This is a solemn duty.

This is a solemn duty.

We have not had a miss in a decade of our Trade of the Year picks and I'd hate to break that streak. I am currently considering that my trade of the year should be NO TRADE as I really don't trust the markets and I'd rather short Tesla (TSLA), which is often a suicide run but TSLA never stops going up and $650 is $608Bn in market cap – more than EVERY other car company COMBINED – so that stock has left logic and reason behind long, long ago.

And yes, just one week ago, they made this chart and TSLA was 20% lower than it is now. Since then it's gained a Volkswagen in value and that's clearly ridiculous but, when things are clearly ridiculous, what is to stop them from getting more so?

So, TSLA is too dangerous to short but, if I were to short it, I would buy the Jan 2023 $800 puts for $350 and I would sell the Jan 2022 $800 puts for $295, which would put me in the calendar spread for net $55 and I would pay for 10 of those $55,000 by selling 3 Jan 2022 $750 calls for $152.50 ($45,750) so we'd be in the spread for net $9,250 and our hopes there are that the short calls expire worthless and the short puts either expire worthless or can be rolled lower and whatever value is left on the long puts greater than $9,250 is our profit. We'll see how that goes next year.

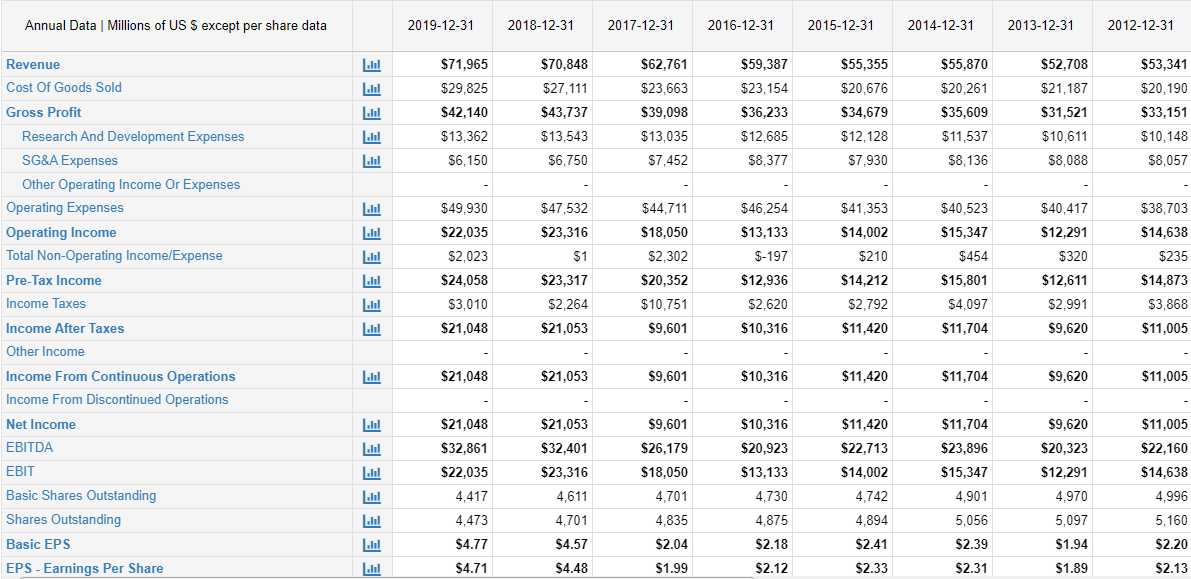

In last year's Trade of the Year Report, we ended up picking Barrick Gold (GOLD) at $16.50 with a net $750 spread that would pay $12,000 if all went well for a $11,250 (1,500%) profit if GOLD were over $17 in Jan, 2022 (one of our famous "Stupid Options Tricks" we teach our Members. GOLD rocketed up to $30 in the summer and we took an early exit and now it's back to $23.95 and I'm almost ready to jump back in:

I don't see the Dollar getting too much stronger so Gold and GOLD should continue to do well in 2021 and the easiest way to play is to promise to buy GOLD at $16.50 again, which seems like a no-brainer, right? We do this by selling 5 of the 2023 $20 puts for $3.50 ($1,750) and that obligates us to buy 500 shares of GOLD for $20 but, since we get $3.50 per share in our pockets for making that promise, our net would be $16.50.

That's how we can make 15% of the stock's value just for promising to own it at a 31% discount to the current price. Nice trick! GOLD has been volatile enough that we could pair the short puts with a 2023 $20 ($7.20)/$25 ($5.20) bull call spread at net $2 and we could buy 10 of those for $2,000 which would net us into the entire spread for net $250 and the spread will pay back $5,000 for a $4,750 (1,900%) profit if GOLD is over $25 in Jan, 2023.

