Shorting sure does seem pointles, doesn't it?

Shorting sure does seem pointles, doesn't it?

No matter what the news, the market seems to climb higher and no one seems to notice (or care) that the Dollar continues to get weaker, down almost 5% since September. That's a 5% Tax on you total net worth thanks to these inept economic policies so when you wonder where all this stimulus money is coming from – it's being extracted from every Dollar you've ever made in your life and every asset you own (if they are Dollar-based).

The Dollar is down 8% since July and down more than 10% since March while the S&P 500 has climber from 3,100 to 3,700, which is 20% and that makes sense because earnings are priced in Dollars so the weak Dollar gives you a 10% inflated view of earnings and stocks are priced in Dollars, so the weak Dollar gives you a 10% inflated view of the value of the stock. There's really nothing there – yet people get excited!

Let's say, for example, your mom takes your temperature and it's 98.6 and the temperature outside is 75 degrees. Later she takes your temperature and it's 37 degrees and the outside temperature is now 24 degrees. Clearly it's the freezing temperatures that have frozen your body, right? Or perhaps the first reading was in Fahrenheit and the second was in Celsius?

That's what we're doing when the Dollar, which is the "constant" we measure value by, drastically changes during the course of a year. It leads us to get false readings in all of our data and causes us to make false conclusions since the underlying assumption in the markets (and all trading algorithms) is that we have a consistent base of measurement. This is a huge flaw in the system!

