Courtesy of Pam Martens

By Pam Martens and Russ Martens

The U.S. stock market, as measured by the Dow Jones Industrial Average, lost 1,833.97 points last week. The Dow was down every day except Thursday, when it eked out a gain of 139.16. The market was reacting to the following bad news: soaring cases of COVID-19 in the U.S.; a reemergence of the virus in Europe causing business shutdowns there; the failure of the U.S. Congress to pass a new stimulus bill; and a sharply lower price for West Texas Intermediate (WTI), domestic crude oil – which signals a further slowdown in economic activity. (At 7 a.m. this morning, WTI was down further, with a $34 handle.)

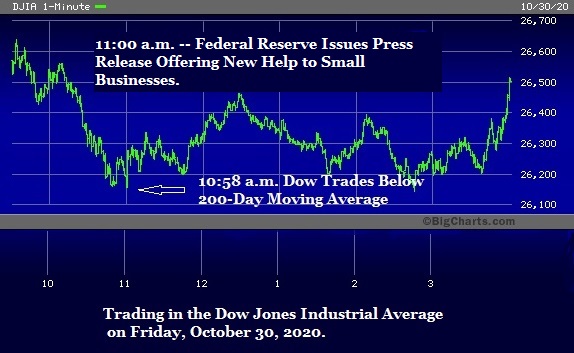

The stock market’s losses would have likely been greater last week were it not for an intervention staged by the Federal Reserve at 11:00 a.m. on Friday. Here’s what happened and why Americans should be deeply concerned.

The 200-day moving average on the Dow is watched by market technicians as an indicator of where the Dow is heading going forward. By 10:58 a.m. on Friday, the Dow had lost 502 points on the day and was trading at 26,156.45, below its 200-day moving average of 26,200.50.

…