A lot of 38s this morning.

A lot of 38s this morning.

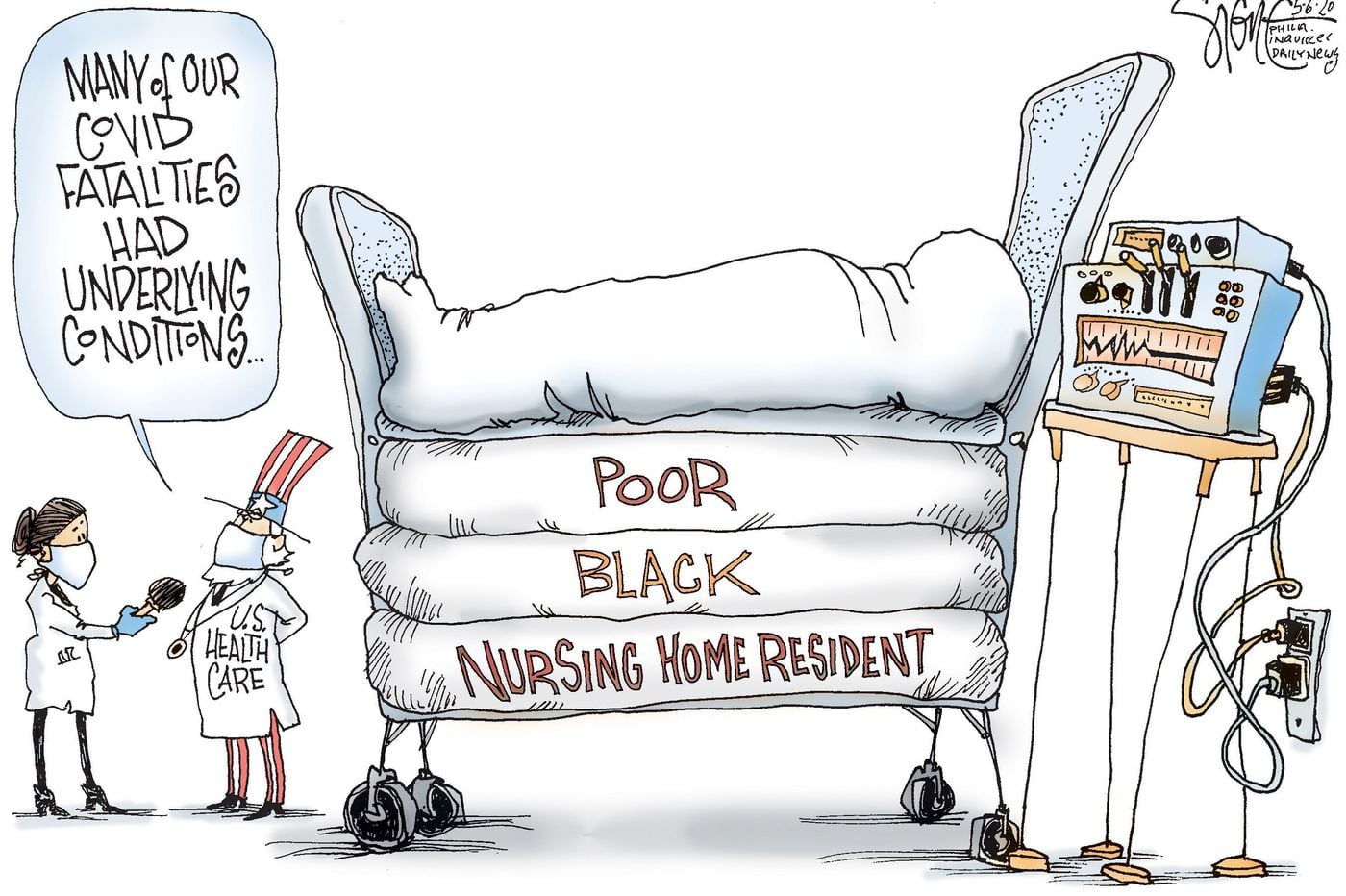

I'm not one of those numbers people but I just noticed it in my scans and found it interesting. More so, I find it disturbing that 3,843 Americans died yesterday from Covid-19 and 118,991 people were infected (just under 1M per week) and you would think, listening to the news, that we have this situation well in hand. People – this is denial. Yes, we have a plan but you can't have 27,000 people a week dying and act like things are good. That's 108,000 people per month – Burbank, CA has 102,511 people in it. Green Bay, WI has 104,576, Boulder, CO has 105,673.

This is still an ongoing crisis but the market is pricing in two things that don't go together – that the virus is "fixed" but also that we will keep getting Trillions of Dollars in stimulus while the economy makes a fantastic recovery. This is what they call "pricing to perfection" but actually we're pricing perfection PLUS stimulus and have now moved well beyond perfection in our valuations.

