Phil's trade of the year for 2021: Intel

Phil's Money Talk Portfolio is up 51% Year to Date!

- Read Phil's review of his Money Talk Portfolio here.

- Watch Phil and Kim Parlee discuss the Money Talk portfolio and Phil's trade of the year for 2021 on BNN Bloomberg:

Phil Davis, founder of philstockworld.com and managing partner at PSW Investments, recaps the performance of the MoneyTalk PSW portfolio and explains why tech giant Intel (INTC) is his trade of the year. (BNN Bloomberg)

Trade of the Year 2021: Intel (INTC)

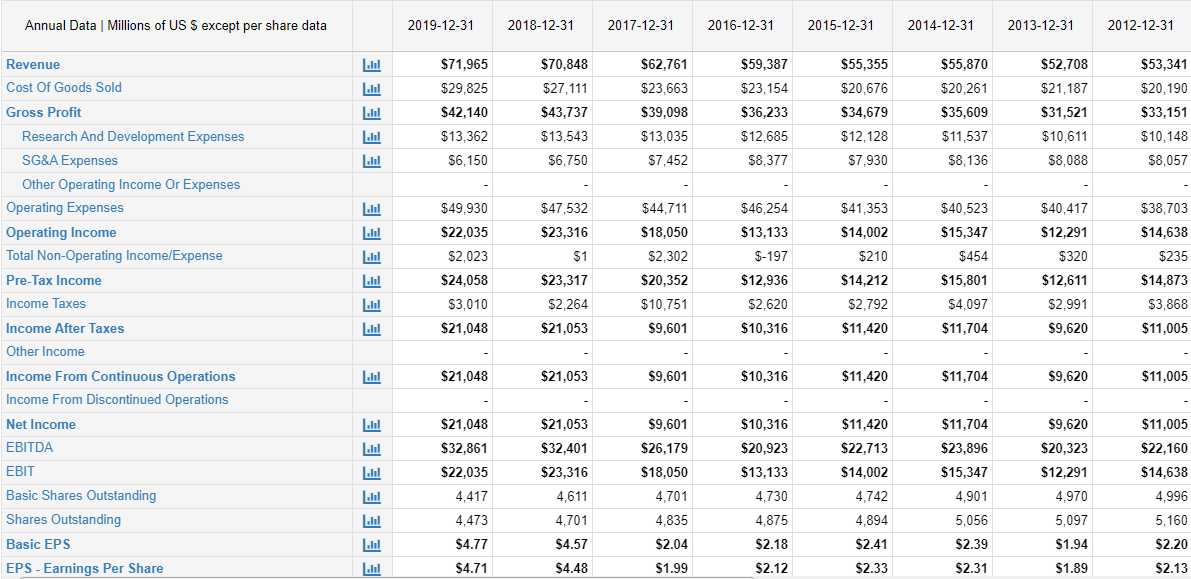

I'd rather not pick another Tech as SWPR is technically tech but I have no choice but to recognize Intel (INTC) as the trade most likely to return 300% over the next two years AND be the least likely to take a loss. Those two factors, low risk and high reward, make INTC our 2021 Trade of the Year. After bottoming out at $45 on delays in their new chip sets, INTC has already recovered to $50 but that's only $205Bn and INTC makes $21Bn a year in Net Income for a P/E of less than 10.

The recent volatility has left the option premiums elevated so we can take advantage of that with the following trade idea for the Money Talk Portfolio:

- Sell 10 INTC 2023 $45 puts for $7.30 ($7,300)

- Buy 25 INTC 2023 $45 calls for $10.75 ($26,875)

- Sell 25 INTC 2023 $55 calls for $7.00 ($17,500)

That's net $2,075 on the $25,000 spread with $22,925 (1,105%) of upside potential at just $55. Ordinary margin on the short puts should be $3,059 but, even with IRA or 401K full margin, this is a very nice way to make $22,925 in two years as the downside risk on INTC is very limited. Their main rival, AMD, has just $7Bn in sales vs $72Bn for INTC, they are 1/10th the size and no significant threat.

With another $22,925 of potential upside, we have over $60,000 of potential gains in the MTP and that means we can coast into the new year without fear of missing out (FOMO) if the rally continues and, if it doesn't, we have massive amounts of cash to deploy and almost all of our margin buying power available as well.

2021 outlook for markets

Global markets continue to flirt with record highs even as the global economy deals with the economic fallout of the COVID-19 pandemic with more stimulus spending. Phil says investors should be cautious and be ready to head for the exits if the spending party looks to be coming to an end.