$1,609,027!

$1,609,027!

Our combined portfolios are up over $1M (166%) in just over a year and the best thing is our Long-Term Portfolio (LTP) is back to about 50% CASH!!! - and you know I love my CASH!!! In fact, we only made a couple of adjustments but let's please consider what happened to the 21 remaining positions since our Dec 16th review, where I said:

We have 33% less positions, so it's easier to adjust if we do have a correction and we have 33% less longs for our Short-Term Portfolio to protect – lowering our insurance costs as well. Those are the "consequences" we've suffered from "missing out" on a fantastic rally. Certainly it's been a lot more relaxing and I aim to keep it that way into the New Year – just in case.

So next time you feel compelled to trade due to a Fear of Missing Out (FOMO) – keep in mind – missing out on what? We already made FANTASTIC returns for the year – why risk it just to make a tiny bit more?

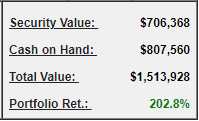

Did we miss out by cutting our positions? No! A month later the EXACT same positions are at $1,513,928 - gaining $113,643 (8.1%) in 27 days - and that's from a half CASH!!! position! People say why don't we do a lot of new trades and I keep saying what trades could possibly be better than the ones we already have? These are the remaining positions that ran the gauntlet of 2020 and were the best of the best of a portfolio that's now up 202.8% in 14 months. Making gains like this with conservative plays in a toppy market is as much as we could ever hope for at this stage of the rally.

Did we miss out by cutting our positions? No! A month later the EXACT same positions are at $1,513,928 - gaining $113,643 (8.1%) in 27 days - and that's from a half CASH!!! position! People say why don't we do a lot of new trades and I keep saying what trades could possibly be better than the ones we already have? These are the remaining positions that ran the gauntlet of 2020 and were the best of the best of a portfolio that's now up 202.8% in 14 months. Making gains like this with conservative plays in a toppy market is as much as we could ever hope for at this stage of the rally.

And that's not including the $300,000 we took off the table when we closed down our old Short-Term Portfolio (STP) and our new STP is down 52.8% but, fortunately, that's "only" down $105,555 against the $1,013,928 gained in the LTP it is sworn to protect.