Overall, we're still lurking about that 3,850 line, which is the 35% line (over 2,850) per our 5% Rule™. I'm not going to get into the whole valuation discussion again but we'll either break out of this channel (back to 3,700) or we'll fail it and failure has no support all the way back to 3,560. That makes the risk/reward play for shorting the S&P (/ES) Futures below the 3,850 line a very tempting play.

There WILL be stimulus – it's just a matter of how much but $1.9Tn is baked in and it certainly won't be more and earnings have been generally good so that's baked in and most of the big market movers have reported so there's no new catalyst and we're only vaccinating 1M people per day or 10% of the population in a month and Q1 ends in 60 days so can't improve much there and even if we get to 1.5M/day by the end of March, that's only 1/3 of the population vaccinated by the end of Q2 so marginal improvements then – not full improvements in the economy ahead.

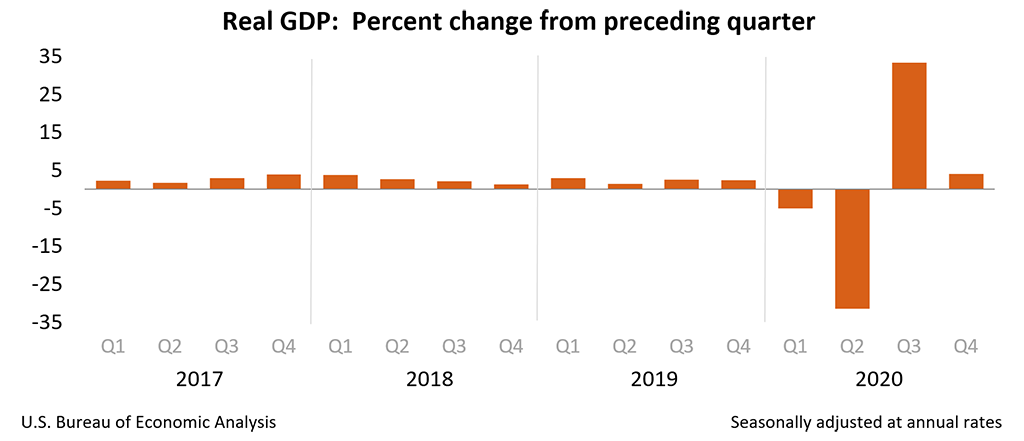

Then what are people so excited about? The math is obvious, we are NOT going to be in a full, NATURAL recovery until, at best, the 2nd half of this year – and that's if all goes according to plan. So last year, to keep our GDP near it's normal level ($20Tn) the Government spent $7Tn (1/3 of GDP) with the Fed pumping about $4Tn into the economy and our direct stimulus doing the rest.

Then what are people so excited about? The math is obvious, we are NOT going to be in a full, NATURAL recovery until, at best, the 2nd half of this year – and that's if all goes according to plan. So last year, to keep our GDP near it's normal level ($20Tn) the Government spent $7Tn (1/3 of GDP) with the Fed pumping about $4Tn into the economy and our direct stimulus doing the rest.

Keep in mind that there was no real effect of the virus on our economy in Q1 so we were only fixing a problem that began in Q2. This year, we are hitting the ground running with 26.6M infections and 451,000 deaths so far but another 100,000 people will be dead in 30 days and another 3M infected. If, at the beginning of the crisis, someone had projected that for our TOTAL, we would have had some real panic on our hands. So congratulations for learning to live with catastrophe, I suppose – well, those of you who do manage to live, that is…

