver and secret service agents just to do a propaganda wave outside the hospital, not to mention the staff who had to move Patient Zero out of isolation – completely against hospital policy.

Whatever the truth is about Trump, with Biden opening up an insurmountable lead just ahead of the election, the market is rallying this morning and the Dow is up 200 points but we're still way overbought and due for another correction.

Even with this morning's action, we're still only at 3,360 on the S&P 500, right at the weak bounce line according to our 5% Rule™, which is also now the 200-hour (2 month) moving average. I have called it the one-month moving average in the past but really it's 200 market hours so more like 2-months or roughly the same as the 50-day moving average.

Officially, in fact, the 50-day moving average on the S&P 500 is at 3,361.60 so the 5% Rule™ predicted this months ago and here we are, at the inflection point of the election, right where we're supposed to be. Knowing the future is useful as it lets us make good bets on the market. One month ago, we published our first edition of Real Options Investor on August 31st, when the S&P was at 3,500, we discussed 4 trade ideas for a bearish end to the year:

All four positions are currently on track with a 17.5% gain for the month, adding $17,450 to our virtual $100,000 tracking portfolio. The Tesla (TSLA) October $400 puts ony have 11 days until they expire and we need TSLA to stay over $400 to make another $8,453 in 11 days (if they expire worthless) but, at this point, we're going to put a stop on them at $22.50 to lock in a 50% gain ($11,350) – just to be safe. In either case, we will be selling more short puts when these expire.

Northern Dynasty (NAK) is right on track with a potential to return $5,000 and currently net $2,875 so $2,125 (74%) upside potential if NAK holds $1 into February makes it very attractive, even if you missed our net $1,750 entry.

The Nasdaq Ultra-Short (TQQQ) is at the money at net $14,075 and the potential pay-off on a drop to $95 is $30,000 so this too can double if the Nasdaq stumbles. This is our policy of hedging first and buying longs later – especially in a market we are nervous about.

IMAX has come down quite a bit since we bought it and is now a net $3,238 credit to enter the position, which will pay back $1,500 in March if IMAX is back to $15 but we're going to take advantage of the sell-off with the following adjustment:

- We're going to roll the 5 March $12 calls at $1.75 ($875) to 10 2023 $10 calls at $5 ($5,000). Roll is just shorthand for selling the 5 March calls we have and buying the 2023 $10 calls instead and we're taking advantage of the low price to double down.

- We're going to offset the cost of that roll (net $4,125) by selling 5 of the 2022 $15 calls for $3 ($1,500) and once the short March 15s expire, we can sell more short calls to make up more money.

- The 10 short March $14 puts at $3.70 ($3,700) can be rolled to 5 short 2023 $15 puts at $6 ($3,000) so that costs us net $700 but lowers our purchase obligation from 10 contracts at $14 ($14,000) to 5 contracts at $15 ($7,500) which also lowers our margin requirement. We originally collected $2,000 for the puts so now we spent $700 on the roll so we have a $1,300 credit still towards the 500 shares of IMAX we may be assigned at $17 ($7,500) lowering that potential cost to $6,200 or $12.40 per share.

IMAX is way down because several theater chains have shut down again and we're not expecting a quick recovery but the ability to sell short options over time against the position and the fact that the rest of the World has re-opened much better than the US means the stock is still very much under-valued.

In our September 9th letter we sold 5 short puts on NTAP and OMC to generate $4,725 in cash and those two puts are now up $638 (13.5%) in less than a month. We did not add a trade to our portfolio on the 15th or the 22nd as we were well-balanced and on track and last Monday, on the 28th, we played Pfizer (PFE) two ways (for comparison purposes) with the following trade ideas:

- Buy 500 shares of PFE for $36 ($18,000)

- Sell 5 PFE 2023 $35 calls for $5.30 ($2,650)

- Sell 5 PFE 2023 $33 puts for $5.50 ($2,750)

That's net $12,600 out of pocket and, if called away at $35 ($17,500) we make $4,900 (39%) against the cash outlay but we will be charged margin against the short puts – it's not a free lunch. The dividends of $1.52 (0.38 per quarter) will pay us $190 per quarter while we wait, which is 1.5% PER QUARTER – way better than the bank!

A more aggressive way to play, by comparison, is to do what we call an Artificial Buy/Write where we don't actually own the stock. Since we are WILLING to own 500 to 1,000 shares at net $29 – selling the 2023 $35 puts for $6.60 is free money since it nets us in for $28.40. So we can be aggressive and sell 5 of those puts for $3,300 and use that money to buy 15 of the 2023 $30 calls for $8 and sell 15 of the 2023 $37 calls for $4.60 for net $3.40 ($5,100).

Why 15 and not 10, which would be net $100? Because it is my intent to sell short calls over time to create an income stream that will, hopefully, exceed the dividend flow from the other trade. It will be fun to compare the two's performance over time so we'll put them both in the portfolio and see which one performs best:

- Sell 5 PFE 2023 $35 puts for $6.60 ($3,300)

- Buy 15 PFE 2023 $30 calls for $8 ($12,000)

- Sell 15 PFE 2023 $37 calls for $4.60 ($6,900)

That's net $1,800 on the $10,500 spread so our upside potential is $8,700 (483%), which is substantially more than we expect to make on the straight stock play and our risk is owning 500 shares of PFE for $35 ($17,500) plus the $1,800 we're laying out (assuming we're wiped out on our longs), which would be net $38.60 – a bit higher than the current price.

