Tesla (TSLA) got added to the S&P 500!

The stock is taking off like a Space X rocket in Futures trading, up about 15% and boy am I glad we stopped shorting them! Of course, now they are going to make a tempting short again as $500 is clearly ridiculous as that's about a $500Bn valuation for a car company with $25Bn in sales and about $2Bn in profits so call it 250x earnings back at the highs.

Being in the S&P doesn't make you more valuable but it does force index fund managers to buy your crappy stock and that will give all the hedge fund manipulators who have been playing games with TSLA for years a chance to head for the exits into the volume buying spree as the index fund managers (the guys using YOUR retirement funds) are forced to buy TSLA at ridiculous prices. See what a great scam that is?

That's one of the great ways the rich get to force the poor to give them money. Other fun ways are payday loans, Payroll Taxes, Unemployment Insurance, Social (in)Security, ETFs, Rental Properties, Leases, Church…. (see: "The Dooh Nibor Economy"). We've done extremely well for ourselves during this pandemic as the market has flown higher but, a week before Thanksgiving – I think the party is truly over for the year so I URGE YOU to CASH OUT any positions you don't want to see through a 20-40% correction – because that is a very likely thing in the next 3-6 months.

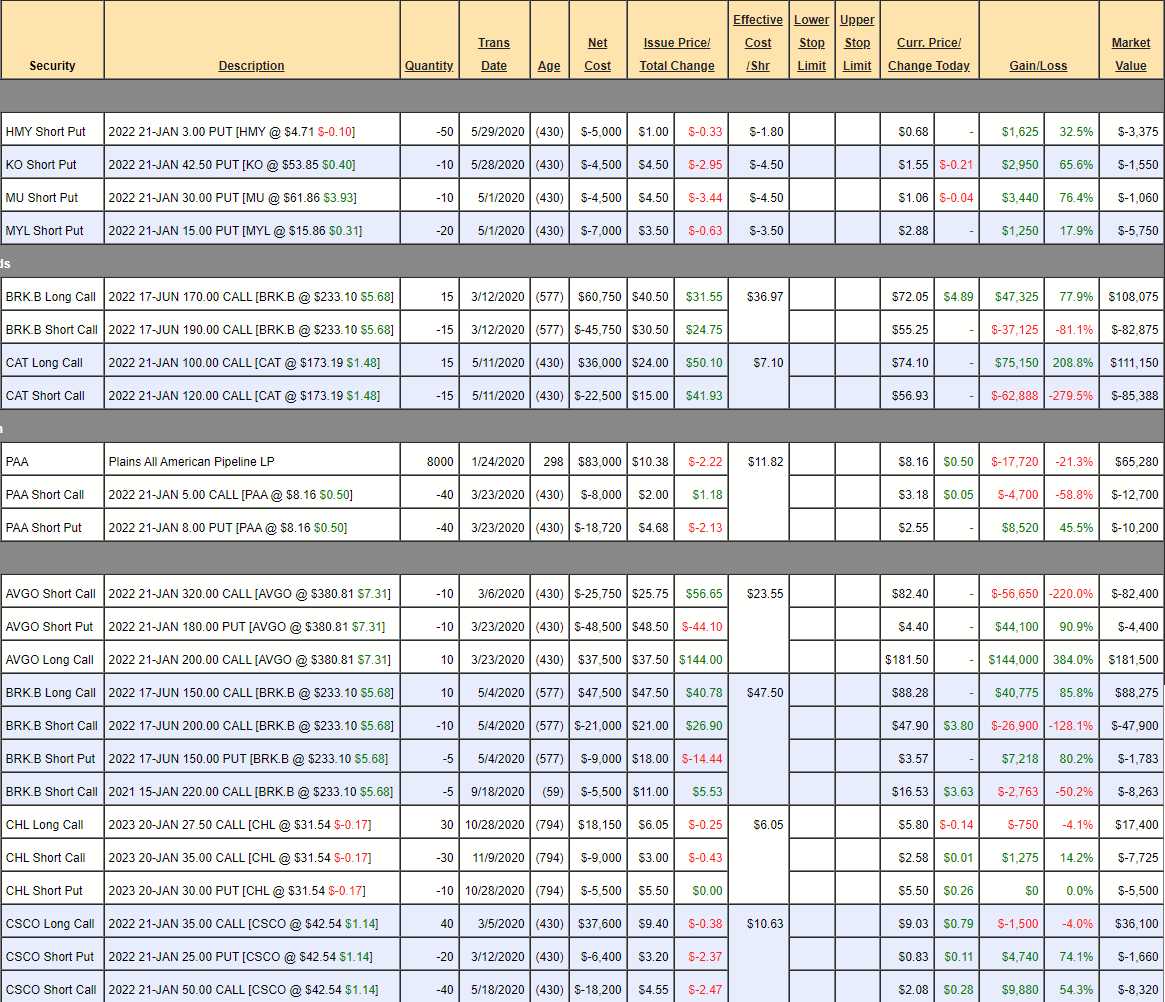

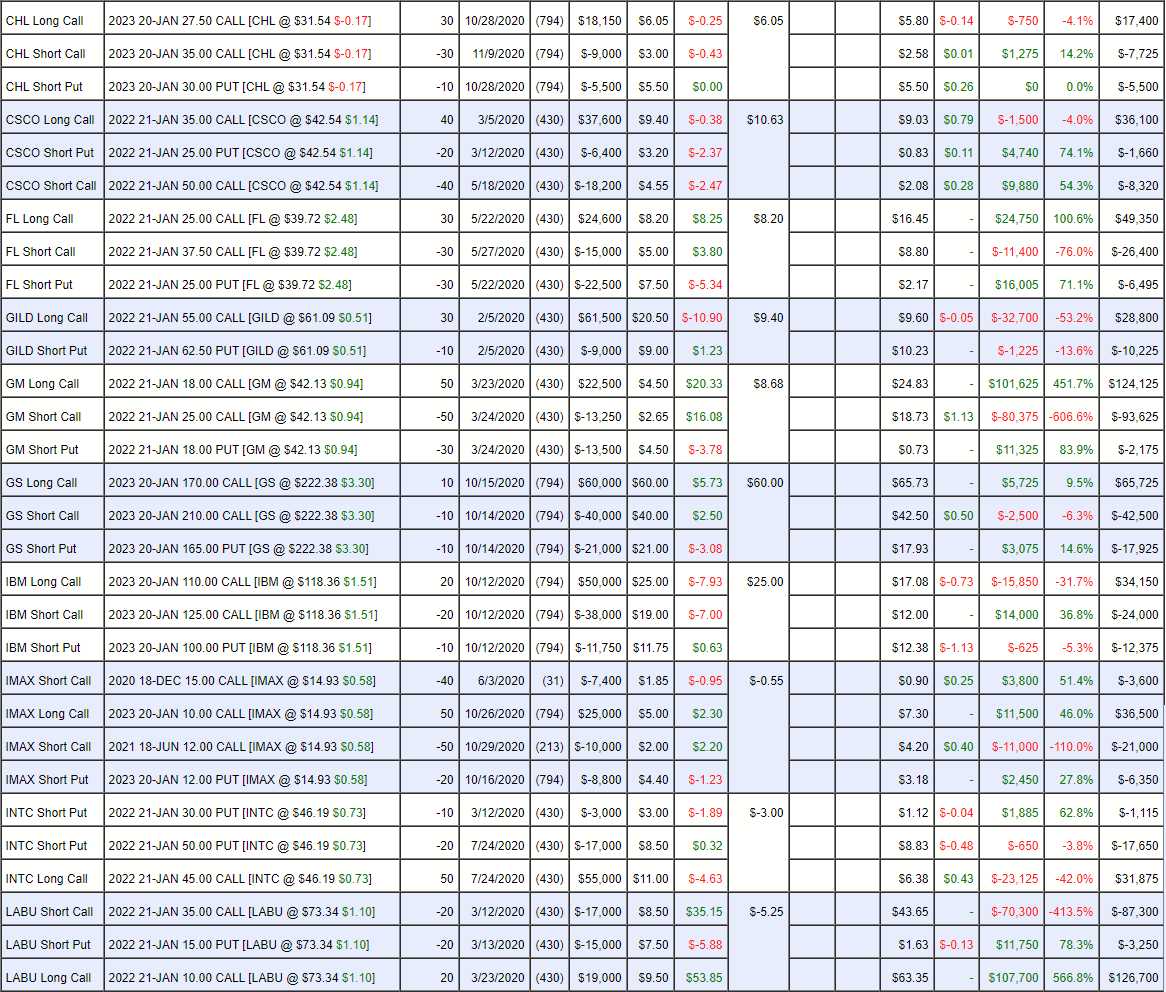

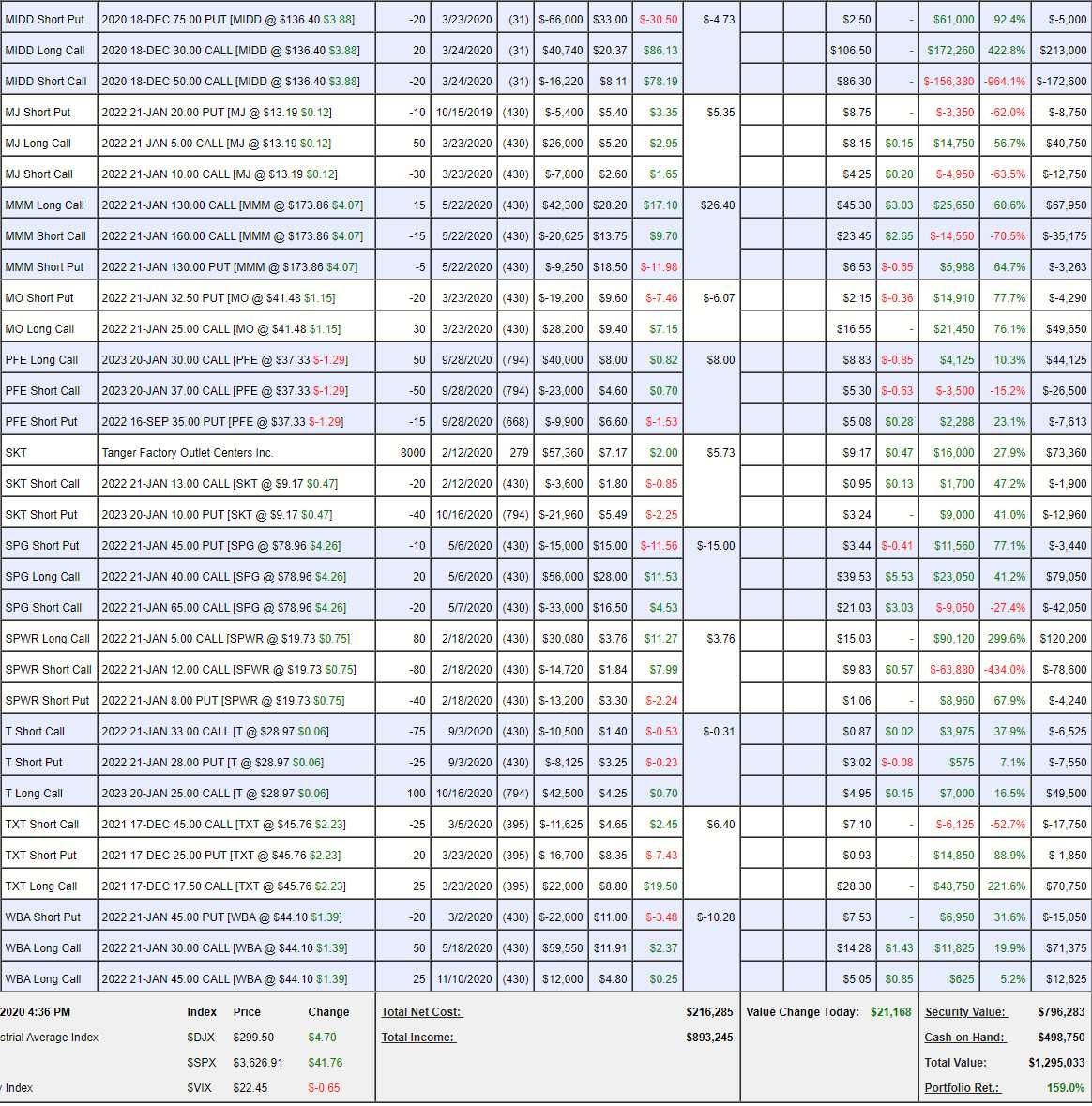

Our last Long-Term Portfolio (LTP) Review was back on October 16th and, at the time, we were at a very healthy $1,070,623 – up 114% for the year. We got very aggressive with SKT and I discussed SPWR, T and WBA as still being great new trades and those all went very well:

Other than that, we left the porftolio alone and that was a great decision as it, along with the market, has blasted higher and now we are at $1,295,033 – up 159% for the year and up $224,410 (22.4%) for the month. That's why we just can't quit our LTP – these positions are just too good! Still, if it were not a teaching portfolio I would ABSOLUTE GO TO CASH – that is way too much money to make in a month or a year and there will be a reckoning – mark my words…

We are at $498,750 in cash already and we have elmintated most of our naked puts to reduce our downside risk and we have the protection of our $200,000 short-term Portfolio, which should gain about $300,000 if there's a 10% correction but – if we can gain 20% in a month – we can lose 20% in less time than that so big gains like this make me more cautious, not less.

We never had many tech stocks, so that's not the issue and we do have a vaccine – so hopefully the economy will improve but we still have a long road to recovery and the market is completely ignoring that – and also ignoring that these stocks are already over-priced, removing the virus we are ignoring anyway isn't going to fix that….

- HMY – Who doesn't want HMY at net $2? It's almost at $5 now and, if there's a market melt-down, gold might do well anyway so not going to kill that one.

- KO – We'll kill this one only because it's already up 2/3 with a year to go so why risk it?

- MU – Same as KO, it's up too much not to kill.

- MYL – I don't love them enough to risk it so let's kill.

