Good morning!

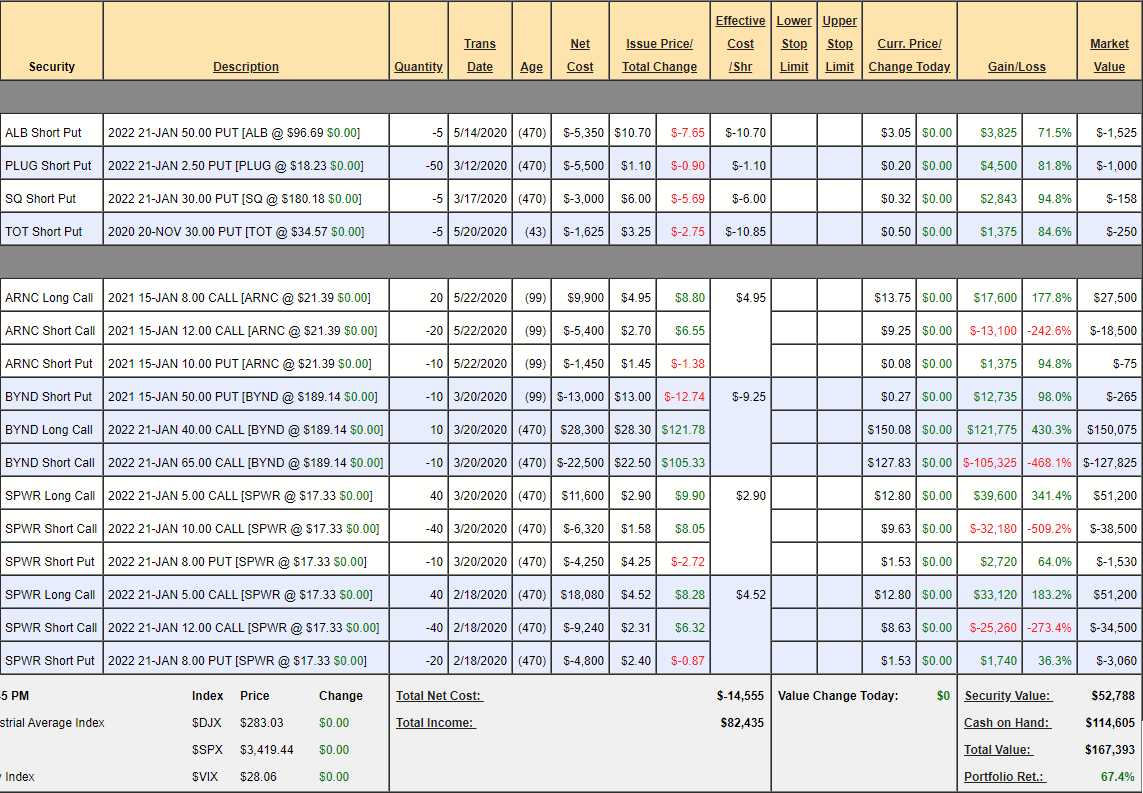

Speaking of the Future is Now Portfolio, it's been doing very nicely (up 67.4% for the year) but it is risky times so let's cash in our short puts, which are over 80% anyway (ALB too) and make room for more Futuristic trade ideas down the road.

Since we don't have hedges, cashing the short puts reduces our downside risk and we REALLY want to own our other positions, so we're not worried about those puts but let's see if they are worth keeping:

- ARNC - This is an $8,000 spread and it's currently net $8,725 so we should really cash those out, right?

- BYND - This is a $25,000 spread at net $21,985 so I guess there's no point in waiting 16 months for the last $3,015, is there?

- SPWR - We liked them so much we played them twice! We have the $20,000 spread that's currently net $11,170 so that's good for a new play! Then we have the older $28,000 spread that's currently net $13,640 and that's good for a double too if SPWR doesn't fall below $12 - so both of those are keepers.

See how I snuck that in there? We just killed the Future is Now Portfolio, other than SPWR, which my hands got sore from banging the table on early this year but at least we added JETS and we'll look for some more bargains as earnings season comes around again.

To reiterate, out new trade idea for this portfolio (from the Morning Report) is:

Stimulus talks are still up in the air with the Airline Industry hanging by a thread. Yesterday, the Democrats tried to extend the previous aid to the airlines through March but Republicans blocked it – because then it wouldn't have been seen as coming from the President himself, so 38,000 more workers are furloughed through inaction.