Election Day!

The Futures certainly seem happy about it with the Dow (/YM) up 420 points and the S&P (/ES) up 40 points. Biden still has a commanding lead in the polls but there has been so much interference and disenfranchisement of voters already that there's no telling what will actually end up being counted so – anyone can win.

5.2M people, mostly people of color, have been deemed ineligible to vote by the courts, usually because they are unable to pay court ordered money sanctions (considered a felony), according to the Sentencing Project. In three states – Alabama, Mississippi, and Tennessee – more than eight percent of the adult population, one of every thirteen people, is disenfranchised and in Floriday, 900,000 people who have been in jail are never allowed to vote again despite the 2018 ballot referendum that was supposed to restore their voting rights in the country's largest swing state.

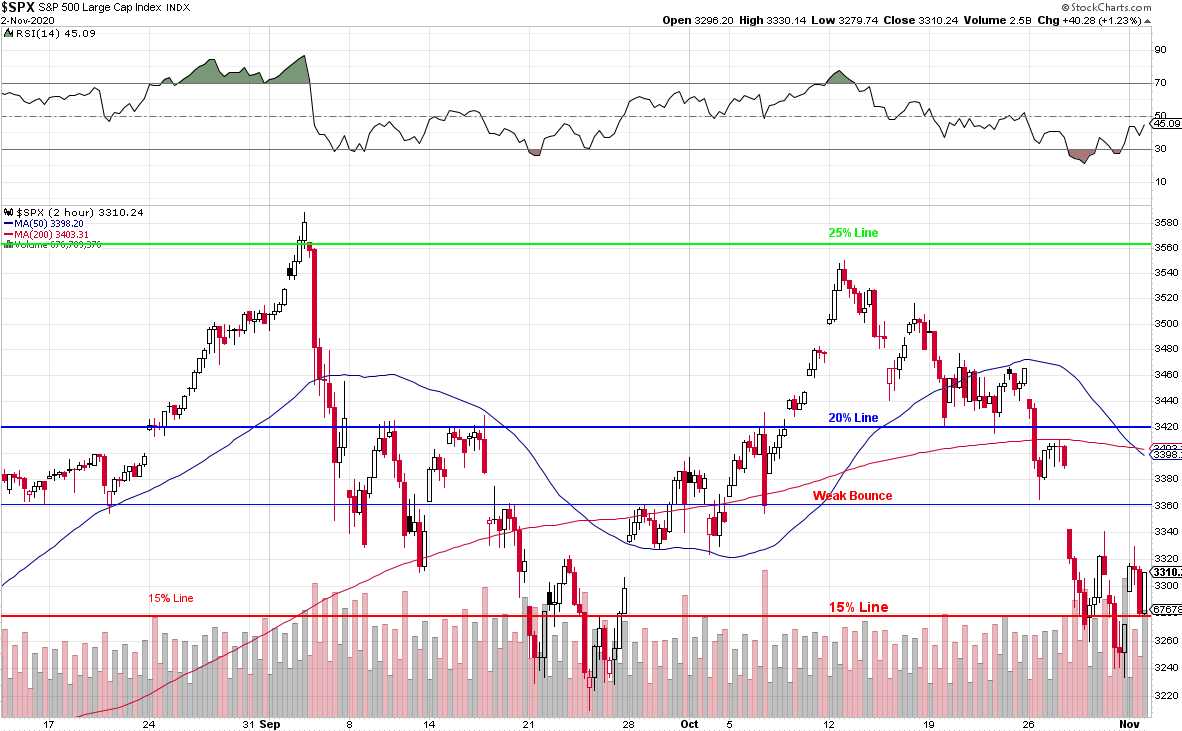

Speaking of swings, the S&P 500 is now back to 3,335 – a move I called "almost inevitable" last Wednesday and we bounced right off our predicted 3,277.50 line, where we wisely cashed in our hedges but now we'll see if the weak bounce line (3,335) holds up and, as I said at the time, it's not likely we make ti back over 3,392 as now you can see the "death cross" being taken by the 50-hour (two week) moving average crossing under the 200-hour (2 month) moving average. By the way, the weak bounce line on the chart is from our original drop from 3,600 to 3,200 in Aug/Sept – not this recent drop.

That death cross is going to turn 3,400 into serious upside resistance but we're 2.5% away from that so no worries this morning and it's not like we'll have a decision tomorrow in the election so I don't see a major catalyst unless the Fed steps up and does their own stimulus on Thursday.