Of course, we lose our big discount and we'd net into 500 shares of GOLD at $20 plus the $250 we're investing in the spread so $20.25 would be our net cost if it all goes wrong, still $3.70 (15.5%) less than the current price and only 500 shares for $10,250. That is not a big risk and the reward is great so it's an excellent trade – could easily be the Trade of the Year again.

We are not shy about revisiting the well in our Trades of the Year. Apple (AAPL) was our Trade of the Year 3 years in a row and, each time, it hit its goals. The Trade of the Year is the trade we feel is most likely to return at least 300% over 24 months. Last year, we were strongly considering our 2018 Trade of the Year, IBM (IBM), which had fallen back and we did make the play and it's still in our Money Talk Porfolio:

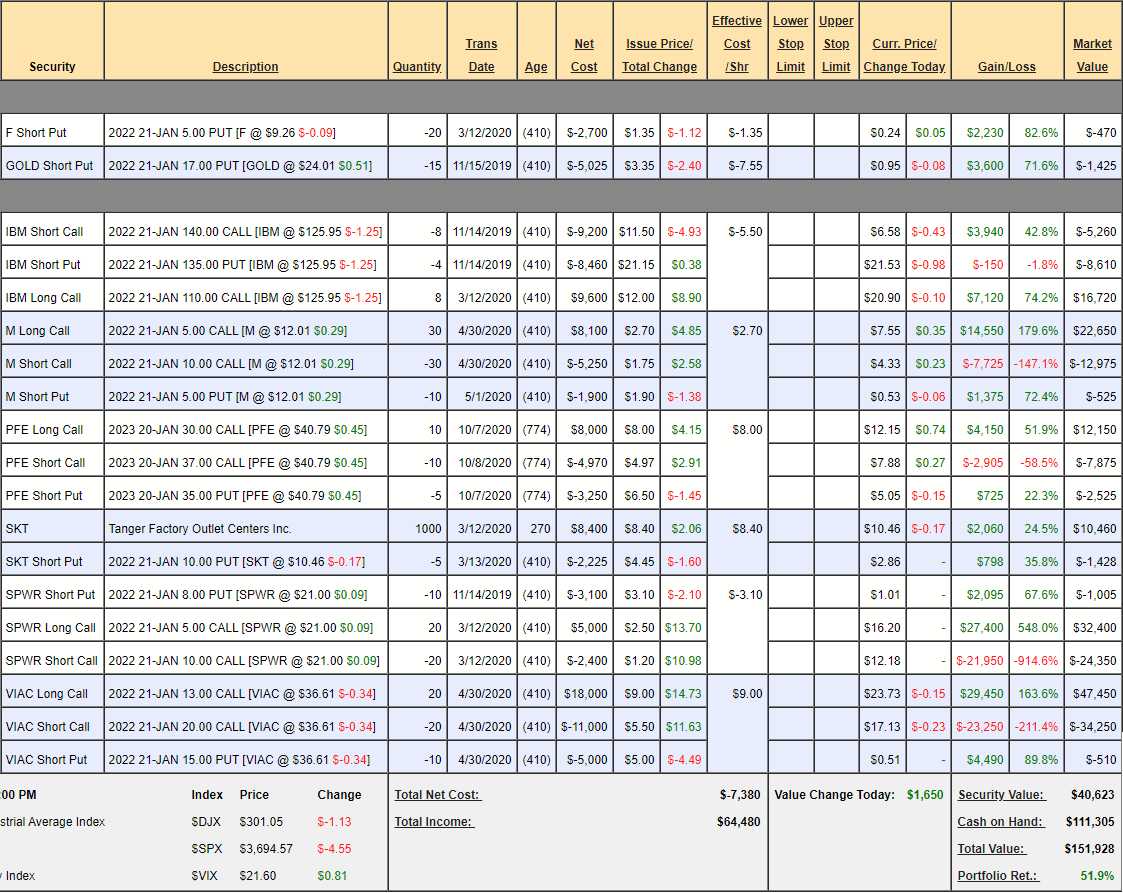

| 2022 21-JAN 140.00 CALL [IBM @ $125.95 $-1.25] | -8 | 11/14/2019 | (410) | $-9,200 | $11.50 | $-4.93 | $-5.50 | $6.58 | $-0.43 | $3,940 | 42.8% | $-5,260 | ||

| 2022 21-JAN 135.00 PUT [IBM @ $125.95 $-1.25] | -4 | 11/14/2019 | (410) | $-8,460 | $21.15 | $0.38 | $21.53 | $-0.98 | $-150 | -1.8% | $-8,610 | |||

| 2022 21-JAN 110.00 CALL [IBM @ $125.95 $-1.25] | 8 | 3/12/2020 | (410) | $9,600 | $12.00 | $8.90 | $20.90 | $-0.10 | $7,120 | 74.2% | $16,720 |

Another huge winner as we netted in for a credit of $8,060 and now it's worth net $2,850 so the overall gain is $10,910 at the moment but the spread has the potential of being 8(00) x $30 for $24,000, which would be a gain of $32,060 so we still have $21,150 (194%) left to gain on this spread and I do love IBM long-term – so it's a keeper.