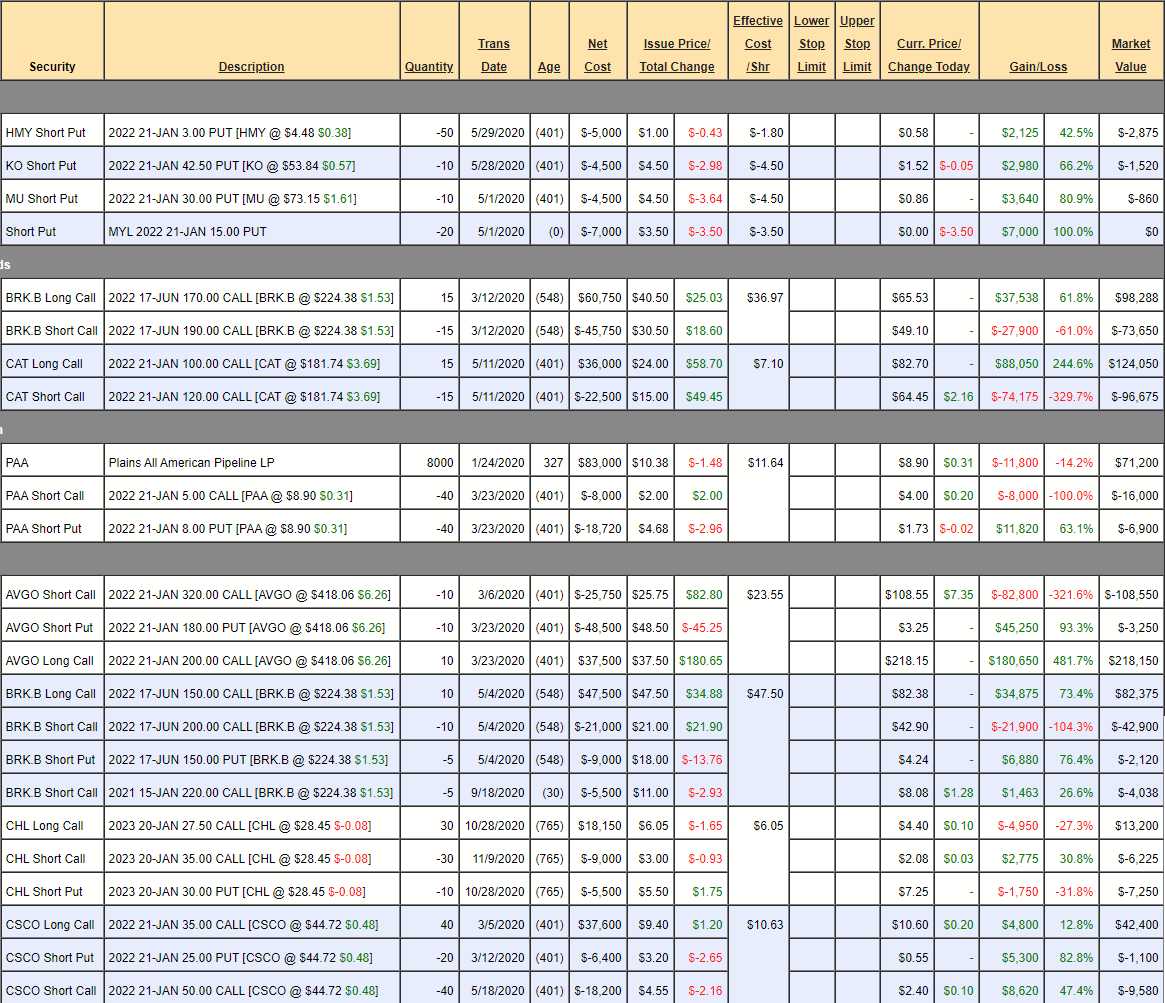

Our last Long-Term Portfolio Review was on November 17th ("Tesla Tuesday – Musk Makes the S&P 500 and our Long-Term Portfolio Review") and, at the time, we were up a whopping 159%, at $1,295,033 for the year (because what hasn't worked this year in a bullish portfolio?) and we decided to cash out many positions. Fortunately, I have an unadjusted version so we can see how much opportunity we lost by being cautious:

$1,421,320 is now up 184.3% for the year and $126,287 for the month. THE MONTH! That is completely insane! So that's the most we would have made BUT, what we actually did was this:

- KO – We'll kill this one only because it's already up 2/3 with a year to go so why risk it?

- MU – Same as KO, it's up too much not to kill.

- MYL – I don't love them enough to risk it so let's kill.

- BRK.B – It's a $30,000 spread at net $25,200 – kill.

- CAT – Another $30,000 spread at net $25,762 – kill.

- PAA – I guess we can kill the short puts to eliminate the risk and sell some more if it pulls back.

- AVGO – $95,000 out of $120,000 potential. May as well kill it.

