144,000 infections, 1,600 deaths – yesterday!

144,000 infections, 1,600 deaths – yesterday!

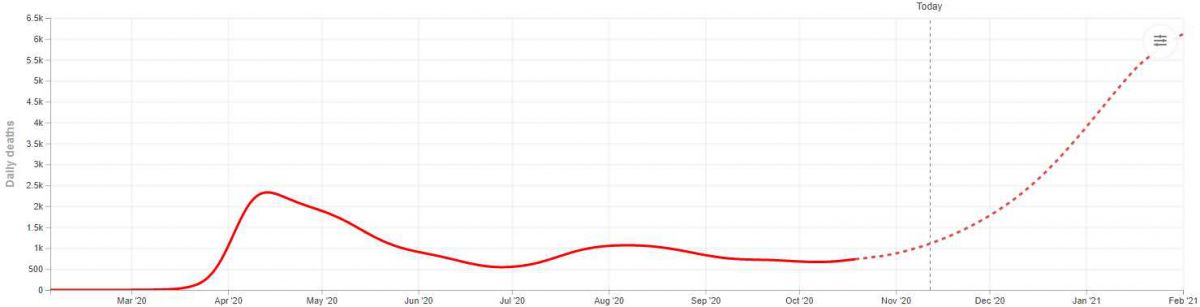

I hate to harp on the virus but, come on people, this is serious! The chart on the right just two weeks ago projected 1,100 deaths just 3 weeks ago but we're 50% above that already. A range of factors has contributed to the recent surge in infections, hospitalizations and deaths, say epidemiologists and public-health officials. Inconsistent messaging on masks and other preventive measures has hindered their effectiveness, they say, and pandemic fatigue has increased some people’s willingness to take risks.

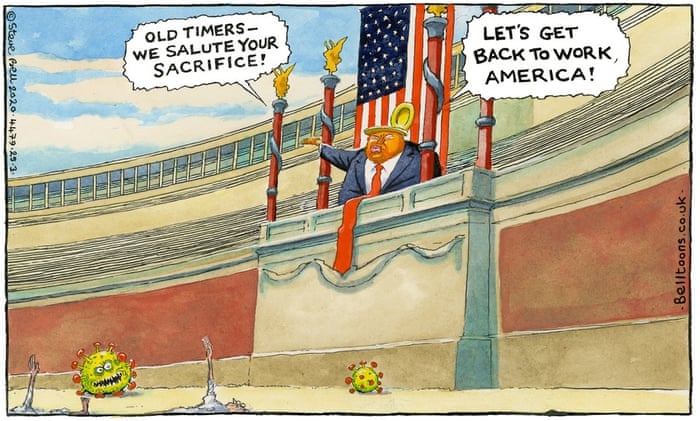

We may not be able to survive another 2 months of Donald Trump at this rate as we could be well over 200,000 people being infected per day by January 20th – 1.4M people per week, 6M people per month and our hospitals are already overwhelmed with new cases and that can lead to many more deaths than the current projection of 103,500 Americans who will die on the altar of Donald Trump in the 69 days (hopefully) he has left in power.

We may not be able to survive another 2 months of Donald Trump at this rate as we could be well over 200,000 people being infected per day by January 20th – 1.4M people per week, 6M people per month and our hospitals are already overwhelmed with new cases and that can lead to many more deaths than the current projection of 103,500 Americans who will die on the altar of Donald Trump in the 69 days (hopefully) he has left in power.

At this rate of acceleration of death, if policy doesn't change, we are on a path to 3,000 people per day dropping dead by January 20th. At what point do you think the market might notice that? Hard to have growth projections for your business when 1M of your potential customers are going to die in the year ahead. Of course we assume President Biden will change policy right away but, as I noted in the Webinar yesterday, that too will have economic consequences. The economic consequences can't be escaped at this point – they are behind doors number 1, 2 AND 3.

With just two weeks until Thanksgiving (and Black Friday), that's another looming disaster we have to look forward to so I'd be VERY CAREFUL in the weeks ahead. The other major issue that's going to be slamming the markets is President Biden is very likely to raise taxes on the wealthy and that includes Capital Gains. With the market at record highs, the cost or NOT cashing in by December 31st could mean 5, 10, even 20% of your profits so, unless you project the market up substantially more than 10% in 2021 – there's really no point to riskng it at this stage.

With just two weeks until Thanksgiving (and Black Friday), that's another looming disaster we have to look forward to so I'd be VERY CAREFUL in the weeks ahead. The other major issue that's going to be slamming the markets is President Biden is very likely to raise taxes on the wealthy and that includes Capital Gains. With the market at record highs, the cost or NOT cashing in by December 31st could mean 5, 10, even 20% of your profits so, unless you project the market up substantially more than 10% in 2021 – there's really no point to riskng it at this stage.

Another thing that will likely change under President Biden is Corporate Income because, under President Trump, Corporate Tax Rates were cut 50% and those are certain to be rolled back and that's going to have a substantial impact on earnings – as will the end of stimulus in a still-weak economy – a very likely scenario for 2021. Stimulus will end beause it has to – our $19Tn economy is $27.2Tn (143%) in debt and the next stimulus bill will put us well into $30Tn (157%) next year.

Another thing that will likely change under President Biden is Corporate Income because, under President Trump, Corporate Tax Rates were cut 50% and those are certain to be rolled back and that's going to have a substantial impact on earnings – as will the end of stimulus in a still-weak economy – a very likely scenario for 2021. Stimulus will end beause it has to – our $19Tn economy is $27.2Tn (143%) in debt and the next stimulus bill will put us well into $30Tn (157%) next year.

This year's budget deficit is going to come in around $4Tn, that's 20% of our GDP and our GDP is still down over 10%! In fact, remember when they used to tell you Consumer Spending was 60% of the economy and the rest was Government and Corporate Spending? Now it's gone the other way and Government Spending has passed $10 TRILLION DOLLARS this year already – over 50% of our GDP! Socialism? You're soaking in it…

They say the only things that are certain are death and taxes – 2021 is likely to give us plenty of both!

At least we're able to have some fun fiddling while Rome burns. Yesterday's Oil (/CL) Futures short paid off very well with a $2,600 gain by the time we ended the trade during our Live Trading Webinar. This morning we're recovering back to the bounce line at $42 and our prediction is that fails and we fall below $41 this time we can short that $42 line today with tight stops above – keeping in mind there's a very volatile inventory report at 11am. If we break over $42, then back to repeat yesterday's plan.

At least we're able to have some fun fiddling while Rome burns. Yesterday's Oil (/CL) Futures short paid off very well with a $2,600 gain by the time we ended the trade during our Live Trading Webinar. This morning we're recovering back to the bounce line at $42 and our prediction is that fails and we fall below $41 this time we can short that $42 line today with tight stops above – keeping in mind there's a very volatile inventory report at 11am. If we break over $42, then back to repeat yesterday's plan.

Oil Extends Gains on Signs OPEC+ Edging Toward Keeping Cuts.

OPEC Deepens Forecast for Drop in Global Oil Demand.

The market is ‘being very cavalier’ about risks the U.S. faces, Jim Cramer says.

U.S. prepares for worst four months of the pandemic as it stares down the ‘darkest’ days yet.

Growth-Stock Scare Looking Like a False Alarm to Options Market.

N.Y. Sets Curfew for Restaurants, Bars, Gyms as Covid-19 Cases Rise.

U.K. Steps Up Talks With Industry as Brexit Disruption Closes In.

U.K. Real Estate Agents See Property Market Weakening in 2021.

Biden Covid advisor says U.S. lockdown of 4 to 6 weeks could control pandemic and revive economy.

JPMorgan Finds No Benefits From COVID Lockdowns.

Goldman Spots An "Early Indicator" US Economy Is Rolling Over Due To Covid Resurgence

Once "Immune" To The Pandemic, The Financial Industry Is About To Face A Wave Of Layoffs.

That last one is interesting as Conservatives are outraged that 17 people were shot in Chicago while silent about 1,600 people who died of Covid the same day. I don't even understand how a person can keep that kind of double-standard in their heads….

484 people in Illinois died of Covid last week, that's 69 people per day. In Georgia, where we have the election for control of the Senate on January 5th, 100 people per day are dying of Covid and 1,637 people per day are becomming infected – maybe we should just give them guns to enforce social distancing? Instead we're going to hold rallies, right?

Be careful out there….