If it's Monday we must have a new vaccine.

If it's Monday we must have a new vaccine.

Every Monday for the Month of November (other than before the election – hahahaha), we have had an announcement that there is a 90% effective Covid vaccine and today it's AstraZeneca/Oxford's turn. MRNA and PFE have already announced theirs and it looks like Pfizer is the loser in the vaccine race as theirs requires special, extreme-cold delievery while the other vaccines require only normal refrigeration.

AstraZeneca said it would seek emergency-use authorization from the World Health Organization to experiment on distribute the vaccine in Low-Income countries and prepare regulatory submissions to authorities in countries that have early-approval programs. Pending regulatory authorization, the shot could be available in limited volumes by year-end, with hundreds of millions more doses available each month after that

We sure need that vaccine as US Hospitalizations for Covid hit a record this weekend with 142,732 new cases yesterday, capping off another week of 1M infections in the US. Friday we were just 3,996 short of 200,000 new infections so by next weekend we should expect to be seeing populations the size of Salt Lake City or Vancouver getting infected in a single day. 83,870 people are hospitalized around the country with a new record being set daily.

New York Gov. Andrew Cuomo warned that cases are rising so quickly in parts of the New York City borough of Staten Island that nonessential businesses may be closed and mass gatherings banned there later this week. The bodies of hundreds of people who died in the city during spring surge are still in freezer trucks on the Brooklyn waterfront.

So happy Monday!

Of course we can't blame Trump – even in Japan, with a population of 126M people living in a country the size of California, they have had 132,300 cases of the virus TOTAL and the seven people who died this weekend bring their nation's death toll to 1,981, TOTAL. So don't blame President Trump – he's doing the best he can, right?

Of course we can't blame Trump – even in Japan, with a population of 126M people living in a country the size of California, they have had 132,300 cases of the virus TOTAL and the seven people who died this weekend bring their nation's death toll to 1,981, TOTAL. So don't blame President Trump – he's doing the best he can, right?

Other G20 leaders (Trump boycotted the announcents) have vowed to work together to combat the Corona Virus that has now infected over 12M people world-wide. The G20 Communiqe pledged "To spare no effort to protect lives, provide support with a special focus on the most vulnerable" – all things Trump could care less about. G2019 leaders cautioned that economic recovery under way in some parts of the world appeared uneven and said they would suspend debt repayment for 73 poorer countries through June 2021.

President Trump left the White House at 11:15 a.m. local time, just as the closing session began, and arrived at his Virginia golf course about 45 minutes later. He participated in a session earlier in the morning on protecting the Planet, using the event to criticize the Paris Climate Accord.

President Trump left the White House at 11:15 a.m. local time, just as the closing session began, and arrived at his Virginia golf course about 45 minutes later. He participated in a session earlier in the morning on protecting the Planet, using the event to criticize the Paris Climate Accord.

By the time Trump played the 9th hole, 42 Americans had died so he told his team to "pick up the pace" and, by the time they finished lunch in the clubhouse, over 200 Americans had died during his 5-hour round of golf. This was a new record for a Sunday – Trump will surely go down in history…

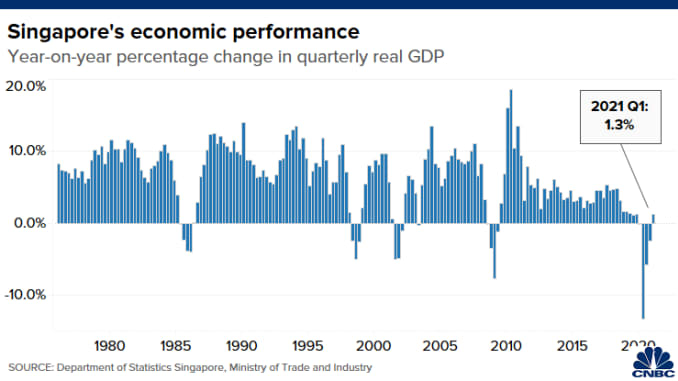

The G2019 Nations are right to be concerned about the Global Economy, Singapore, who are a bellwether for Asia, just reported that Q3's GDP is still 5.8% below last year, much worse than expected by leading Economorons but at least and improvement from Q2's 13.2% contraction. Singapore has started lifting some restrictions since early June – which allow most activities to resume – but some measures remain, such as compulsory mask-wearing and a cap on gatherings.