- BRK.B – It's a $30,000 spread at net $25,200 – kill. Keep in mind that we don't NEED to get out of these so the way to get out is to offer to sell 5 of the June 2022 $170s for $72.50 and offer to buy 5 of the June 2022 $190s for $55 and, after they fill, ask for good prices for the next 5, etc. Don't take bad prices unless you really, Really, REALLY have to – and we clearly don't on this deep in the money position.

- CAT – Another $30,000 spread at net $25,762 – kill. Of course, you know what happens when you try to kill CAT…

- PAA – Now I can't think of a reason not to own the pipeline company when Biden is taking over and clean energy will come into focus. Plus they just paid us 0.18/share on the 29th ($1,440). I guess we can kill the short puts to eliminate the risk and sell some more if it pulls back.

- AVGO – $95,000 out of $120,000 potential. May as well kill it.

- BRK.B – We're running this one as an income play so we'll keep it. If the market drops 20%, BRK.B will drop 20% but that's only back to $180 so I'm not worried about the short puts and we can roll the short calls so all is well here.

- CHL – Brand new trade, still good for a new one.

- CSCO – I told you so last week – they were way too cheap and I still like them.

- FL – People gotta wear sneakers, right? In this case, $16,455 out of a potential $37,500 is worth keeping as it's a relatively small (easily adjustable) position and I feel the short put price ($25) is a bargain I wouldn't mind owning them at so there's no real risk on this net credit trade other than owning cheap shares of FL for the long-term.

- GILD – Back in the bargain basement so we're going to roll the 30 2022 $55 calls at $9.60 ($28,800) to 50 of the 2023 $45 ($17.25)/$65 ($7.25) bull call spreads at net $10 ($50,000) and those pay $100,000 if all goes well. So we spent $21,200 to go $28,000 in the money and we already bought back the first short calls so our cost basis is better than it looks.

- GM – The bull call spread is $30,500 out of a potential $35,000 and the puts, by themselves, would be bought back so the two independent decisions mean we should kill the trade. Certainly we can make more than 20% using $30,500 in cash so there's no reason to hang onto these and risk anything.

- GS – Net $6,000(ish) out of $40,000 potential is worth keeping and the puts are nice and conservative. Good for a new trade, in fact.

- IBM – I just don't consider them risky down here. Happy to be "forced" to own them at $100, which would be about 11x earnings.

- IMAX – Told you so! Actually it went up so fast we're now getting burned on the short Dec $15s but we'll just roll them along.

- INTC – About to be an "I told you so" so we'll stick with this and, in fact, we can spend $7,000 to roll the 50 2022 $45 calls at $6.35 ($31,750) to 50 2023 $35 ($14)/50 ($6.25) bull call spreads at $7.75 ($38,750) so we're investing $7,000 more to move into a $75,000 spread that's mostly in the money.

- LABU – Who isn't a fan of Biotech this month? Net $36,150 on the $40,000 spread means we have to say goodbye though.

- M – I told you so??? Maybe too soon but just wait.

- MIDD – Wow did they get away from us! Net $35,400 on the $40,000 spread means a sad goodbye to this one.

- MJ – Yet another "I told you so" – this game is fun!

- MMM – Has enough room to run and good enough company that I'm willing to leave it. Very small assignment risk on a stock we don't mind owning.

- MO – Nice comeback. So glad we bought back the short calls! There's no penalty in selling 10 (1/3) March $42.50 calls for $1.50 ($1,500) while we wait as it's easy to roll and protects us a little.

- PFE – Still has that new trade smell and doing nicely already.

- SKT – Another "I told you so" – could be a new record for one month! This company was making $100M/yr and you can still buy the whole thing for $856M. Just silly!

SPG – Two REITs in a row! Another "I told you so" too! Back to the malls we go…

- SPWR – Not my baby!!! At net $37,360 out of a potential $56,000, I think we can hang on to SWPR a bit longer.

- T – Another new(ish) play and already cranking but we have an aggressive $80,000+ spread and it's still only net $35,425 so I guess good for a new trade, even if you missed the net $28,425 entry.

- TXT – At the money but net $50,000 on a $68,750 spread is hard to justify the risk, especially as they were just at $32.50 so let's kill it.

- WBA – Yet another possibly premature "I told you so"! We're very aggressive on these but we did just (wisely) 1/2 cover the calls because THAT'S OUT JOB – TO SELL PREMIUM!!!

I hope that shows you how serious I am about going to CASH!!! We rarely take such a hatchet to our LTP positions and, of course, since we still have our STP covers for a $1.2M portfolio (as well as our other Member Portfolios, of course), we are now extremely net bearish into the holidays.

As I have predicted, Black Friday will be a disaster and Christmas is still cancelled – how is that a bullish premise?

Be careful out there!