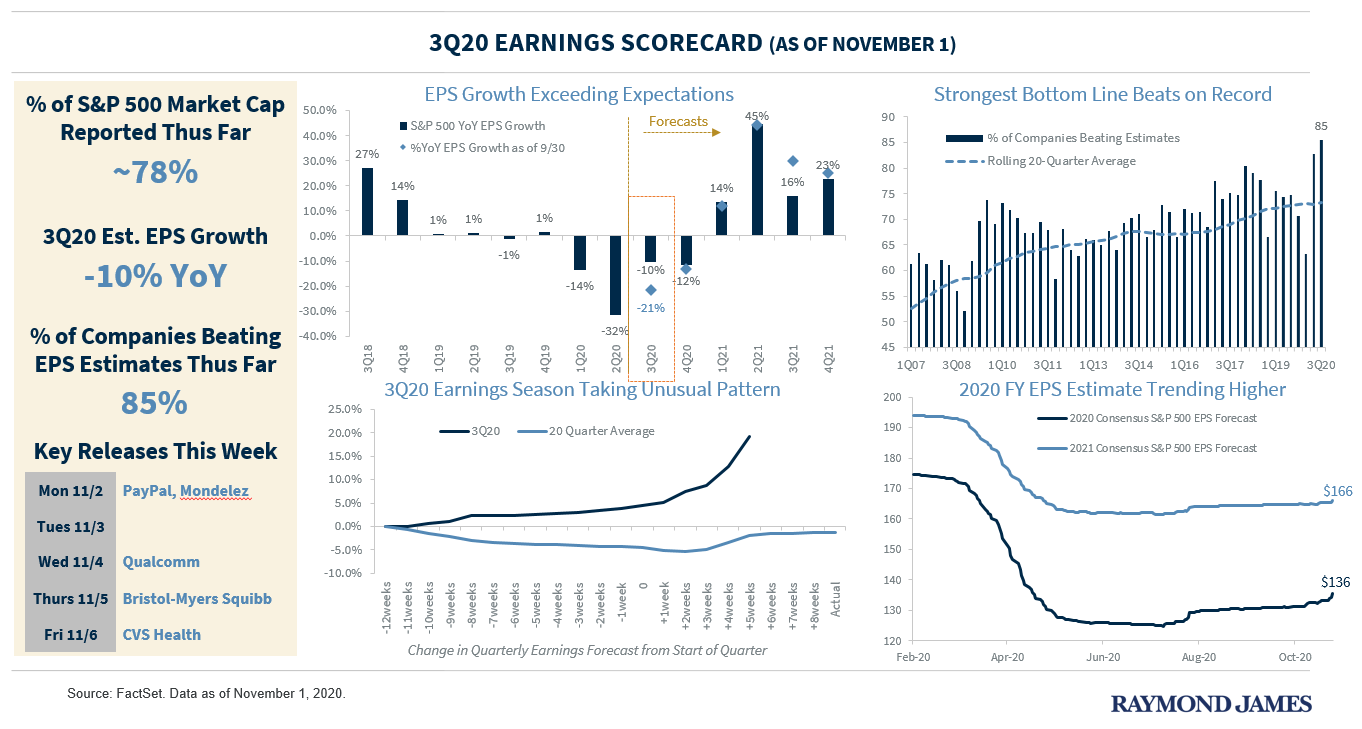

As you can see with 78% of the S&P 500 reporting so far, although 85% of the companies have beaten estimates – that's only because those estimates were a joke as the actual earnings are still down 10% from last year – 10%! Q4 is projected to be WORSE, not better. Full-year earnings are expected to be $136/share on the S&P so 3,340 is 24.6 times those earnings, while last year earnings were $166 when the S&P was at 3,000 so 18x earnings last year. That's a 25% increase in the p/e of the average S&P 500 stock since last year – grossly overpriced!

This is why I continue to expect a correction – because we are still trading at an INCORRECT price. Also, if Biden wins, we need to consider that he will roll back Trump's tax breaks to Corporations and that will hit them for about 20% of their current profits so, even if the virus fades and let's them get back to last year's earnings levels – the taxes will rise and take those gains back. Don't expect fireworks from this market – no matter who wins.

Have fun at the polls (if you are allowed to vote).

And I have never said this with more sincerity: May the best man win!