Inflation!

Inflation!

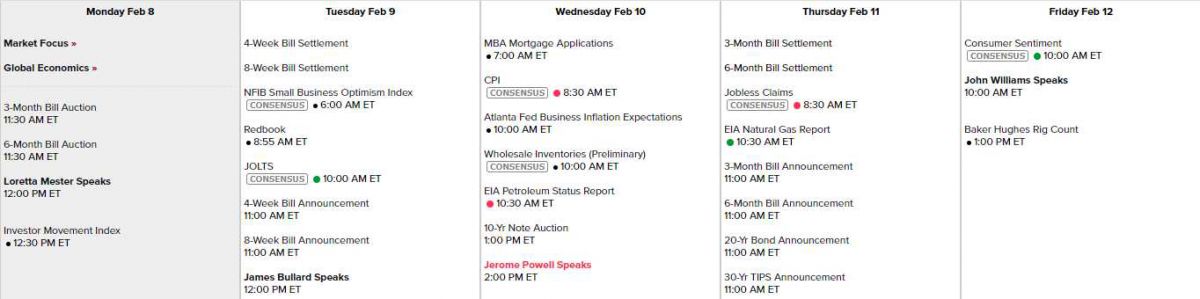

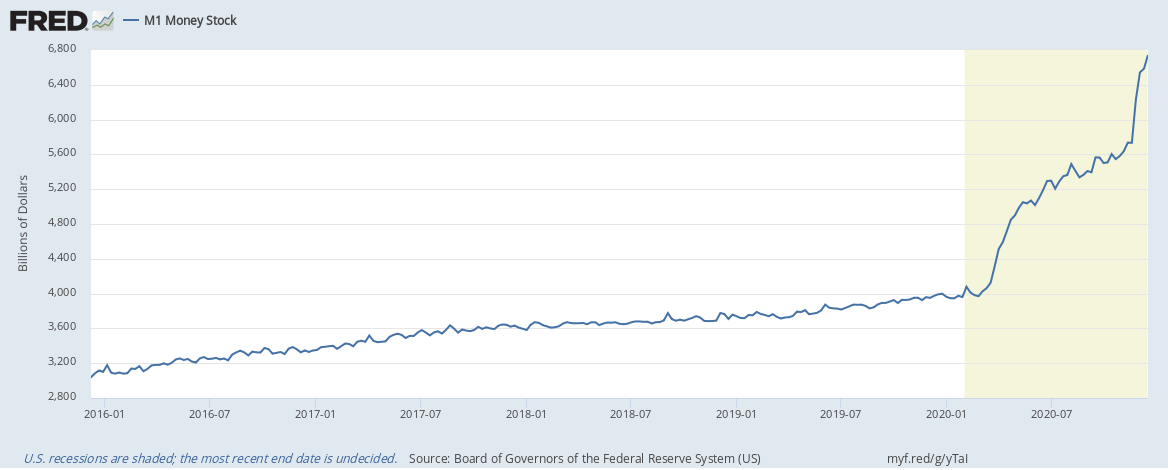

That's the new word driving the markets. Of course all this freshly-printed money was eventually going to spill out into the economy but, all of a sudden (after strategy meetings at Davos) all the prognosticators are now spinning inflation as the new reason the markets will go higher and higher. And it's a good reason, as you can see from this chart of the M1 Money Supply (physical money), which has jumped from 4Tn to 6.8Tn (70%) in 2020.

Keep in mind it took the United States of America 244 years to get to $4Tn and we just added $2.Tn in one year. As Admiral Farragut said: "Full speed ahead and damn the torpedoes" and that sums up the Fed's strategy quite nicely as they have FLOODED the World with Dollars in the past 12 months but those Dollars aren't moving – because we're all locked in our houses. They are moving to Amazon and Ebay and pretty much every streaming sevice on the planet and to ISPs and, of course to Apple and to Grub Hub and Door Dash and Cloud Servers – the stuff we are doing inside but imagine what will happen when we go outside and spend 70% more money than we had in 2019?

Of course there is going to be inflation and, depending on how you model it, there could be MASSIVE INFLATION ahead as 70% more money in circulation can lead to 70% more spending and a 70% boost to our GDP, from $20Tn to $34Tn and that could reduce our debt to GDP ration back below 100% (barely). We've done this before, of course.

After World War 1:

| YEAR | JAN | FEB | MAR | APR | MAY | JUN | JUL | AUG | SEP | OCT | NOV | DEC | AVE |

|---|

| 1917 | 12.5 | 15.4 | 14.3 | 18.9 | 19.6 | 20.4 | 18.5 | 19.3 | 19.8 | 19.5 | 17.4 | 18.1 | 17.4 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1918 | 19.7 | 17.5 | 16.7 | 12.7 | 13.3 | 13.1 | 18.0 | 18.5 | 18.0 | 18.5 | 20.7 | 20.4 | 18.0 |

| 1919 | 17.9 | 14.9 | 17.1 | 17.6 | 16.6 | 15.0 | 15.2 | 14.9 | 13.4 | 13.1 | 13.5 | 14.5 | 14.6 |

| 1920 | 17.0 | 20.4 | 20.1 | 21.6 | 21.9 | 23.7 | 19.5 | 14.7 | 12.4 | 9.9 | 7.0 | 2.6 | 15.6 |

After World War II:

| 1946 | 2.2 | 1.7 | 2.8 | 3.4 | 3.4 | 3.3 | 9.4 | 11.6 | 12.7 | 14.9 | 17.7 | 18.1 | 8.3 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1947 | 18.1 | 18.8 | 19.7 | 19.0 | 18.4 | 17.6 | 12.1 | 11.4 | 12.7 | 10.6 | 8.5 | 8.8 | 14.4 |

| 1948 | 10.2 | 9.3 | 6.8 | 8.7 | 9.1 | 9.5 | 9.9 | 8.9 | 6.5 | 6.1 | 4.8 | 3.0 | 8.1 |