Sunpower (SPWR) was another runner-up last year because there was uncertainty regarding their spin-off but there turned out to be no reason to worry about them or CBS, which became VIAC and also went on to do very well for us. Reiterating others that were under consideration, at the time, I said:

Teva (TEVA) is a good value but too uncertain, Oil Service ETF (OIH) also a good value but also too choppy with a dim demand outlook and the uncertainty of the Aramco IPO (will they flood the market with oil trying to make numbers?). GME and BBY already got away from our lows but Tanger Factory Outlet (SKT) is still unloved and we think they are still stupidly cheap at $15.88 but a bit too Fed dependent to be the Stock of the Year (we don't want something where factors out of their control can hurt their business). L Brands (LB) is still stupidly cheap but the Biotech ETF (LABU) already popped 40% while we've been considering it.

Mittal (MT) we would like to see a bit cheaper or at least break over $17.50 finally, Travelers (TRV) is the best bargain on the Dow and a possible play, Northern Dynasty (NAK) is a penny stock but, at 0.57, I'd buy 10,000 shares for $5,700 and forget about it for 5 years – just in case they ever get their permit (I'd also sell half if they hit $1.14 so I'd have 5,000 shares at net $0!).

Frontier (FTR) is down to 0.75 so do we buy them before or after restructuring? I'd say 1,000 shares now ($750) and plan to spend $4,250 once they announce a new CEO and get a reaction.

Barrick Gold (GOLD) is reasonable again at $16.44 and at $15 I'd certainly want to buy them and we can do that with options so very tempting… Cleveland Cliffs (CLF) is being hurt by the China Trade Issues but, as a North American Iron Ore Manufacturer, they have certain advantages and should really pop if we ever do get a deal. Capril Holdings (CPRI) already took off on us, IMax (IMAX) is stupidly cheap at $21.25 but hard to call a Stock of the Year as they are a slave to Hollywood's releases to make their share of the money.

Lockheed Martin (LMT) is our stock of the Decade for the 2020s but that's way higher now than when we picked it. Annaly (NLY) is too cheap at $9.12 and pays a nice dividend but options aren't exciting enough for a Stock of the Year. Walgreens (WBA) was our first choice for Stock of the Year but someone else liked them so much they offered to buy the whole company and they already popped 25%.

Oops, FTR did NOT go well at all – they ended up restructuring. To be fair, they did jump 50% into December but, after that, spiraled into darkness, never to return. IMAX got clobbered and is now $14.46 and WBA was once again my first choice for Stock of the Year this year but they already popped quite a lot off the lows.

Likewise SKT also had a big pop and they were my second choice for Trade of the Year:

AT&T (T) was in the running but also took off. Intel (INTC) is still in the running at $50 as it seems like such a sure thing not to be any lower (like GOLD) and that's all it takes for us to construct a 300% play. Cisco (CSCO) is also stupidly cheap and I like them for the same reasons (Internet of Things, 5G, Robots) but INTC is as ridiculously cheap as TSLA is ridiculously expensive. Also stupidly cheap is IBM (IBM), who are still near where they were in November, when I made this comment in our Live Member Chat Room:

Submitted on 2020/11/10 at 11:50 amIBM/Ravi – From scratch I would go with:

- Sell 5 IBM 2023 $100 puts for $20 ($10,000)

- Buy 15 IBM 2023 $110 calls for $20 ($30,000)

- Sell 15 IBM 2023 $135 calls for $10 ($15,000)

- Sell 5 IBM Jan $120 calls for $4 ($2,000)

That's net $3,000 on the $37,500 spread so that's $34,500 (1,150%) upside potential at $135, which is not very far away. The short calls can be rolled and I don't think IBM will explode and, of course, any time IBM doesn't gain a few % in a quarter, you lower your basis.

Also nice that we're starting out $10,500 in the money so it's another Trade of the Year contender with that kind of leverage!

