We'll be testing Dow 30,000 again today.

We'll be testing Dow 30,000 again today.

After yesterday's wild ride, dropping 900 points and then getting 300 of them back into the close – traders are somewhat jittery this morning and, as I mentioned yesterday, we're about to get early earnings reports on Thursday and it will not be good if they disappoint.

I have pointed out on serveral occasions that the earnings don't justify these valuations so we'll be watching the Dow components very closely to see if they can justify their 29.73x p/e ratio, which is up 39% from an uninfected 21.35x one year ago. That's nothing compared to the 39.45x the Nasdaq is trading at (27.55 last year) or the 40.40x the S&P is now at (25.53 last year).

Let's assume, for a moment, that the virus is a negative or, in the very least, not a positive event. Corporate Profits are lower than they were last year so what is the new valuation based on if not stimulus and the pace of stimulus last year was $3.3Tn direct from the Government and another $2.8Tn from the Fed – pretty much $500Bn a month to buy us that 40% increase in valuations.

Let's assume, for a moment, that the virus is a negative or, in the very least, not a positive event. Corporate Profits are lower than they were last year so what is the new valuation based on if not stimulus and the pace of stimulus last year was $3.3Tn direct from the Government and another $2.8Tn from the Fed – pretty much $500Bn a month to buy us that 40% increase in valuations.

Perhaps this will be the new normal and our Government will just keep pumping $500Bn/month into the economy but, even then, will earnings ever actually catch up or is it always going to be speculation that things will improve – one day? Corporate profits were $2.3Tn in Q4 of 2019 and Q2 of 2020 came in at $1.8Tn, which were down 21.7%. Q3, not on the chart, was worse, at $1.6Tn but estimates are we should "bounce back" in Q4. That's already baked in – what if the market disappoints?

And, of course, even bouncing back only gets us back to about $2Tn, still around 15% below last year yet we're left paying 40% more for the same companies. Will it never correct? That's a pretty rough premise to hang your investing hat on, isn't it?

China has a message for companies expecting another year of stimulus to keep the lights on – "Toughen up or Prepare to Fail". After letting inefficient firms survive for years, Beijing is now allowing them to fail. Bond defaults rose to a record $30 billion in 2020, including high-profile enterprises that had previously counted on the implicit guarantees of the state. Scrutiny and punishment of credit-rating agencies are increasing, while domestic exchanges delisted at least 16 stocks from their main boards last year — the most in data going back to 1999.