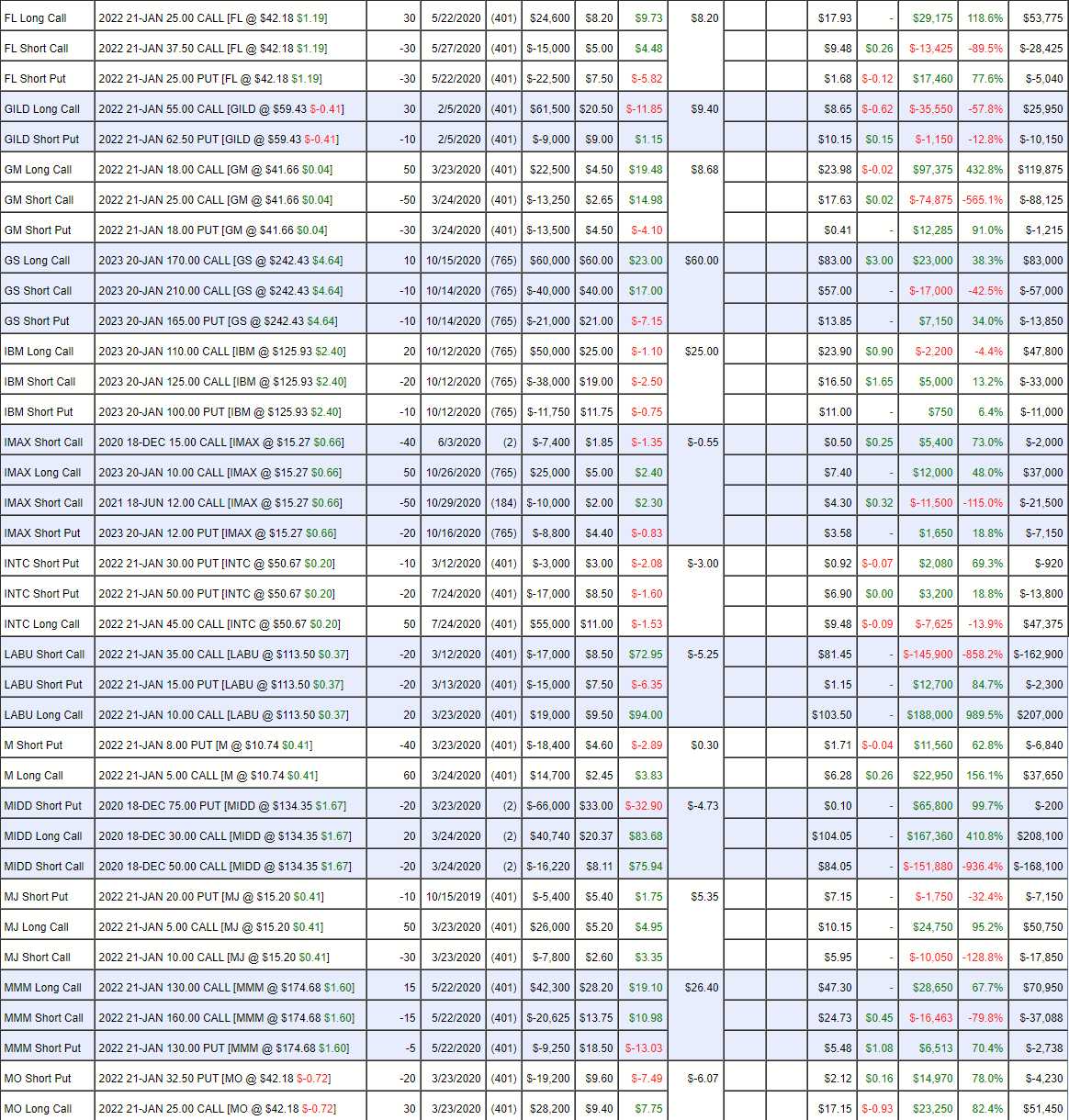

- GILD – Back in the bargain basement so we're going to roll the 30 2022 $55 calls at $9.60 ($28,800) to 50 of the 2023 $45 ($17.25)/$65 ($7.25) bull call spreads at net $10 ($50,000)

?

- GM – The bull call spread is $30,500 out of a potential $35,000 and the puts, by themselves, would be bought back so the two independent decisions mean we should kill the trade.

- INTC – About to be an "I told you so" so we'll stick with this and, in fact, we can spend $7,000 to roll the 50 2022 $45 calls at $6.35 ($31,750) to 50 2023 $35 ($14)/50 ($6.25) bull call spreads at $7.75 ($38,750)

?

- LABU – Who isn't a fan of Biotech this month? Net $36,150 on the $40,000 spread means we have to say goodbye though.

- MIDD – Wow did they get away from us! Net $35,400 on the $40,000 spread means a sad goodbye to this one.

- MO – Nice comeback. So glad we bought back the short calls! There's no penalty in selling 10 (1/3) March $42.50 calls for $1.50 ($1,500) while we wait as it's easy to roll and protects us a little.

- TXT – At the money but net $50,000 on a $68,750 spread is hard to justify the risk, especially as they were just at $32.50 so let's kill it.