That's still playable if you like making 1,150% in two years. Chimera (CIM) is a REIT and it's hard to pick REITs but I love them at $10.75 paying a $1.20 (11.03%) dividend and you can buy 1,000 shares for $10,750 and sell 10 of the 2023 $10 puts for $3.20 ($3,200) which is promising to buy 1,000 more for net $6.80 and you can sell 10 of the 2023 $10 calls for $2.20 ($2,200) so you've effectively spent net $5,350 on the $10,000 potential spread and all CIM has to do is hold $10 and you make $4,650 plus $2,400 in dividends = $7,050 (131%), which is nice, but not good enough to be our Stock of the Year, unfortunately.

Last year, we closed out our previous Money Talk Portfolio on September 18th, after gaining 148.1% in two years. That's why we ended up adding a few of our Stock of the Year contenders to the new MTP, as we were looking for all new trade ideas last November. This year, we have to decide which positions we are keeping and which we'll be cashing before we decide what the Trade of the Year will be.

Keep in mind we only trade the Money Talk Portfolio when I'm on BNN (quarterly) so it's the very definition of a low-touch portfolio. That also affects our trading decisions as we don't want to play stocks we're not VERY comfortable just leaving alone for 2-4 months at a time. At the end of our first full year with the new MTP, here's how we stand:

- F – Selling a short put is the basis for most of our entries. As we mentioned above, it's a way to get paid to promise to buy stocks at a discount (see "How to Buy Stocks for a 15-20% Discount"). In this case we were paid $2,700 for promising to buy Ford at $5 but now the stock is at $9.25 and there's only $470 left on the short put and we have to wait a whole year to collect it. We can do better so we'll cash this one out.

- GOLD – Similar situation. We have no fear of being assigned GOLD at $17 but it's an opportunity cost and we've already collected 71.6% of our max possible – so we'll cash it out.

- IBM – As noted above, it's a keeper with $21,150 left to gain.

- M – I'm very angry they took off, they are a sentimental favorite. It's a $15,000 spread at net $9,150 so 64% more to gain ($5,850) is worth keeping.

- PFE – This was a new pick from the last time I was on the show. Already doing well but it's a $7,000 spread at net $1,750 so $5,250 (300%) left to gain puts it almost at Trade of the Year territory. Almost.

- SKT – Another one I love but we have to take advantage of this run and sell 10 of the 2023 $10 calls for $3.50 ($3,500) to drop our net down to $2,675 with a potential gain of $7,325 (273%) if SKT simply holds $10 and hopefully they will restart the dividends too for bonus money. As the net is currently $5,532, there is actually only $4,468 left to gain.

- SPWR – It's a $10,000 spread at net $7,045 so $2,955 (42%) left to gain. Since we are 200% in the money, there's no reason to kill this trade as we don't really have anything better to do with that $7,045 than make the 42% over the next 12 months, do we?

- VIAC – This is a $14,000 spread also almost 200% in the money but, at net $12,690, there's only about 10% left to gain and we can certainly do better than that with $12,690 in CASH!!!, so we're going to kill this one, sadly.

What a fantastic group of picks! 3 cash outs will leave us with just 5 positions but those 5 positions are on track to gain another $39,673 so it's a very good base and nicely diversified with Tech, Retail, Pharma, REIT and Solar.

I'd rather not pick another Tech as SWPR is technically tech but I have no choice but to recognize Intel (INTC) as the trade most likely to return 300% over the next two years AND be the least likely to take a loss. Those two factors, low risk and high reward, make INTC our 2021 Trade of the Year. After bottoming out at $45 on delays in their new chip sets, INTC has already recovered to $50 but that's only $205Bn and INTC makes $21Bn a year in Net Income for a P/E of less than 10.

The recent volatility has left the option premiums elevated so we can take advantage of that with the following trade idea for the Money Talk Portfolio:

- Sell 10 INTC 2023 $45 puts for $7.30 ($7,300)

- Buy 25 INTC 2023 $45 calls for $10.75 ($26,875)

- Sell 25 INTC 2023 $55 calls for $7.00 ($17,500)

That's net $2,075 on the $25,000 spread with $22,925 (1,105%) of upside potential at just $55. Ordinary margin on the short puts should be $3,059 but, even with IRA or 401K full margin, this is a very nice way to make $22,925 in two years as the downside risk on INTC is very limited. Their main rival, AMD, has just $7Bn in sales vs $72Bn for INTC, they are 1/10th the size and no significant threat.

With another $22,925 of potential upside, we have over $60,000 of potential gains in the MTP and that means we can coast into the new year without fear of missing out (FOMO) if the rally continues and, if it doesn't, we have massive amounts of cash to deploy and almost all of our margin buying power available as well.

Looking forward to 2021!

***

Watch Phil on BNN MoneyTalk here: