153,000 new cases yesterday.

The virus is spreading at an alarming rate and the futures are up half a point this morning – go figure. Do you want to know why you can't see the US on this chart? Because 153,000 new cases for 330M people is 463 cases per Million people – the chart doesn't go that far!

Across the United States, daily caseloads surged. Illinois reported a record number of infections for the second day in a row. Ohio and Minnesota each topped 7,000 daily cases for the first time since the pandemic began, while Pennsylvania and Indiana reported more than 6,000 cases in a day, according to Johns Hopkins. Other states recording all-time highs included Colorado, Utah, New Mexico, South Dakota, North Dakota, Oregon, New Hampshire and Vermont.

The rising numbers of cases pushed hospitalizations higher. The number of people hospitalized due to Covid-19 rose to a record 67,096 for Thursday, according to the Covid Tracking Project. Intensive-care units continued to face pressure. As of Wednesday, there were 12,796 Covid-19 patients in ICUs, the highest number since May 2. The U.S. death toll, meanwhile, surpassed 242,000 as more than 900 new fatalities were reported, according to Johns Hopkins.

Grocery stores are reinstating purchase limits on items like paper towels or soap for the first time since the spring, as consumers stock up on staples amid rising Covid-19 cases. With people staying at home more, retailers say there is renewed demand for paper products and frozen foods. Stores also are reporting new shortages in staple cooking ingredients like butter and spices.

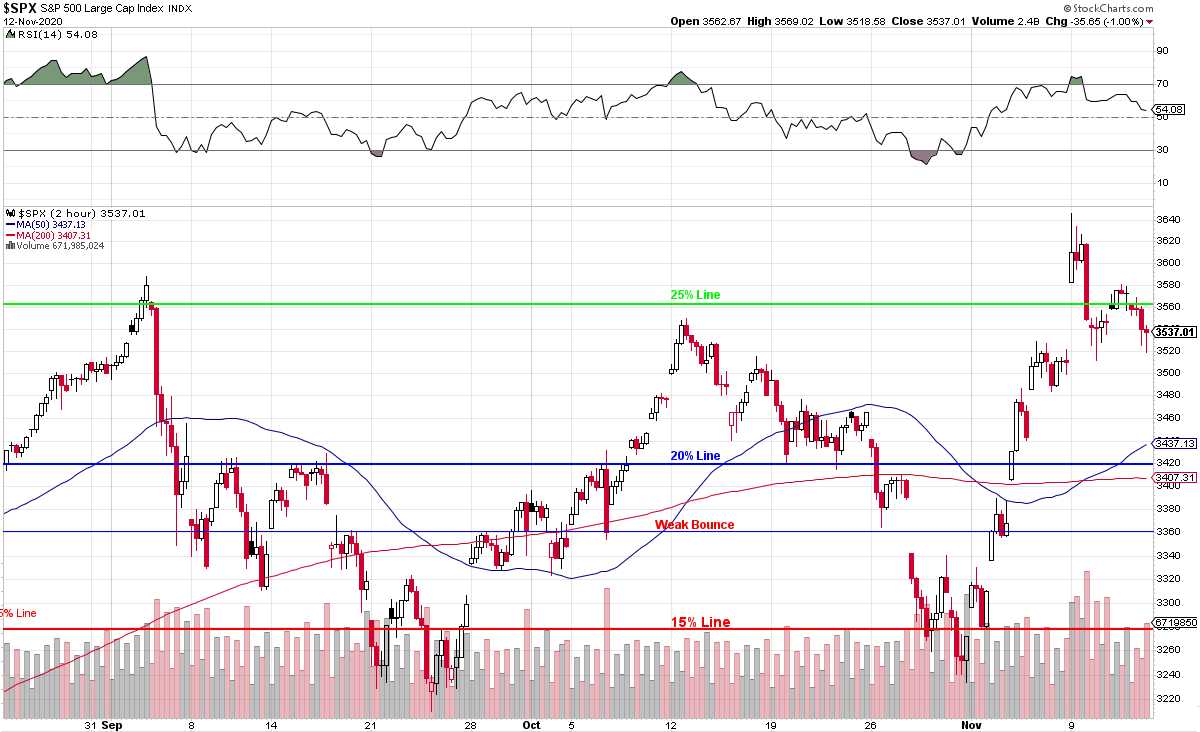

The markets had a bad, but not terrible week as we're still hanging out just under the 25% line and, while an optimist may say that looks bullish, a realist might say that looks exhausted and it won't take much to push us right back down to the 15% line at 3,277.50 again.

Last week we made some changes in the Short-Term Portfolio, to increase our coverage into the weekend as we had "No Stimulus, No President". This week we have a President but we also have an ex-President that won't leave – so I don't consider it much of an improvement yet and, of course, no stimulus either. The Long-Term Portfolio had a good week, going from $1,055,660 to $1,145,403 (up 129% for the year), so up about $90,000 for the week means we should take about $30,000 and spend it on more hedges to lock in our gains.

With the little dip in the S&P, the STP had a nice week, going from $174,483 to $203,763 so it's one of those nice weeks where we're up a bit in both portfolios. That happens because, whether bullish or bearish, we try to sell as much premium as possible and, in a week where we're pretty flat – we can make money on both sides!

- CMG – We bought back the short-term short puts last week so we're more aggressively bearish now. If CMG stays below $1,300 into January we make $26,975 on the short calls and the spread is good for $120,000 or more below $1,100 and it's currently at net $93,270 but we're not in that for the win – we're using it to cover the short puts (we are covering our short calls with CONVICTION!) we sell and we made $10,365 on the last set. We'll sell more on the next dip.

- SQQQ – We rolled to 2x the 2022 $15 calls and SQQQ is at $19.90 so we're well in the money on what I'll call a $300,000 spread because the short Jan $25s will be easy to roll and the other short calls are at $30 but, really, we can do better over the next year. Currently the spread is net $67,312 so we conservatively have $232,688 of downside protection if SQQQ goes up $5, which is 25% and it's a 3x Ultra so an 8% drop in the Nasdaq would do it.

TZA – Here's a great place to spend money. We moved our Jan $25 calls to the April $15 calls for $2 and now they are $1.58 but the April $10s are only $2.70 so let's spend $1.12 ($11,200) to roll the April $15s down to the April $10s and double down on the April $10s (100 more) for another $27,000. So we've spent $38,200 but now our 200 TZA April $11 calls are $1 in the money ($20,000) and a 10% drop in the Russell, to 1,550, would be a 30% bump in TZA, to $14.30 and the spread would be $86,000 so we'd get about +$50,000 back on our investment.

So that's about $300,000 worth of protection against a 10% market drop and I don't think the LTP will lose more than that so we don't NEED to add more protection than that at the moment as it's a regular weekend but then it's Thanksgiving and we're going to want serious proetcion into the holidays.

For now, let's just enjoy Friday the 13th!

Have a great weekend,

– Phil