Overall, the Newsletter Portfolio is now up 18.3% and we're pretty well-balanced but I'd sure feel better protecting our $18,325 gain with a bit more hedging. Rather than complicate things with a new hedge, let's take advantage of the rally to buy back 5 of the TQQQ March $95 puts for $16 and to roll the TQQQ March $125 puts at $29.50 to the TQQQ March $135 puts at $34.50 so we're spending $5 ($5,000) to add $10,000 more protection and we're spending $8,000 to free up a slot, which we can immediately use to sell 5 of the TQQQ October $120 puts for $4 ($2,000), which expire in just 11 days, rather than 165 days to March expiration.

So we're well-hedged at the moment and we'll see how things go. I'm still very concerned about the virus and, now that President Trump supposedly has it – it's going to be kept on everyone's minds for the rest of the month and that just does not seem condusive to a market rally. Should this Christmas shopping season turn out to be a bust for Retailers, we can expect the repercussions to spread far and wide through the economy.

While overall Retail Sales are down only 1.8% from last year, the sales have shifted away from Consumer Goods (down 16.8%), Furniture (down 11.3%), Vehicles (down 3.4%), Gasoline (down 16.9%), Clothing (down 34.9%), Bars and Restaurants (down 20.9%),Department Stores (down 18.9%) to Non-Store Retailers selling PPE Equipment (up 19.6%), Grocery Stores (up 12.2%) and Building Materials (11.4%) are also up due to a lot of preventive construction.

And, by the way, that's as of August, with 5 months closed and 3 months open. If we finish the year with 5 months closed and 8 months sort of open then – DOOM – is my prediction!

So, while net sales may be more or less the same, the DRASTIC shift in spending away from the kind of stores that typically serve you means your malls are in trouble, your shopping centers, strip malls etc. are all going to be in trouble and, at a certain point, the stimulus runs out and then we're ALL in BIG TROUBLE.

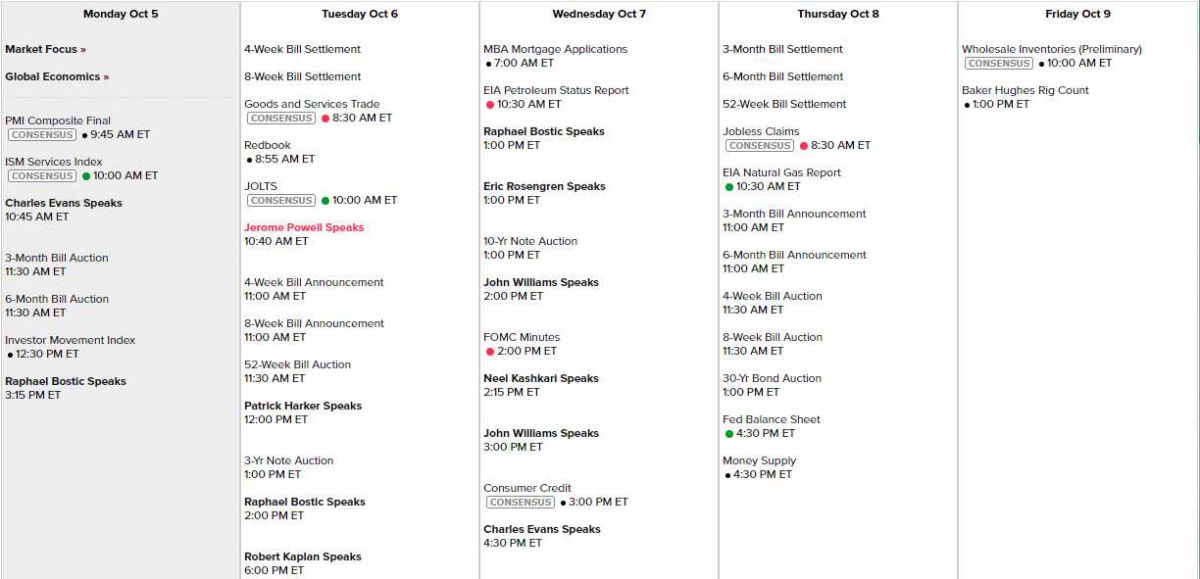

Looking ahed on the week, we have 12 (twelve) Fed Speakers in just 3 days, mostly tomorrow and Wednesday and the FOMC Minutes on Wednesday so they must be afraid of something bad happening. PMI was flat to last month but with a lot of inflation and ISM is back to 57.8, which is pretty good for the Service Sector.

Looking ahed on the week, we have 12 (twelve) Fed Speakers in just 3 days, mostly tomorrow and Wednesday and the FOMC Minutes on Wednesday so they must be afraid of something bad happening. PMI was flat to last month but with a lot of inflation and ISM is back to 57.8, which is pretty good for the Service Sector.

Tomorrow we'll see Goods and Service Trade Data along with a Jobs Report and Powell speaks at 10:40, followed by 3 more Fed speakers in the afternoon. 6 Fed speakers on Wednesday around the minutes indicates there's something in those minutes they feel the need to spin and really not much data other than that this week.

The rest of the month is going to be all about the election and the spread of the virus and that's a lot of uncertainty so, as I said in our first newsletter, this is NOT a good time to be over-invested in the markets. We have no new trade ideas at the moment, just the adjustments to our existing ones but plenty of upside potential there so be careful and let's see how this week, and the month, unfold.

All the best,

– Phil