WTF people?

WTF people?

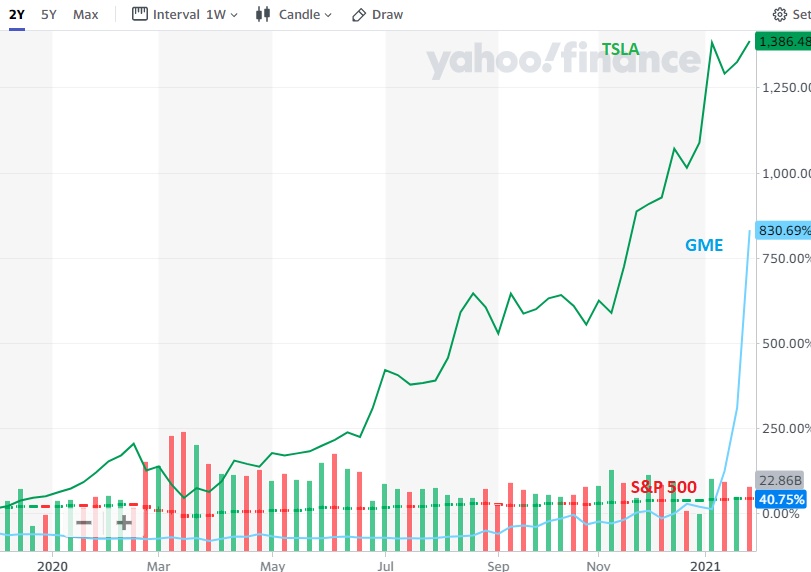

GameStop (GME) is "only" up 830% in the past 12 months while Tesla (TSLA) is p 1,386%. The market cap of GameStop is $24Bn and that's completely ridiculous as Best Buy (BBY), who sells $43Bn worth of merchandise and MAKES $1.5Bn/yr has a market cap of $29Bn at $113. GME, by comparison, has $6.5Bn in revenue and LOST $673M in 2019 and $471M in 2020 and they PLAN on losing $141M in 2021.

Tesla, on the other hand, isn't just being valued as highly as ONE of their competitors – they are being valued higher than ALL OF THEIR COMPETITORS COMBINED. McDonald's is worth more than all fast food, Wal-Mart isn't worth more than all of retail, not even Amazon is worth more than the rest of the on-line competition but TSL50A has idiots paying $850Bn at $864 compared to $200Bn for Toyota (TM) at $145. Toyota has $275Bn in sales and MAKES $17Bn for a p/e of 12 while TSLA has $30Bn in sales (1/10th) and $2.5Bn in profit (1/7) yet TSLA is valued at 340x earnings, 28 TIMES the value Toyota commands.

When a game is ridiculous, irrational and the rules keep changing – it is best not to play. I know there's no money to be made in being a stock market guy telling you not to play the market but this is NOT a good time to play it and I'm calling it like I'm seeing it. Our Members have gotten very good at hedging over the years but even they are pulling back and playing it "Cashy and Cautious" for the moment.

The Fed was not much help yesterday, essentially "staying the course" with Powell saying yesterday that "the pandemic still provides considerable downside risks" The Fed last year cut short-term interest rates to near zero, launched a bond-purchase program worth $120 billion a month and said it would maintain these measures until its goals of lower unemployment and 2% inflation are achieved.

As coronavirus cases resurged in recent weeks, many states responded with new business shutdowns and restrictions. Employment and retail sales fell in December, and the number of Americans filing new claims for unemployment benefits has been rising since November.

“Following a sharp rebound in economic activity last summer, the pace of the recovery has moderated in recent months, with the weakness concentrated in the sectors of the economy most adversely affected by the resurgence of the virus and by greater social distancing.” Powell said

I guess the Fed could just buy $2Tn worth of GameStop and then, when it hit's $5,000, sell it for $20Tn and pay off the debt. That should ork between now and next Friday at the rate that stock is gaining. You can't short these stocks but going long and chasing them is a foolish game too, so we're stuck on the sidelines, observing the action.

There's a great article in the Wall Street Journal detailing how GameStop, in particular, ended up in such a bubble but, as the author notes – it's just a microcasm of the whole market, which is in it's own bubble for most of the same reason.

Be careful out there.