After Veitnam:

| 1973 | 3.6 | 3.9 | 4.6 | 5.1 | 5.5 | 6.0 | 5.7 | 7.4 | 7.4 | 7.8 | 8.3 | 8.7 | 6.2 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1974 | 9.4 | 10.0 | 10.4 | 10.1 | 10.7 | 10.9 | 11.5 | 10.9 | 11.9 | 12.1 | 12.2 | 12.3 | 11.0 |

| 1975 | 11.8 | 11.2 | 10.3 | 10.2 | 9.5 | 9.4 | 9.7 | 8.6 | 7.9 | 7.4 | 7.4 | 6.9 | 9.1 |

After Watergate:

| 1978 | 6.8 | 6.4 | 6.6 | 6.5 | 7.0 | 7.4 | 7.7 | 7.8 | 8.3 | 8.9 | 8.9 | 9.0 | 7.6 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1979 | 9.3 | 9.9 | 10.1 | 10.5 | 10.9 | 10.9 | 11.3 | 11.8 | 12.2 | 12.1 | 12.6 | 13.3 | 11.3 |

| 1980 | 13.9 | 14.2 | 14.8 | 14.7 | 14.4 | 14.4 | 13.1 | 12.9 | 12.6 | 12.8 | 12.6 | 12.5 | 13.5 |

| 1981 | 11.8 | 11.4 | 10.5 | 10.0 | 9.8 | 9.6 | 10.8 | 10.8 | 11.0 | 10.1 | 9.6 | 8.9 | 10.3 |

And never since. You could say it's about time, 40 years later, for some good old-fashioned inflation. I remember, back in the late 70s, we used to quit our jobs if the boss didn't give us a 10% raise every year – just to keep up with inflation. Banks paid you 10% interest AND gave you a toaster to open an account!

And never since. You could say it's about time, 40 years later, for some good old-fashioned inflation. I remember, back in the late 70s, we used to quit our jobs if the boss didn't give us a 10% raise every year – just to keep up with inflation. Banks paid you 10% interest AND gave you a toaster to open an account!

Inflation is our post-crisis go-to move and yes, we will have a post-crisis inflation – I'm just not sure when it will start. Inflation is a scary thing and owning stocks is the best way to protect yourself but also tricky as you have to consider whether the companies can pass increased costs on to their consumers and also how fast their expenses are inflating.

Generally, however, a well-run company will keep up with inflation and that means their bottom-line earnings will also inflate. What happens when earnings inflate 70%? Stock prices inflate 70%. That's why it's important to own stocks, whether you believe in the market or not.

Inflation dosen't actually lead directly to market performance, however:

- 1915 – 99.15, 1920 – 71.95

- 1945 – 192.91, 1948 – 177.30

- 1972 – 1,020, 1976 – 1,004

- 1977 – 831, 1981 – 875

That's because, usually (always in the above periods), costs rise for the companies faster than they can pass it along to the consumers and wages begin to rise (another cost) and certain fixed costs for the consumers, like homes and autos and food – begin to rise quickly and suck up their disposable income before they can get raises and this leads consumers to tighten up, rather than to spend.

That's because, usually (always in the above periods), costs rise for the companies faster than they can pass it along to the consumers and wages begin to rise (another cost) and certain fixed costs for the consumers, like homes and autos and food – begin to rise quickly and suck up their disposable income before they can get raises and this leads consumers to tighten up, rather than to spend.

Of course, the Davos crowd is well aware of this but a ticket to Davos STARTS at $62,000 and you weren't invited. You are the people "THEY" are manipulating, telling YOU to go out and spend that M1 Money Supply and kick-start the economy so that money can trickle up – back into the pockets of the Top 0.1%, where it was intended to go.

More than a century ago Oscar Wilde, the Irish playwright, penned a perfect description of the social psychology underpinning the market. In Lady Windermere’s Fan, one character asks, “What is a cynic?” The friend responds, “A man who knows the price of everything, and the value of nothing.” The dialogue continues, and the original inquirer states, “And a sentimentalist is a man who sees an absurd value in everything, and doesn’t know the market price of a single thing.”

That's where we are today, between the sentamentalists and the cynics and the sentimentalists certainly have the upper hand at the moment but it's still bases on the optimism that the World will be back to normal in 6 months and I'm not sure that's true. Does that make me a cycnic or a realist?

- "A Wake-Up Call" – AstraZeneca Jab Fails To Prevent Mutated COVID Strain From South Africa.

- Commodities Are Soaring 25%: That's Consistent With Headline Inflation Of Almost 4%.

- Why Are So Many Americans Stockpiling Guns, Silver, & Food Right Now?

- Monetary Policy Is Pushing Americans, Kicking And Screaming, Up The Risk Curve.

- All of President Biden’s key executive orders — in one chart.

- "There Is No Modern Precedent": American Murder Rate Soars 30% In 2020.

- Renaissance Hit With $5 Billion In Redemptions After "Terrible" Returns.

- Hedge Fund CIO: "I Didn’t Realize How Many People Understand The Extent Of The Fed Market Manipulation".

- "This Is The Wildest Market I've Ever Seen": Druckenmiller's Must-See Goldman Interview.

- U.K coronavirus strain is doubling in the U.S. every 10 days, study finds.

- Retailers see sales rebounding—eventually. Europe’s murky outlook may snag growth.

- Covid-19 Is Likely Here to Stay.

- Yellen, Summers Spar About Overheating Risk in Stimulus Plan.