We're holding up so far.

We are flirting with disaster at the 3,420 line but, so far, it's holding up on endless promises of endless stimulus – currently over 10% of our GDP ($2Tn) is on the table to be pumped into our economy in the last 2 months of the year – just like we did in Q2 and that gave us a 20% pop in the S&P, from 3,000 in late June to 3,600 at the end of August. The question now is, can $2,000,000,000,000 give the markets another 20% boost or is it only enough to fill the hole that's been blown in this economy by the Covid Crisis?

Nancy Pelosi said she hoped that fresh stimulus spending would be retroactive, although Republican Senate Majority Leader, Mitch McConnell has warned the White House against a bigger Democrat-led deal before the election. The administration said its offer is now up to $1.88Tn, below the $2.2Tn Pelosi has pushed for. “The rise in yields suggests that the market thinks a stimulus deal will be forthcoming and that the Democrats are set to take both the presidency and the Senate at the Nov. 3 election,” said John Hardy, chief foreign-exchange strategist at Saxo Bank.

All this stimulus talk has sent the Dollar down over 2% since September and the S&P, which is priced in Dollars, is up 6% and Oil is up 10% and Gold is up 4% and we'll see if that 92 line holds up again as we print another $2Tn. It should as the rest of the World is still in bailout mode as well with the ECB meeting next week to discuss policy into their Winter Holiday.

European Central Bank President Christine Lagarde said the unexpectedly early pickup in coronavirus infections is a “clear risk” to the economic outlook, in a sign that policy makers are gearing up for more monetary stimulus. The remarks were broadcast hours after ECB chief economist Philip Lane told Germany’s RTL that while the virus might still be contained, “we have to prepare for worse scenarios” if it can’t.

“Most scientists in the euro zone were expecting the resurgence of the epidemic in November or December, with the cold,” Lagarde said in a pre-recorded interview with France’s LCI on Tuesday evening. “It’s come earlier, and from that point of view that has surprised. It’s not a good omen.”

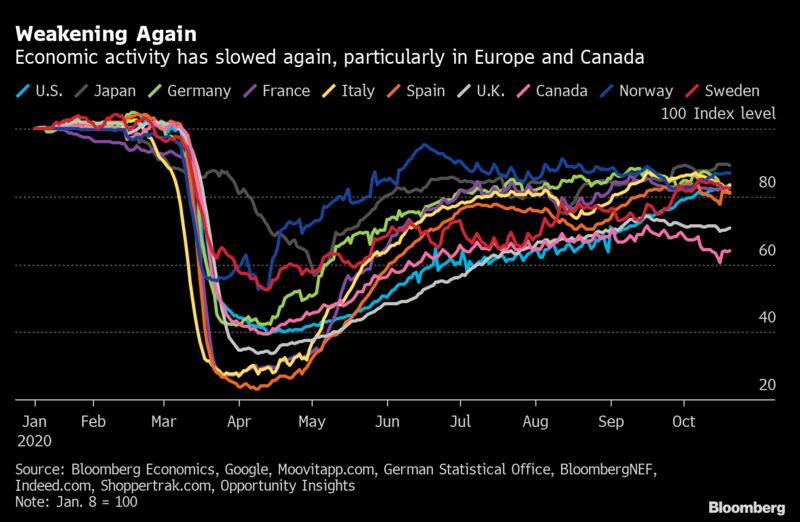

After gaining traction in the latter half of September, Economic Activity has again weakened in October, particularly in European countries, according to Bloomberg Economics’ gauges that integrate high-frequency data such as mobility, energy consumption, and public transport usage. Following concerns about renewed outbreaks amid strong rises in Covid-19 cases, activity in Germany, France, Spain and Italy has leveled off. The US is picking up but still at about 2/3 of where we were before the virus hit – down 33% overall.

After gaining traction in the latter half of September, Economic Activity has again weakened in October, particularly in European countries, according to Bloomberg Economics’ gauges that integrate high-frequency data such as mobility, energy consumption, and public transport usage. Following concerns about renewed outbreaks amid strong rises in Covid-19 cases, activity in Germany, France, Spain and Italy has leveled off. The US is picking up but still at about 2/3 of where we were before the virus hit – down 33% overall.

Meanwhile, that doesn't stop the market from rallying as hope does spring eternal that another $2Tn of debt will fix things right up. That means, by this time next year, the US economy will be roughly $32Tn in debt, which will be 177% of our $18Tn GDP. Since our Government currently collects $3Tn in taxes, then doubling the tax rate for 10 years won't even pay off our exisiting debt, or the interest on that debt, or any additional money we borrow during that time. Passing this $2Tn stimulus bill will push us close to $6Tn (200%) in debt for 2020, which means we would also have to cut Government spending by 66% just to stop running up additional debt.