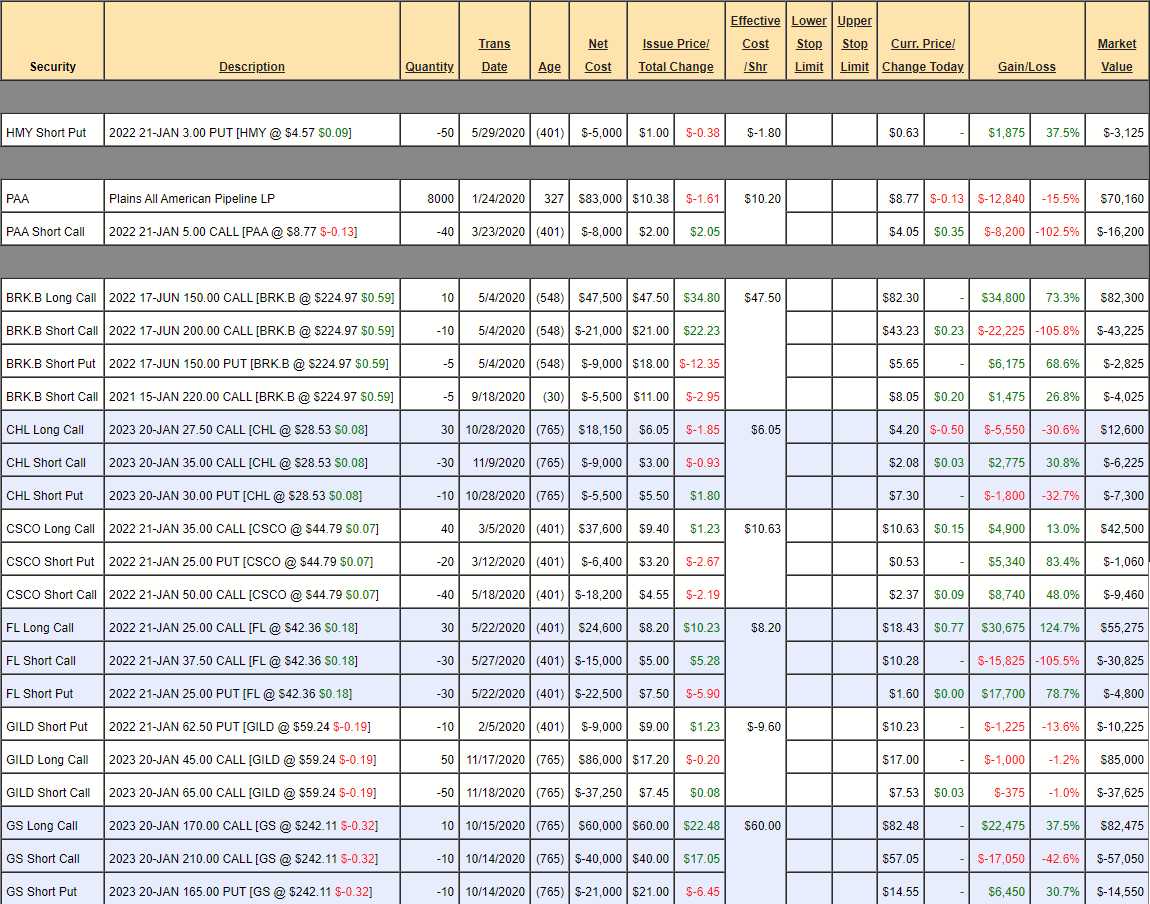

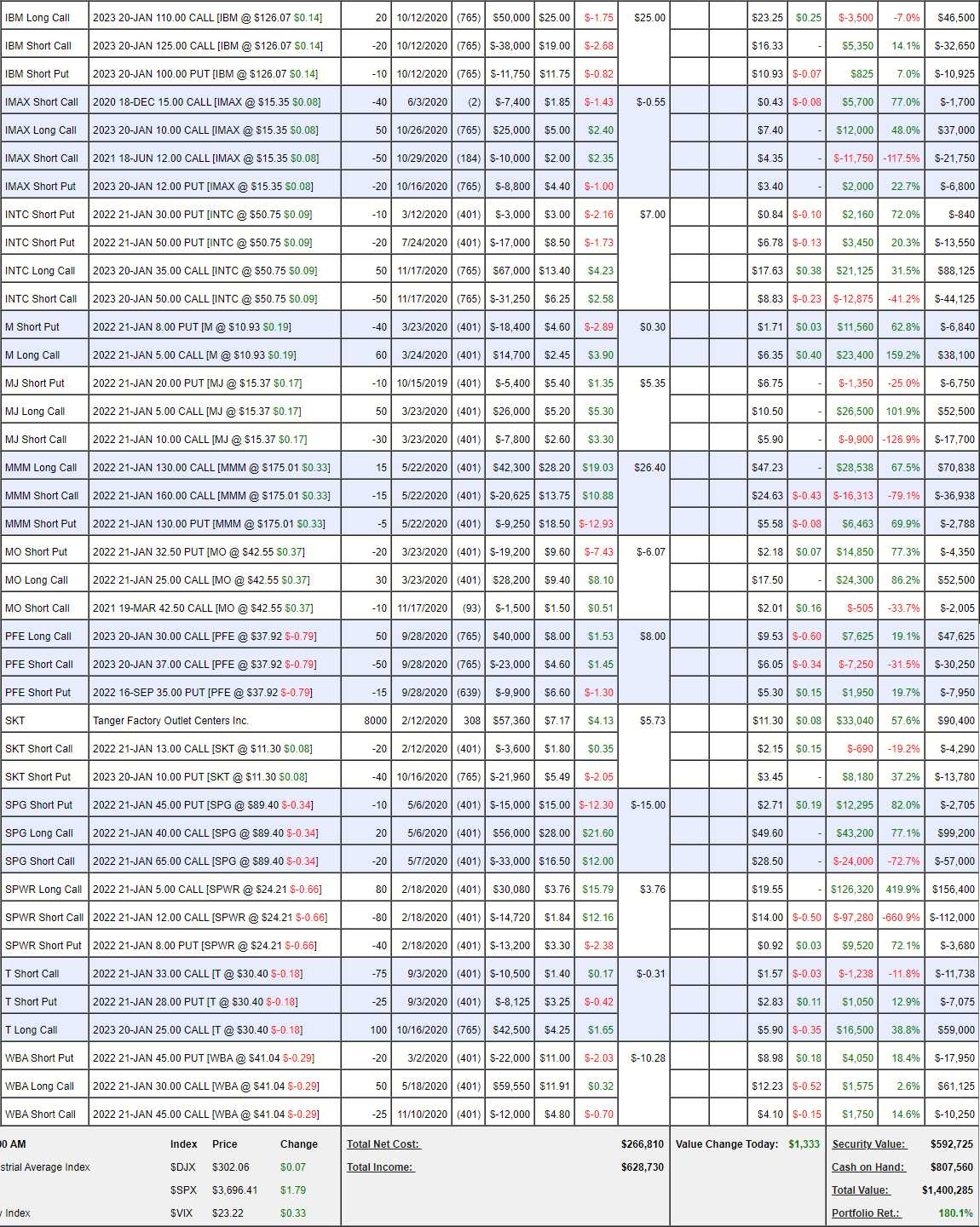

You would think it was a mistake to kill all those positions into a rally but, after making the adjustments, the exact same LTP (not including new positions) is still up 180.1% ($1,400,285) as of yesterday's close AND we have $807,560 in CASH – $308,810 more than we had last month. So, being cautious cost us all of $21,000 in potential gains for the month (not counting what we did with the cash) while putting us in a much safer position into the holidays.

We have 33% less positions, so it's easier to adjust if we do have a correction and we have 33% less longs for our Short-Term Portfolio to protect – lowering our insurance costs as well. Those are the "consequences" we've suffered from "missing out" on a fantastic rally. Certainly it's been a lot more relaxing and I aim to keep it that way into the New Year – just in case.

So next time you feel compelled to trade due to a Fear of Missing Out (FOMO) – keep in mind – missing out on what? We already made FANTASTIC returns for the year – why risk it just to make a tiny bit more?

Of course we're still shorting the S&P Futures (/ES) at 3,700 as the potential reward clearly outweighs the risk of keeping a tight stop over that line but be careful around the Fed meeting today as it's likely they will try to squeeze the market higher on any hint of more stimulus.