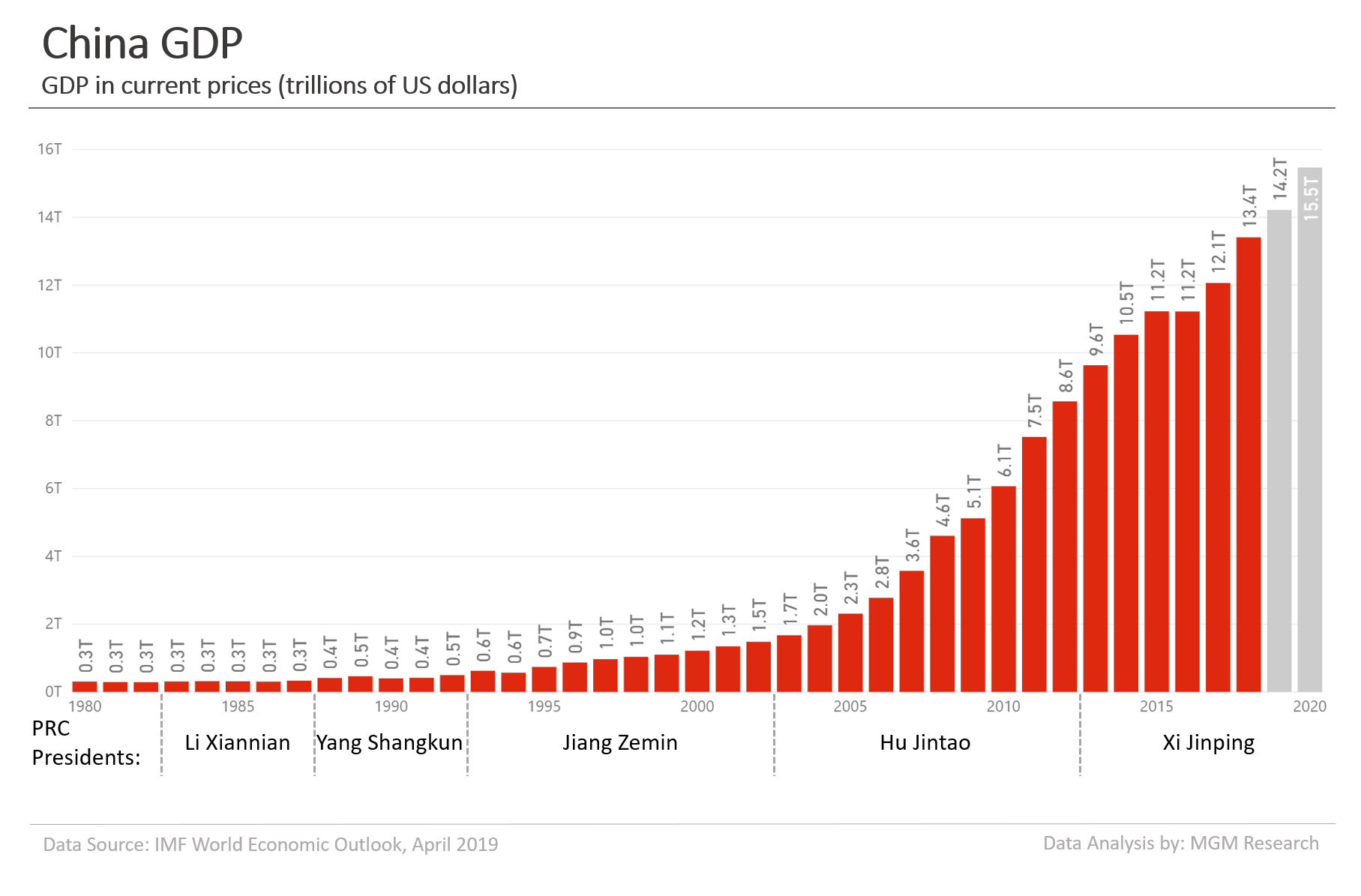

China really has no choice in the matter as debt in the Financial System is now at 277% of their GDP and $30Bn worth of those bonds defaulted in 2020 alone. In December alone, China tripled the maximum prison sentence for securities fraud to 15 years, proposed shortening the delisting process for unprofitable stocks and vowed to improve oversight of the country’s credit-rating industry. China also imposed a cap on bank lending to property developers, a sector that’s laden with debt.

That's in the past 30 days, folks. I know we have a lot on our plate but let's not forget to worry about China – one of the traditional ways that market collapses tend to begin. The chart above was their PROJECTED debt pre-pandemic – there's no clear indication of the actual number yet but likely we are at about $18Tn, $16Tn higher than 2004 or right about $1Tn (10%) per year of debt – exactly the same as China's "growth" in GDP this past decade.

Is this the new "normal" that we're running the World on? Just keep pumping money into the economy to pretend it's healthy and growing while never actually doing the hard work it takes to actually create a healthy economy? A healthy economy can take a hit and recover on its own but a comatose economy that's been artificially kept alive for many years is not likely to jump out of bed and do a jig, is it?

Is this the new "normal" that we're running the World on? Just keep pumping money into the economy to pretend it's healthy and growing while never actually doing the hard work it takes to actually create a healthy economy? A healthy economy can take a hit and recover on its own but a comatose economy that's been artificially kept alive for many years is not likely to jump out of bed and do a jig, is it?

In the UK, where they are back on lockdown, industry groups representing retail, pubs and auto makers are pressing the government to help avert business failures by extending tax relief to companies, giving grants and assuring that the current program to support furloughs will be continued beyond April. The full emergency lockdown is a devastating blow for companies large and small that have already had to cope with months of disruption since the pandemic took hold in March. Britain’s retail and hospitality businesses are likely to be the hardest hit as all non-essential shops, restaurants, and bars will have to stay closed.

In the US, a recent survey showed 1/3 of our remaining small businesses (25% already closed) did not think they would survive 6 more months. Even if the vaccines are effective against the new strains of the virus (or it may come back each year like the flu), we will need to borrow MASSIVE amounts of money to address this situation and already the US has $7.7Tn worth of debt coming due in 2021 and Japan has a $2.9Tn bill to pay as well – any small change in interest rates could be devastating to either economy.

- Cruz: Google Is The "Most Dangerous Company On The Face Of The Planet".

- Two Decades Of Airline Passenger Traffic Wiped Out In 2020.

- Why There Is Literally No "Cash On The Sidelines".

- Hedge Funds are all in into this sell-off.

- "Look Out Below": Carl Icahn Issues Major Warning On Markets, Warns Rally Will End In "Painful Correction".

- Snyder: The United States Has Become A Banana Republic.

- Over 70% Of Republican Voters Want Their Lawmakers To Be More Like Trump.

- California’s Covid numbers grow with hospitals swamped.

- GOP looks to Trump to boost turnout, as Dems run up early vote tallies in Georgia.

- ‘No One Else Is Listening’: Readers Share Experiences With Long-Haul Covid,

- Saudis, Russia at Odds Over Boosting Oil Output Amid Covid-19 Pandemic.

- Apple Leads Big-Tech Slump With Worst Drop Since November