Now silver is flying thanks to Reddit.

Now silver is flying thanks to Reddit.

Silver rose by as much as 11% to $30 an ounce, its highest value since 2013. The moves are the latest example of small-time traders buying stocks and other assets that large Wall Street funds bet against, resulting in large losses for major investors. Some users in the Reddit forums WallStreetBets and WallStreetSilver argued that silver is a heavily manipulated market, and a surge in the silver price could hurt large financial services companies. "If you don't care about the gains, think about the banks like JP Morgan you'd be destroying along the way," said Reddit user RocketBoomGo, in a widely circulated post.

Isn't it terrible the way these investors are manipulating the market. Meanwhile, the Dow is being manipulated 600 points above Friday's Futures close by PROFESSIONAL manipulators (see the difference?) who have jacked the index up 2% in very thin, pre-market trading NOT by getting a bunch of retail investors to buy but but getting a bunch of professional analysts to upgrade the prospects of key Dow components so they will be re-pricied at the open forcing PASSIVE INVESTORS to pay higher prices when the index fund purchases are triggered on the open market.

See? That is the way the markets are SUPPOSED to operate. Giving people an opinion in an open forum and leaving the action of the marketplace up to thousands of individual investors – now that is un-American!

See? That is the way the markets are SUPPOSED to operate. Giving people an opinion in an open forum and leaving the action of the marketplace up to thousands of individual investors – now that is un-American!

Despite what some retail traders had hoped, some of the biggest profiteers from last week's market action were said to be Wall Street giants such as asset manager BlackRock and the private equity firm Silver Lake. However, other big investors have been hammered by the trading frenzy. Hedge fund Melvin Capital – which bet heavily that shares in Gamestop would fall – lost 53% of its value towards the end of January, according to media reports. The firm has since received commitments for fresh cash from investors, leaving it with around $8Bn in assets, but that is still down from $12.5Bn at the beginning of 2021, according to Reuters.

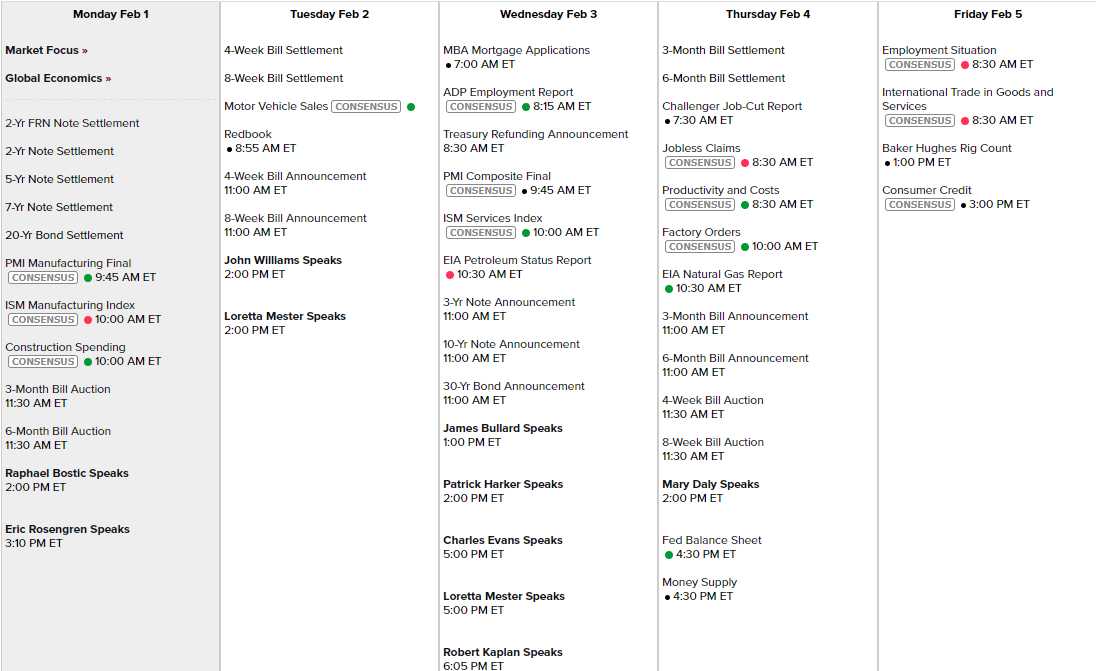

Meanwhile, it's a slow data week with 10 Fed speakers but the attention shouls swing back to earnings as 1/3 of the S&P 500 reports this week. We have PMI and ISM today and Non-Farm Payrolls on Friday but a pretty dull data week otherwise:

With no Fed speakers sheduled on Friday, I imagine they think the Non-Farm Payrolls Report for January will be pretty good. Earnings are going to be jam-packed so we should have the lay of the land by the end of the week as we see which way the money has been flowing in the last 3 months of the pandemic.

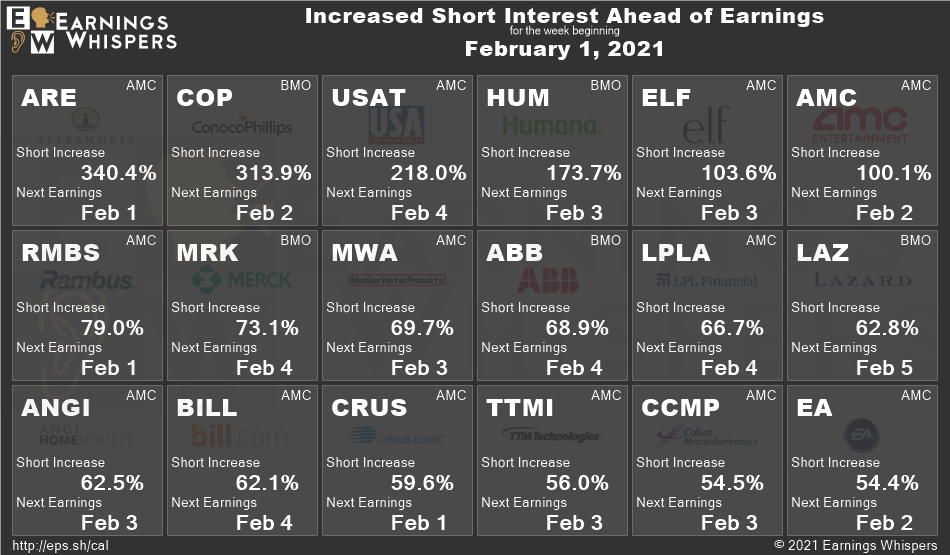

And here's an interesting chart to watch in the age of Robin Hood – Increased Short Interest ahead of Earnings:

Given the rise of GME, EA may be an interesting play into their earnings. EA is already trading at a high multiple (30x) and not a stock I would generally play but 12M shares are being shorted and that's 4 days' worth of volume so interesting things may occur. A fun way to play this would be to buy the Feb $150 calls for $3.60 ($360) and sell the June $170 calls for $4.50 ($450) so that's a net 0.90 ($90) credit and the delta on the $150s is .36 vs .26 on the Junes so we should do well on a move up and not too bad on a move lower.

Meanwhile, it should be a very interesting week.