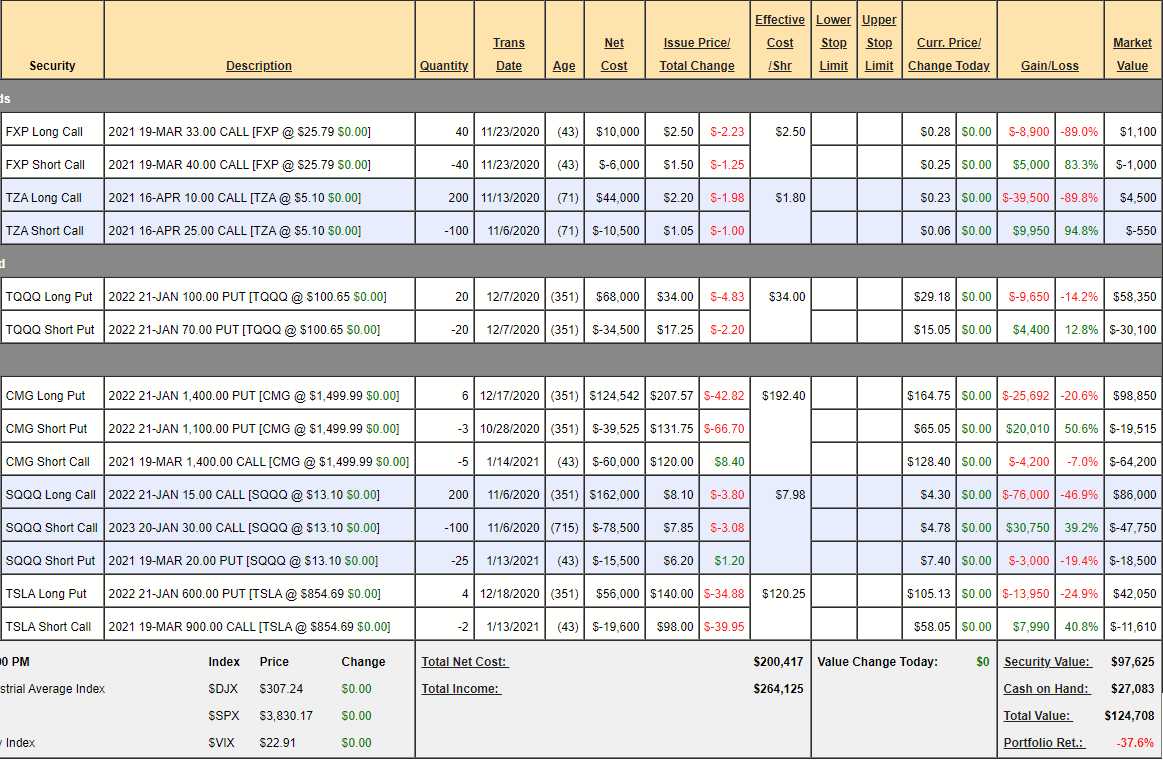

Just in case reality pays us a visit in February, let's take a look at our Short-Term Portfolio (STP), which is tasked to protect our Long-Term Portfolio (LTP) and other long positions in a downturn. This insurance portfolio is down 37.6% (another 38!) since it's 10/28 reboot for a loss of $75,292 but those losses were much more than offset by gains in our long positions and our upside potential here in a 20% correction is expected to be $293,000 but now is a good time to make sure we have enough – just in case…

- FXP – We think China's credit situation could be a huge problem this spring. FXP is a 2x inverse ETF on the Chinese market but this spread is far out of the money at $26 as a 20% drop in the Hang Seng would be a 40% gain to 36.4, so what good are the March $33 calls? Our calls are just 0.28 and we can roll them to 40 of the March $25 calls at $2 ($8,000) for net $6,880 and sell 40 of the June $35 calls for $1 ($4,000) so we're spending net $2,880 to put ourselves at the money on the $40,000 spread. We're selling longer-term calls to get more premium and, eventually, we'll most likely roll our long calls to June or September.

- TZA – This is a 3x ETF and April is far away but $5.10 x 1.6 is only $8.16 so that's our goal on a 20% drop so these are no longer offering protection. We'll cash out of April $10s for $4,500 and buy 200 June $4 ($1.50)/8 (0.65) bull call spreads for $17,000 on the $80,000 spread.

- TQQQ – Hard to bet against the Nasdaq but TQQQ is also a bet on decay of the 3x ETF over the course of a year. It's a $60,000 spread at net $28,000 and I still like it.

- CMG – They recovered a bit yesterday but I feel confident they've reached peak idiocy in their valuation. It's a $180,000 spread currently around $14,000 and we'll get to sell a lot more premium during the year.

- SQQQ – This one is the 3x Ultra-Short on the Nasdaq and, based on earnings – it's not likely to happen. A 20% drop would take it from $13.10 to $20.96 but this is more like long-term insurance so we're simply going to roll the 200 2022 $15 calls at $4.30 ($76,000) to 200 2022 $10 calls at $5.40 ($108,000) and we can pay for that by selling 100 of the 2023 $30 calls for $4.75 ($47,500) so we're dropping our calls $62,000 in the money and putting $15,500 in our pocket. At $21, this spread will pay back $220,000 so we are very well-protected.

- TSLA – Mostly this is about selling short-term calls so we have a free put but the 2022 $600 puts are $105 and the 2022 $800 puts are $214 so let's spend $109 ($43,600) to move $200 ups in strike and we'll get half back by selling 4 of the July $600 puts for $50 ($20,000) and those can be rolled to the 2022 $450 puts ($48) and we'd be thrilled to collect $350 x 400 ($140,000) on our now net $54,040 spread and, of course, we have more short put and call sales ahead of us and we'll still make this free.

So now we have a good $500,000 in downside protection for our now $1.5M LTP (and the others) but they are all a good 50% CASH!!! so they don't really need all that much protection so now we have room for a bit more bargain-hunting during earnings season!