Not a bad week.

Not a bad week.

Especially if we ignore Trump's "No stimulus" hiccup on Tuesday night but the market qickly reversed itself again and got back on the pre-programmed path of onwards and upwards we default to whenever there's not enough news to cause any volume of selling.

Market volumes have indeed been anemic this week and all it took were 90M S&P ETF (SPY) transactions on Tuesday to knock us down 80 points in two hours. That was more trading than we had in any two other days this week as we haven't had any serious market volume since early Sepember, when the S&P 500 fell 15% and, before that, early June, when the S&P fell 10%. This is a very low-volume rally and that's a very dangerous kind to invest in at they can easily pop – like a bubble!

| Date | Open | High | Low | Close* | Adj Close** | Volume |

|---|---|---|---|---|---|---|

| Oct 08, 2020 | 342.85 | 343.85 | 341.86 | 343.78 | 343.78 | 44,892,400 |

| Oct 07, 2020 | 338.12 | 341.63 | 338.09 | 340.76 | 340.76 | 56,999,600 |

| Oct 06, 2020 | 339.91 | 342.17 | 334.38 | 334.93 | 334.93 | 90,128,900 |

| Oct 05, 2020 | 336.06 | 339.96 | 336.01 | 339.76 | 339.76 | 45,713,100 |

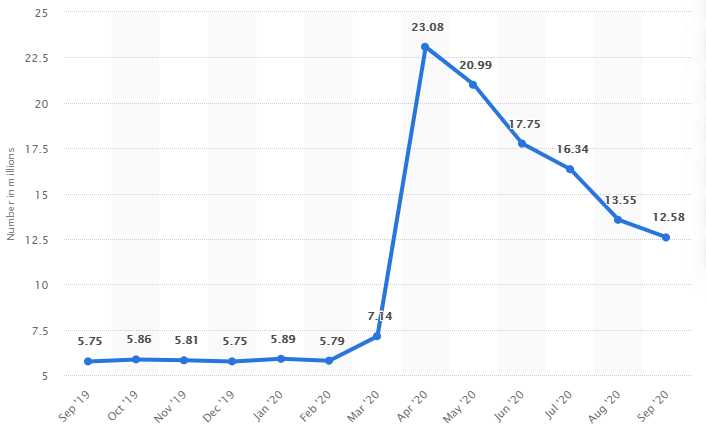

Take a look at the NYSE's total trading volume this summer, down about 50% and our trading volume had already been low the past few years, now it's below what used to be half-day holiday levels on a daily basis.

That certainly hasn't stopped the market from being volatile but it does make it easy to maniplulate because it's cheap to manipulate it when very small amounts of trading can make a very big difference. That's why a tweet from the President can send the entire market down 2.5% ($2.5Tn) and then back up again the next day, even though only 100M shares of SPY were traded at $335 ($33.5Bn). That's a 75x leverage ratio for your manipulating Dollar – what a bargain!

Then conside that most of our "rallies" come in the very thinly traded futures and you can see that, with just a few hundred Million Dollars, you can make the market dance pretty much any way you want and our Federal Reserve and this Administration are pumping Billions of Dollars into stocks and bonds every single day to prop up the markets so the President can tell you how great the economy is doing – even as one out of 5 businesses that were open last year are closed this year.

32.9M Americans (10%) were collecting unemployment benefits in July yet the "official" unemployment figure was 17.8M. In it's most recent report, the Government claimed that on 12.6M (8%) people were unemployed but that's very hard to square with what each and every one of us are able to observe among our friends and family.

32.9M Americans (10%) were collecting unemployment benefits in July yet the "official" unemployment figure was 17.8M. In it's most recent report, the Government claimed that on 12.6M (8%) people were unemployed but that's very hard to square with what each and every one of us are able to observe among our friends and family.

Even 12.6 is still double the amount of people that were unemployed in February – hardly what a normal person would call a "great" economy yet, if you repeat a lie often enough there are plenty of gullible people who will believe it – that's something Hitler's propaganda chief, Joseph Goebbels, used to say and, oddly enough, "My New Order" was our President's favorite bedside book – besides the bible, of course…

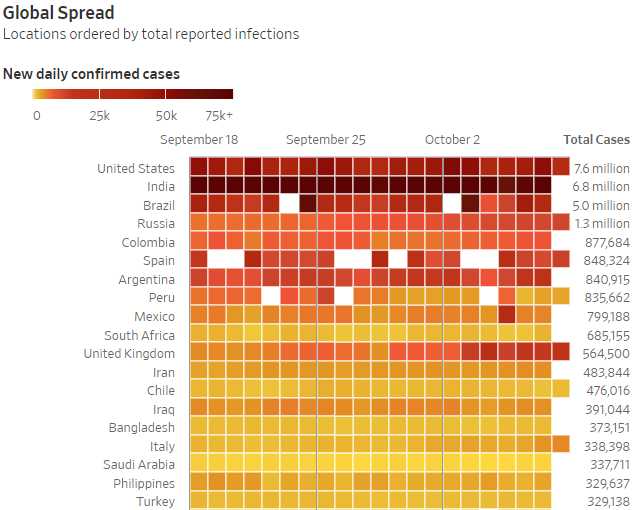

Meanwhile, the only chart that really matters is this one:

Meanwhile, the only chart that really matters is this one:

The US is not the worst country on Earth when it comes to rates of infection – we are second to India, though we still have more total cases than a country with 4 times our population but they are catching up, with almost 7M cases now vs 7.6M in the US.

With 212,000 Americans dead from Presidential neglect, we'll be over 240,000 dead by Election Day and close to 350,000 dead by the time Biden is sworn in and it will still take a while to clean up Trump's mess so we're looking at 500,000 people dead into next year – twice as many as we have now and that's only IF we enforce more stringent rules that will NOT be good for the economy.

Still, 3M Americans die every year so, as our President says "it is what it is" and the country will move on. The economic aftermath may be long and painful but we'll get through it and we're happy to hold our blue-chip stocks but only if they have reasonable valuations. Fortunately, many do and we'll be concentrating on those next week, as we reveiw our portfolios into Friday's expiration and, after that, EARNINGS SEASON!

Have a great weekend,

– Phil