Wheeee, down we go!

Wheeee, down we go!

In yesterday's Live Trading Webinar we discussed the merits of shorting Oil (/CL) Futures at the $41 mark. We had already made a quick $500 shorting oil in our Live Member Chat Room early yesterday morning (and it was in our Top Trade Alert) but we're not sy about betting on the same horse twice and at 4:26 I said to our Members:

/CL back at $41 is back to being a short again below the line now that it's calmed down as I can't see EIA being exciting enough to justify – last week certainly didn't and Columbus Day is not much of a driving/travel holiday, is it?

As you can see, we're back to test $39.50 this morning and we'll take the money and run there as it's the 2nd green S2 support level so it's bound to be bouncy in the very least – should be a $3,000 gain for all our hard work!

Remember: I can only tell you what is likely to happen in the market and how to profit from it – the rest is up to you!

I noted another way to play for our Members as well:

Another reason I like shorting oil here is we're not far away from the rollover on the November contracts and December is very crowded with fake orders that NO ONE is going to want delivered so we could be heading for a nasty crash like we had in March, when there were way too many May contracts to roll into.

ChartCurrent Session Prior Day Opt's Open High Low Last Time Set Chg Vol Set Op Int Cash – 40.19 40.19 40.19 00:00

Oct 13

40.19s*

0.82

–

39.37

–

n/a Nov'20 40.19 41.15 39.82 41.03 15:12

Oct 14

–

0.83 294677 40.20 132930 Call Put Dec'20 40.49 41.43 40.12 41.31 15:12

Oct 14

–

0.82 243237 40.49 392158 Call Put Jan'21 40.84 41.74 40.48 41.62 15:12

Oct 14

–

0.77 72402 40.85 208129 Call Put Feb'21 41.15 42.04 40.83 41.91 15:06

Oct 14

–

0.72 20792 41.19 113984 Call Put Mar'21 41.42 42.32 41.15 42.18 15:07

Oct 14

–

0.66 29218 41.52 149666 Call Put Apr'21 41.77 42.53 41.44 42.42 15:05

Oct 14

–

0.62 9881 41.80 60370 Call Put May'21 41.95 42.75 41.82 42.64 13:46

Oct 14

–

0.60 4670 42.04 47188 Call Put Jun'21 42.19 42.93 41.90 42.81 15:08

Oct 14

–

0.56 32660 42.25 205297 Call Put Look at that turnover today, 132,930 contracts were traded 294,677 times!

SCO (2x short oil) could be fun to play as it popped 200% in March/April. Figure $30 as a target and the Jan $22 calls are $1 so let's buy 50 ($5,000) for fun in the STP and risk $2,500.

If for some reason we get a quick double, we take half off and it's a free ride on the rest.

We'll see how that trade develops with oil down 4% this morning. Stock futures are dropping with dimming stimulus hopes and the prospect of fresh restrictions across Europe casting a shadow over the Global Economic outlook. Uncertainty surrounding the coming elections and the on-again off-again stimulus talks, as well as risks of a second wave of coronavirus infections, the timeline for Covid-19 vaccines and treatments, and questions about how companies are weathering the recession are pushing more and more investors to the sidelines.

London became the latest European capital to tighten lockdown measures, with restrictions set to come into force this weekend. On Wednesday, France declared a state of emergency and imposed a nightly curfew for the Paris region and eight other metropolitan areas across the country. “We have done the easy bit of the economic recovery, the initial rebound. Now we have got to do the hard yards of getting economies back to where they were before lockdown, before Covid,” said EMEA's Altaf Kassam. “These rolling lockdowns are going to crimp that recovery and make it so much harder,” he said.

As I pointed out to our Members on Tuesday:

Meanwhile, over in the not-as-stimulated reality of Europe:

3,750 to 2,250 is down 1,500 points (40%) on the nose and that makes for 200-point bounce lines to 2,450, 2,850 (strong) and 3,250 is the 60% line, which is very significant for Fibonacci so over that is good and under it is not and I'll take Europe's word for it over our manipulated markets.