Meanwhile, over in China, Caixin reports, Huaxin Trust Co. one of 68 companies licensed to conduct trust business in China and one of the largest "shadow banks" in the mainland , is trying to raise as much as 6.8 billion Yuan ($1 billion) from strategic investors as it faces a growing liquidity squeeze that’s already forced it to skip repayments on dozens of investment products over the past few months. Even before the current episode of corporate bond turmoil triggered by the sudden defaults of state owned Yongcheng Coal and Brilliance Auto, China’s regulators had already become increasingly concerned about the hidden risks in the trust sector which plays an key role in the shadow banking sector by providing loans to higher-risk companies and those who have difficulty getting credit from traditional banks. The loans are packaged into high-yielding products which are then sold to retail investors and institutions.

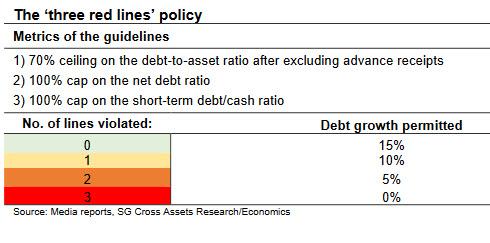

China made a regulatory push to limit debt in October detailed in "China Crackdown On Property Developer Debt Sparks Fears About Systemic Crisis" and laid out the new "Three red lines" policy espoused by Beijing limiting the amount of new debt issuance.

China made a regulatory push to limit debt in October detailed in "China Crackdown On Property Developer Debt Sparks Fears About Systemic Crisis" and laid out the new "Three red lines" policy espoused by Beijing limiting the amount of new debt issuance.

As of Thursday, the trust firm had only repaid four products that matured recently, and extended repayment on 23 products, with the earliest coming due in September, according to its website. Huaxin Trust said in announcements on its website that enterprises had failed to repay the principal and interest on the products forcing the company to extend the repayment dates as allowed in the terms and conditions of the trust products sold to investors. In essence, the repackager of high-yielding debt was pushing off blame on what may soon be a cascade of falling dominoes on companies it had lent money to.

As noted by Zero Hedge: The total assets in China's shadow bank sector have shrunk consistently since peaking in early 2018 as Beijing focused on aggressively limiting the amount of high-yielding debt issued by the sector. However, with tens of trillions in yuan-denominated debt still outstanding within this loosely regulated offshoot of China's financial system, which still represents a last-ditch option for liquidity-challenged companies, as China's economy continues to shrink from the consequences of the pandemic regardless of the rosy and goalseeked data that Beijing is publishing on a monthly basis to convince the world – and China's massive depositor base – that all is well, we expect after the initial round of early tremors to hit China's trust companies such as Huaxin, the real shock to China's financial system is yet to come.

We began playing the Covid Crisis way back on January 23rd with a China Ultra-Short (FXP) hedge in our Short-Term Portfolio and we cashed in on a huge spike in March but now it's back to $32.50 and, in our STP, we can add 40 of the FXP March $33 ($2.50)/$40 ($1.25) bull call spreads for $1.25 ($5,000) and that will pay back $28,000 if China ends up having severe banking issues, which are not likely to be fully revealed until Q4 reporting begins.

It's a good insurance policy that can pay us $23,000 (460%) and, if we stop out with a 50% loss ($2,500) – it's a pretty cheap policy at that.

It's a holiday week in the US, so not much going on (other than the coup). PMI this morning, Richmond Fed tomorrow and GDP, Durable Goods, Consumer and Investor Confidence and Inventories on Wednesday – all followed by the Fed Minutes so Wednesday's going to be exiting at least.

Be careful out there.