"You give it all but I want more

And I'm waiting for youI can't live without you" – U2

It's GDP day and we're all expecting some fantastic numbers at 8:30 as the US economy bounces back from Q2's -31.4% drop but, as I have pointed out before, 100% less 31.4% is 68.6% but 68% + 31.4% is only 89.35% so we need more like a 45% gain in GDP just to get back to our Q1 level, which was already crap at -5% – before Trump even had the virus to use for an excuse on what a terrible job he was doing with the economy.

Q2 was the biggest downturn in GDP in US history – including the Great Depression, including 9/11 and, since then, the Trump Administration and the Federal Reserve have put over $4,000,000,000,000 to work proping up the market. $4Tn is, by the way, an entire Quarter of GDP so, rather than be excited that the GDP is coming back to "normal" we should be alarmed at how adding 100% to the Q3 GDP ONLY gets us back to normal.

| Category | Q2 | Q1 | Q4 | Q3 | Q2 |

| GDP | -31.4% | -5.0% | 2.1% | 2.1% | 2.0% |

| Inventories (change) | -$287.0B | -$80.9B | -$1.1B | $44.0B | $49.4B |

| Final Sales | -28.1% | -3.6% | 3.2% | 2.7% | 2.5% |

| PCE | -33.2% | -6.9% | 1.6% | 2.7% | 3.7% |

| Nonresidential Inv. | -27.2% | -6.7% | -0.3% | 1.9% | 0.0% |

| Structures | -33.6% | -3.7% | -5.3% | 3.6% | 1.6% |

| Equipment | -35.9% | -15.2% | -1.7% | -1.7% | -3.8% |

| Intellectual Property | -11.4% | 2.4% | 4.6% | 5.3% | 4.1% |

| Residential Inv. | -35.6% | 19.0% | 5.8% | 4.6% | -2.1% |

| Net Exports | -$775.1B | -$788.0B | -$861.5B | -$950.2B | -$951.4B |

| Export | -63.2% | -9.5% | 3.4% | 0.8% | -4.5% |

| Imports | -54.1% | -15.0% | -7.5% | 0.5% | 1.7% |

| Government | 2.5% | 1.3% | 2.4% | 2.1% | 5.0% |

| GDP Price Index | -1.8% | 1.4% | 1.4% | 1.5% | 2.5% |

It will be fun to see how much of a V $4Tn buys these days. So far, the Futures are flat ahead of the report and that's despite Oil (/CL) making yet another 5% drop this morning – all the way down to $35.50 with Gasoline (/RB) hitting $1.0275. That's triggering our plan from the PSW Report from Thursday, the 15th, where we used the Ultra-Short Oil ETF (SCO) to short oil at $41, which was:

SCO (2x short oil) could be fun to play as it popped 200% in March/April. Figure $30 as a target and the Jan $22 calls are $1 so let's buy 50 ($5,000) for fun in the STP and risk $2,500.

If for some reason we get a quick double, we take half off and it's a free ride on the rest.

Those calls should be well over $2 this morning so we take 1/2 off the table with a double and we have a free ride on the rest and, assuming we're over $2, we set a stop there so we have a nice $5,000 (100%) gain in two weeks locked in with plenty of additional upside potential. Congratulations to all our subscribers who played along at home!

If you want to get fancy, we can also lock in our gains by placing a long bet on /CL (like we did yesterday) at $35.50 of higher with tight stops below that line. 2 long contracts at $35.50 would make $2,000 at $36.50 and our risk would be losing a few hundred dollars if the line fails and we stop out but we're protecting a $5,000 gain with this insurance. That way, we don't have to be so quick on the trigger to stop out the SCO play as we're sure to get a bounce off $35 and, since we fell from $40 ($41 really but call that an over-shoot, which is why we shorted it!), it's a $5 drop and a weak, 20% bounce would be $1 back to $36 and a stong bounce would be $37 so we can ride SCO back to $37.50 (yesterday's level) while making $4,000 from the /CL longs, STILL take 1/2 off the table but leave the other 2,500 SCOs, which are free, to run AND have $2,000-4,000 in our pocket from the Futures as well. Aren't options fun?

I don't want to talk about the virus this morning but this is a really good info-graphic that demonstrates how it spreads and how we can (if we ever decide we have the will to) prevent it. Share this link with all your ignorant friends!

8:30 Update: 33.1% – AMAZING!! So, if you are wondering (and I'm sure the President is) why the markets aren't soaring off of what is now the BEST quarterly GDP ever recorded – it's because the "smart money" is selling into this news as it's bringing in the suckers who don't understand the math of the situation. In reality, this is the quarter/quarter chart most people look at:

And this is the annualized chart looked at by people who understand what context is:

On an annualized basis, we are still lower than the lows of every recession since World War II. And that's AFTER $4,000,000,000,000 in stimulus. Still, it beats the alternative because, had we not added 100% of our GDP (by borrowing it, by the way) as stimulus, we would have been down a whole 'nother stick and then it would have taken a 200% gain to get back to even – and that would have been very hard, right?

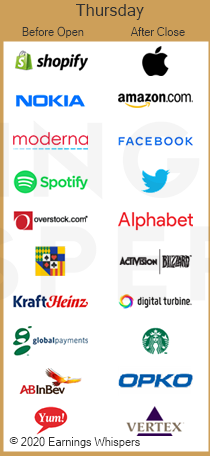

Starbucks (SBUX) also reports and I can't figure out why they are trading at $87.50, which is a $102Bn valuation for a company that lost $678M last Quarter but, more importantly, only made $4Bn the last two years. 25x earnings isn't terrible but this company has very much saturated the market. There are many cities in this country where you can see a Starbucks across the street from another Starbucks – not even McDonald's is that crazy.

I'm not gung-ho to short them as I like the company but you can sell the Jan $90 calls for $4.35 so let's sell 5 of those for $2,175 in the Earnings Portfolio and we can also buy 10 Jan $70 puts for $1.25 ($1,250) as those might be fun if they drop 10% as the $80 puts are $3.25 so we could make $2,000 on that play if all goes well, plus the short call money.

What are we doing here? We're selling more premium than we're buying so if SBUX goes down, we win, if SBUX is flat, we win and unless SBUX is over $91.85 into Jan expirations (21st), we don't lose and we think SBUX will be weak and the market will be weak so many, many ways to win and not many ways to lose makes for a good earnings play.