It's official.

It's official.

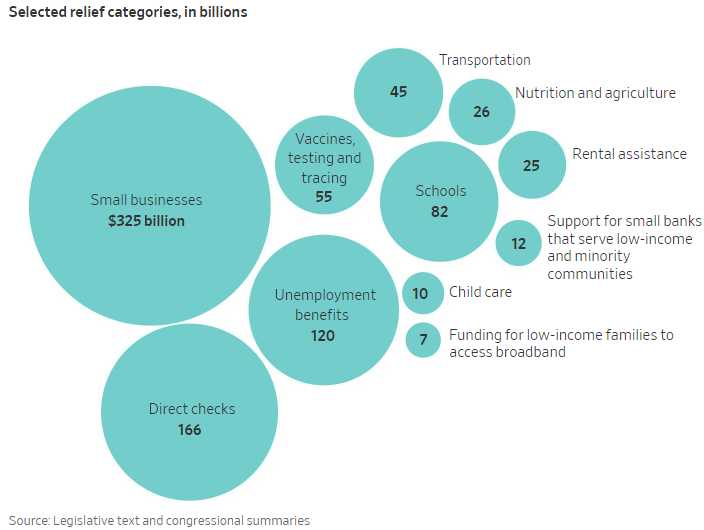

$900,000,000,000 in additional stimulus has been approved by Congress with $325Bn for Small Businesses, which is good – as 25% of Small Businesses that were open in January have already failed and 1/3 of the remaining 75% don't believe they will last 3 more months so that would add up to half the small businesses in America failing – that would be kind of hard to recover from, don't you think?

In the final stimulus package is $600 per person of direct checks but they won't come until after Christmas – a huge mistake if the aim was to boost retail sales. The $300/weekly unemployment bonus is still in place through March 14th and all unemployment benefits will be almost doubled in time, from 26 weeks to 50 weeks but it's the states that pay much of the unemployment so this is really going to stick it to the state budgets.

The bill has $25Bn for tenants who are in arrears, which is really a bail-out for the landlords (who apply on behalf of the tenants) but, for the tenants, the eviction prohibition is extended until January 2021 so go rent a nice place and don't pay for it!

$82Bn has been approved for schools, finally. $22.4Bn is included for Covid testing so those testing companies should do well. That's only $74/person though, won't last long if we intend to do regular testing as the countries who successfully fight the virus are doing. Airlines are getting another $15Bn after getting $25Bn in June so that's $40Bn in bailouts for airlines this year. Delta (DAL) is 16.6% of the US market (1/6) and their total revenues are $44Bn in a normal year and, so far this year, just $13Bn and they lost $5Bn per Q in the last two Qs so drop in the bucket, really.

We expected a bailout and chose the Airline ETF (JETS) as our Top Trade on October, 8th and, as expected, they took off. Banks are getting another $12Bn and Entertainment Venues are getting $15Bn and AMC Entertainment is roughly 20% of the movie market with $5.5Bn in annual revenues but they lost $3.5Bn so far this year on essentially no revenues and are facing bankruptcy. Cinemark (CNK) is likely to come out a winner as they are smaller and losing a lot less ($200M/qtr) and will be able to pick up AMC theaters cheaply if they go bankrupt. I still like IMax (IMAX) though they've already exploded from $11 back to $16 and I'd buy more if they dip again.

Farmers are getting another $12Bn though the last $46Bn went 90% to industrial farms with very little going to family farms and virtually none going to minority-owned farms. $14Bn is going to transit but New York City alone says they need an immediate $4.5Bn to prevent a near-shutdown of subway and bus services. Now that the election is over, the Postal Service is getting $10Bn and there's another $200Bn in tax breaks for businesses (of course) that isn't included in the $900Bn calculation of aid – so we're really at $1.1Tn on this round.

Walgreens (WBA) is also still cheap as $40.50 is $35Bn in market cap for a company that made $4Bn last year and $5Bn the year before (restructuring) and they are currently hiring "thousands" of people to administer Covid shots. Walgreens said it plans to hire about 25,000 people across the U.S., including 8,000 to 9,000 pharmacists and other health-care workers, to administer the vaccine. It currently employs 75,000 pharmacists and technicians so a 33% boost in their labor force for that specific sale (and service fee) and think of the additional revenues from all that traffic!

WBA was going to be our Trade of the Year for 2021 but it took off sharply before Thanksgiving and ruined the fun though our Members still had fun as I was relentlessly banging the table on this stock as it fell below $40 and it's still $40 – so still a good deal. As a new trade you could:

- Sell 5 WBA 2023 $35 puts for $6.30 ($3,150)

- Buy 10 WBA 2023 $30 calls for $13 ($13,000)

- Sell 10 WBA 2023 $45 calls for $6 ($6,000)

That's net $3,850 on the $15,000 spread that's $10,000 in the money to start. At $45 or over, the upside potential is $11,150 for a 289% return on cash. That's not quite good enough to be our trade of the year but, for any other market service – it would be their Trade of the Century, so not a bad addition to any portfolio. The worst-case to the downside is you end up owning 500 shares for $35 plus the $3,850 you lose means you will own 500 shares of WBA for net $42.70 – a bit higher than it is now.

- Stocks Dump'n'Pump As Bank Buybacks & Bailouts 'Crush' COVID Mutation Concerns.

- ‘It’s unconscionable’: Outrage over the ‘three-martini lunch’ tax deduction in the new coronavirus aid deal.

- Why the U.K.’s Mutated Coronavirus Is Fanning Worries.

- N.J. Sees 20% Spike; Bidens Receive Pfizer Vaccine: Virus Update

- U.S. Adds Over 100 Chinese, Russian Companies to Military List.

- Westerners Grow Wary of China Travel Over Threat of Detention.

- Oil Holds Loss With Virus Mutation Threatening Global Movement

- Rich Americans Who Fear Higher Taxes Hurry to Move Money Now.

- IPO Frenzy Drives Record $435 Billion in U.S. Stock Sales.

- Mark Cuban: Bitcoin is ‘more religion than solution’ and won’t help in ‘doomsday scenarios’

- Apple Targets Autonomous Car for Consumers by 2024, Reuters Says.