$1,486,878!

$1,486,878!

Although that's down a bit from our October Portfolio Review, that's only because we cashed out the old Short-Term Portfolio back on October 28th and we didn't carry the gains forward due to a discrepancy arising from the Tesla (TSLA) split so we reset the STP to $200,000 from $620,909 so really, we've made incredible gains in the last month as the LTP was only $974,283 on the day we re-set - as we got heavily bullish during that mini-crash.

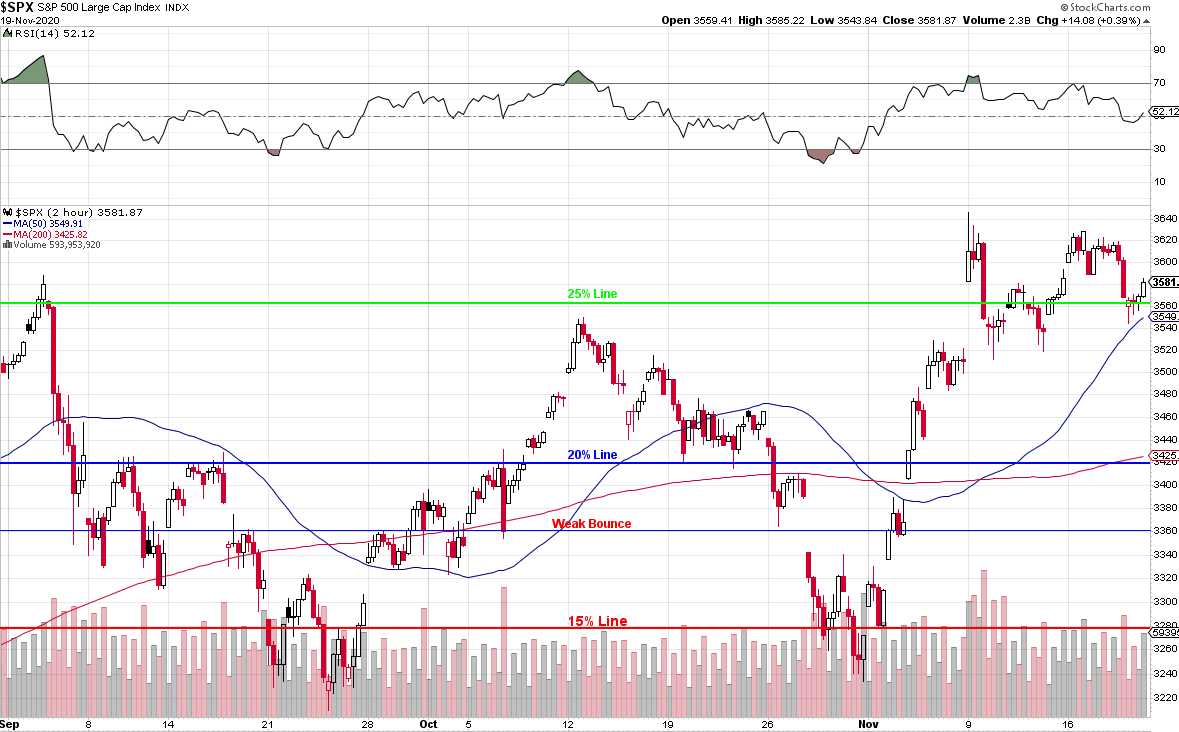

As is has been all year, our timing was pretty perfect and the LTP has rocketed back from $974,283 to $1,295,033 as of Tuesday's review, which is up $320,750 (33%) in 33 days as the S&P flew back from 3,250 to 3,600 (up 10.7%). Of course that's ridiculous and of course we were lucky to time it perfectly so OF COURSE we took the money and ran on Tuesday, cashing in 40% of our LTP positions - enough is enough!

As the great stock trader, Kenny Rogers tells us:

You've got to know when to hold 'em

Know when to fold 'em

Know when to walk away

And know when to run

You never count your money

When you're sittin' at the table

There'll be time enough for countin'

When the dealin's done

S&P 3,600 is certainly enough and certainly too much to risk as we're up more than 50% in 4 years (thank you, Mr. Trump - now LEAVE!) and that's more than double the usual 8% you can expect to gain annually and maybe it will keep going and maybe it won't but we're very confident we can make more money if the bull cycle continues so why risk the holidays when we can lock in these kinds of gains?

With that logic, we'll be taking a look at our other Member Portfolios as we're only at S&P 3,576 this morning, still shorting the Nasdaq (/NQ) below the 12,000 line (now 12,005) as well as the 3,600 line on the S&P Futures (/ES).