Failing that level since then has sent the Euro Stoxx into a sharp dive, quickly falling 2.5% below the line this morning. 3,168 is exactly 2.5% below 3,250 – if you are keeping score. This is why the 5% Rule™ is better than TA – the 5% Rule™ is just math – TA is just bullshit…

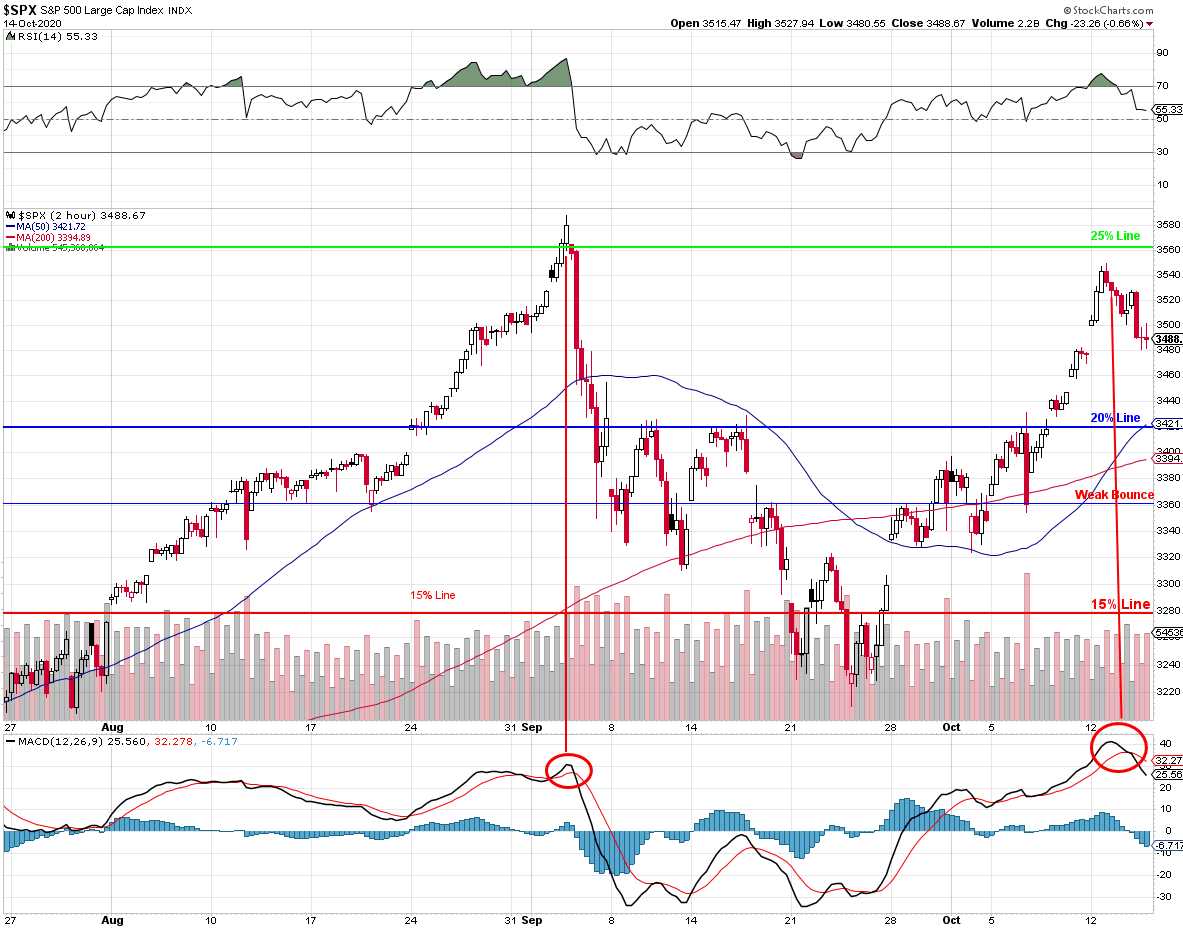

On the S&P 500, we're back to test the 3,420 line, which is the Strong Bounce Line as well as the 20% Line on our S&P Chart, which we've been using all summer to track our trading range (recently, see: "The Weak Ahead in the Markets" for a good explanation of how we got that number). In the grand scheme of things, there is nothign happening here that wasn't completely predictable as we're still inside the same trading range but notice how the MACD indicators are rolling down – that's a very dangerous sign for the markets and that's why we added hedges to our Short-Term Portfolio on Tuesday (see: "Toppy Tuesday – $2Tn Stimulus Talks Buys Us a Trip back to the Highs").

Again, TA is BS but enough people follow that BS to make it a Fundamental Factor we do pay attention to (and yes, I know that's a confusing concept). Still, as I said in the Webinar, Santa Claus is BS but that doesn't mean I can't predict that it's likely that cookies will be placed by the fireplace on Christmas Eve, does it? Our job is to predict what is going to happen and pedicting that millions of idiots will react to chart "signals" is often easy money – like betting a Trump voter can't name 5 European capitals, 3 hybrid cars or the President of Mexico...

Getting support at the Strong Bounce Line (3,420) would actually be a bullish sign for the markets as we'd be consolidating in the top of our range but failing that line gives us a clear shot to revisit the 15% line at 3,280 and, failing that, back to the 10% line at 3,140 and THAT is where we might be on election day – just 3 weeks from Tuesday.

Be careful out there and vote wisely!