Still at those highs.

Trump is determined to go out with a bang so he can blame any market crash on Biden and all the stops are being pulled out to keep things afloat. The Nasdaq was at 5,000 when Trump took office and now were up at 12,000 (up 140% in 4 years) but it's a great short this morning (/NQ) at the 12,000 line as Apple (AAPL) just announced they will be cutting App Store fees by 50% (to 15%) for most developers.

That's going to take a bite out of earnings potential as it shows that, like NFLX, AAPL can't just keep raising rates to generate more revenue – eventually you do get blowback. In Apple's case, they are in court with their clients as well as the Government over their billing practices.

If AAPL goes down from it's current $2Tn Market Cap – it will certainly take the Nasdaq with it so we're shorting the 12,000 line on /NQ this morning with tight stops over the line as it's a very attractive risk-reward play. 11,800 would be a reasonable pullback target – good for $2,000 per contract on /NQ – we'll see how that plays out into this afternoon's live trading Webinar.

Notice we've been pulling back less each time we test 12,000 – that's a very bullish pattern so we're just playing for this little pullback for the moment but, if that 50-day moving average fails (11,500) – it's a long way down (15%) to the next support at the 200-day moving average at 10,250 (by the time we get there).

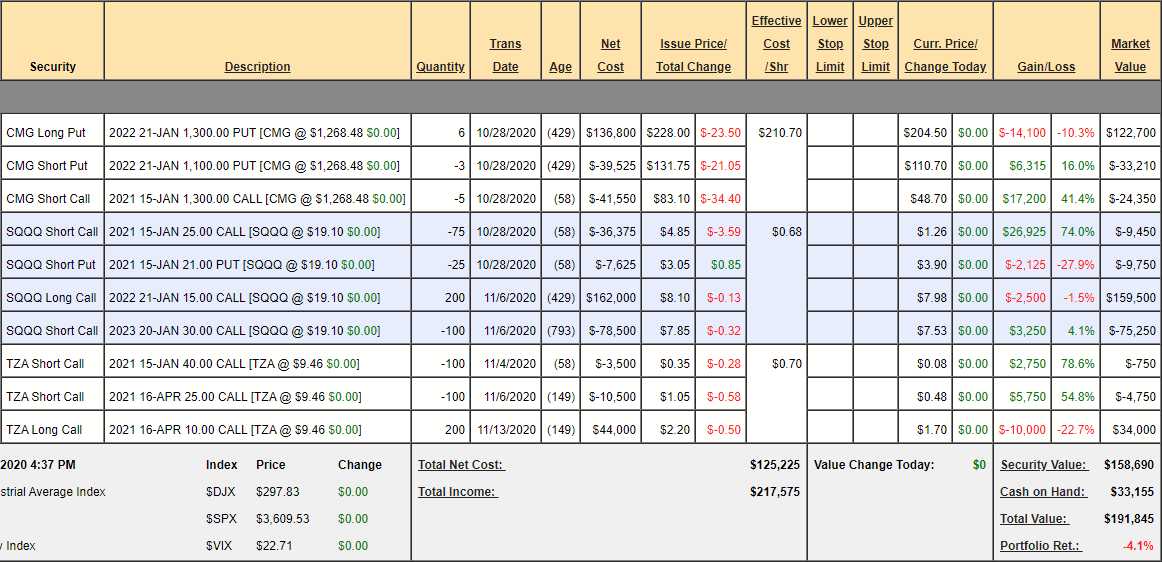

I guess this is a good time to review our new Short-Term Portfolio (STP) which we just started on 10/28 as we cashed out the old one as we had a nice dip and took full advantage. The new STP started with $200,000 to protect what is now a $1.2M Long-Term Portfolio (see yesterday's LTP Review) though now mainly in CASH!!! as we got out of half our positions yesterday.

Our last STP Review was way back on last Friday and we've taken a 5% hit since then as our very aggressive TZA hedge got clobbered with the outperformance of that index but losing $10,000 on our hedges is nothing compared to what we gained in the LTP but now we've cashed out half the LTP and we have to decide if we are staying with these very aggressive hedges, which are still protecting our smaller portfolios but the LTP certainly doesn't need this much:

- CMG – If CMG stays below $1,300 into January we make $24,350 on the short calls and the spread is good for $120,000 or more below $1,100 and it's currently at net $93,270 but we're not in that for the win – we're using it to cover the short puts (we are covering our short calls with CONVICTION!) we sell and we made $10,365 on the last set. We'll sell more on the next dip.

- SQQQ – We rolled to 2x the 2022 $15 calls and SQQQ is at $19.90 so we're well in the money on what I'll call a $300,000 spread because the short Jan $25s will be easy to roll and the other short calls are at $30 but, really, we can do better over the next year. Currently the spread is net $65,050 so we conservatively have $234,950 of downside protection if SQQQ goes up $5, which is 30% and it's a 3x Ultra so a 10% drop in the Nasdaq would do it.

- TZA – On Friday we spent $38,200 to turn this into a $300,000 spread that was at the money at the time. This is where we took our big hit in the STP as we are only half covered and the Russell (/RTY) flew back to 1,800 today (another good short, by the way!). We are fairly positive the short $40 calls will expire worthless and then we'll sell more short calls to reduce our net $30,000 entry but what a good price for $300,000 in protection, right?

- Actually, though, it's not $300,000 as even a 20% drop in the Russell will only pop TZA 60%, from $9.50 to $15.20 and that would pay out $100,000 for net $70,000 in protection. Of course, in a major crisis, the other $200,000 kicks in so this is a two-layer spread and our real plan is, in January, the short $40s will expire and we'll sell 100 April somethings for $1 ($10,000 – currently the $15s) and then spend maybe another $34,000 to roll to the 2022 $8 calls, now $3.20 and then we'll have a full year of solid position AND more time to sell calls to lower our cost basis. Cheap insurance….

So, now that I'm looking at it, we are actually protected just right so I guess, in the back of my mind, I had already decided to kill most of the LTP into the holidays as this really wasn't going to cover the full portfolio as it stands. But it's PERFECT for what we have and I love that we're doing it with just 3 positions – it keeps us very flexible.