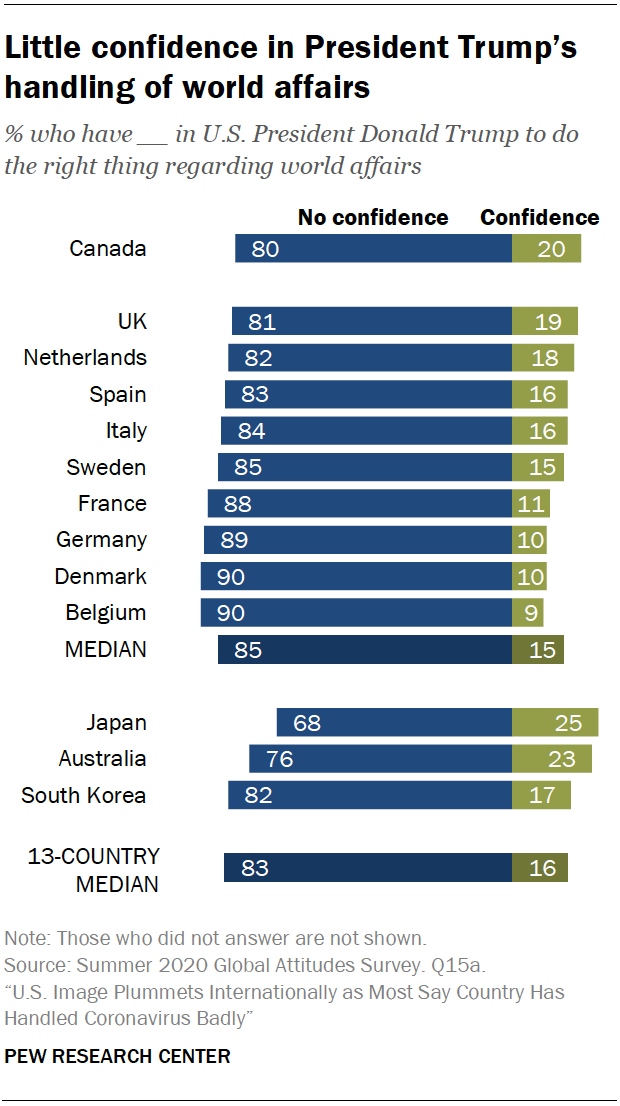

As you can see from this chart, other countries have no confidence in Trump or the US anymore and almost the entirety of Trump's support in Europe comes from Right-Wing Populist Factions, where Trump is seen as the new White Messiah.

Speaking of feeding the hungry, there are food shortages in Asia and, by all accounts, they are coming to the US as well as supply chain disruptions ripple through the Global Economy.

In an October 5, article for the New York Times entitled “China’s mealtime appeal amid food supply worries: Don’t take more than you can eat,” Eva Dou writes,

On the surface, China’s campaign to encourage mealtime thrift has been a cheerful affair, with soldiers, factory workers and schoolchildren shown polishing their plates clean of food.

But behind the drive is a harsh reality. China does not have enough fresh food to go around — and neither does much of the world.

The pandemic and extreme weather have disrupted agricultural supply chains, leaving food prices sharply higher in countries as diverse as Yemen, Sudan, Mexico and South Korea. The United Nations warned in June that the world is on the brink of its worst food crisis in 50 years.

“It’s scary and it’s overwhelming,” Arif Husain, chief economist of the United Nations World Food Program, said in an interview. “I don’t think we have seen anything like this ever.”

One way to hedge against food inflation is with the Agriculture ETF (DBA), which is currently at $14.87. Let's say you buy $300 worth of groceries per week so $15,000/yr and you are concerned about more than 20% inflation. 20% inflation would put DBA up $3 to $18 and cost you $3,000 so we can hedge against that with the following play:

- Sell 10 DBA 2023 $12 puts for $1.05 ($1,050)

- Buy 10 DBA 2023 $12 calls for $4.20 ($4,200)

- Sell 10 DBA 2023 $15 calls for $2.25 ($2,500)

That's net $650 on the $3,000 spread so you are hedging up to $2,350 of any move higher in food prices and the only way you lose more than $650 is if DBA is down 20%, in which case you would be saving $3,000 on your food costs. That's what a hedge is supposed to do – protect you from uncertainty.