There's always a bright side.

There's always a bright side.

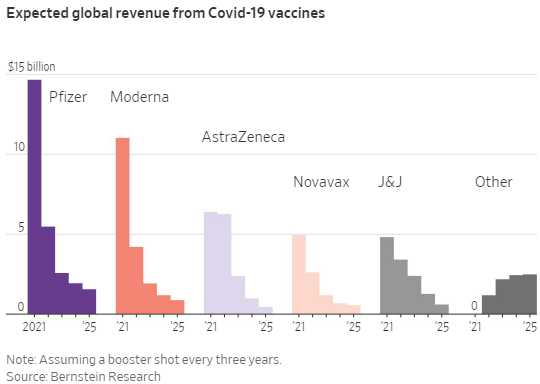

In this case, for vaccine makers, $130Bn in unexpected revenues over the next 4 years and, as I noted back on Sept. 28th in "The Week Ahead – 3,350 is Critical for the S&P 500" and our corresponding Top Trade Alert, "Pfizer (PFE) made $16Bn last year and you can buy that whole company for $200Bn at $36 per share so just 12.5 times earnings… While Pfizer may not ultimately "win" the vaccine race, they are a solid blue-chip pharmacuetical company who are clearly able to keep up with the BioTechs WHILE making a healthy profit. Isn't that the kind of company we like to invest in?"

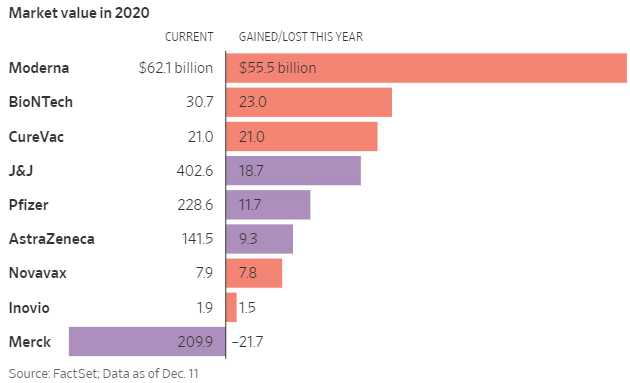

As you can see, PFE is going to generate $21Bn in additional revenues next year alone – a nice boost to their normal $50Bn in revenues and, while they may not make much profit selling their Covid vaccine next year (state of emergency regulations), they will make follow-on revenues for years to come. That's how PFE became our "value play" in the virus space.

The investing premise was simple, the others had gotten away already so we went long on PFE, which was lagging the rest of the sector – a horse no one believed would win the race but we made a place bet – simply betting our horse would finish the race and, even if it didn't, it was still a good horse and we'd run it in future races.

The investing premise was simple, the others had gotten away already so we went long on PFE, which was lagging the rest of the sector – a horse no one believed would win the race but we made a place bet – simply betting our horse would finish the race and, even if it didn't, it was still a good horse and we'd run it in future races.

Johnson and Johnson (JNJ) was also sure to be in the running and is a good, reliable stock but, at $400Bn in market cap, it's twice the size of PFE and would then draw less net benefit from a new line of revenues. That's why PFE is up over 20% since late September and JNJ is only up 2.5%. You don't have to be psychic to predict the future of a stock – you just have to pay attention to trending condisions in the news and the markets and think about how that will impact their business down the road.

That's what our Top Trade Alerts are all about. Sound investing ideas that are not following the short-term trends – we're focused on the long-run and we generally make nice, sensible trades that aren't swinging fot the fences – but will still make very nice returns if they are successful. Our PFE trade idea for the Long-Term Portfolio (LTP) is already up $5,750 against our net $7,100 cash outlay – a gain of 80% in less than 3 months!

We only make our Top Trade picks when we think a trade idea has a very high probability of success as a "set and forget" kind of trade. Other Top Trade ideas around that time were:

Top Trades for Fri, 14 Aug 2020 10:52 – WBA – Would have been my 2021 Trade of the Year if they hadn't popped 25% ahead of my announcement. Who do you think is going to be dispensing a lot of those vaccines?

Top Trades for Thu, 20 Aug 2020 14:00 – T – Any time AT&T dips below $30, we like to buy them. That's been true for more than a decade.

Top Trades for Thu, 03 Sep 2020 15:01 – VIAC – All year long I had been banging the talbe for VIAC, who became stupidly cheap after their merger.

Top Trades for Wed, 16 Sep 2020 15:29 – LNG and M – Biden was likely to re-start climate agreements, which is great for LNG, as would be industry re-starting next year. Macy's, I had been banging the table on all year.

Top Trades for Mon, 28 Sep 2020 11:19 – PFE & T – While we were on the subject of value blue chips that pay great dividends, AT&T came to mind as well.

Top Trades for Thu, 01 Oct 2020 13:39 – EPD – We thought the dividend alone made them a great holding – taking off was a bonus.

Top Trades for Thu, 08 Oct 2020 08:44 – JETS and Future Is Now Portfolio Review – We could see light at the end of the tunnel on the airline industy.

Top Trades for Mon, 12 Oct 2020 06:53 – IBM – We always love IBM when they are cheap.

Top Trades for Wed, 14 Oct 2020 10:06 – GS – We always love GS when they are cheap.

Top Trades for Thu, 22 Oct 2020 09:44 – CHL – I Biden recinds Trump's rule on Chinese listings, this will fly.

Top Trades for Tue, 10 Nov 2020 11:50 – IBM – IBM was still too cheap but leaving the station so this was an adjusted trade in case you missed the first.

Top Trades for Wed, 02 Dec 2020 10:50 – T – T was still cheap, so we kept picking it!

13 winners and one (CHL) loser (92% winners) so far and it took Government regulations to give us our one loser! THAT is a valuable service and you can give a Top Trade Alert Subscription to your friends as a Christmas present and, for each friend you refer – you will be giving yourself a discount off your own memembership. It's the gift that keeps on giving – in so many ways!

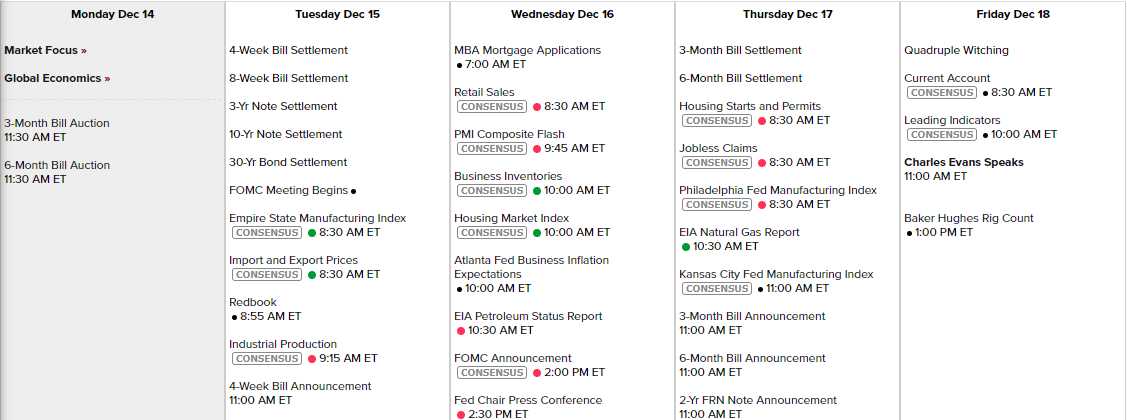

It's a busy market week ahead of the holidays with a Fed meeting on Wednesday along with Powell's Press Conference. Friday is Quad Witching, when everything expires so could be an interesting week.