Buy the Dip

Courtesy of Michael Batnick

If the stock market had a mantra, it would be “buy the dip.”

Today, millions of market participants repeated this over and over again.

Today, the S&P 500 was down nearly 2% at its low point, but it stormed a late comeback to finish positive. This sort of move has happened on 121 other occasions since 1970, or 1% of all days. But what’s more interesting than how often they happen is where they happen.

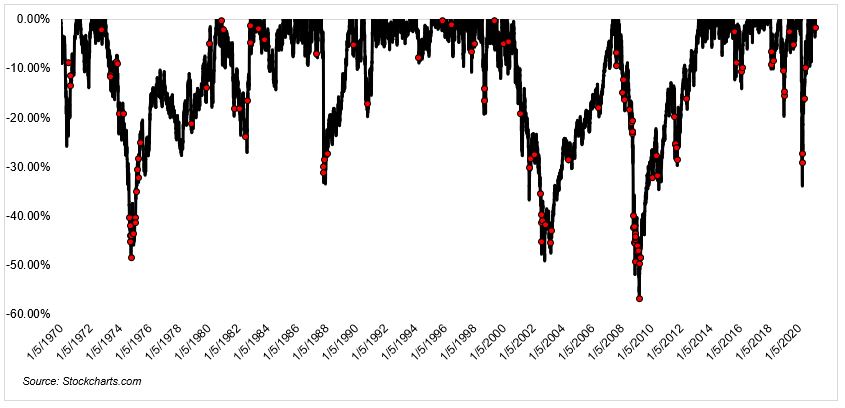

Just from eyeballing the chart below, you can see that when these sorts of days occur, it’s usually when we’re either heading into a correction or when we’re coming out of one. Neither of those conditions are present today.

The average 6-month return when stocks saw this type of reversal was -8.4%. The S&P 500 has returned 14% over the last 6 months.

On average, the S&P 500 was already 23.6% off its high when these intraday reversals happened. It’s not unprecedented for this to happen at an all-time high, but it is rare. This has happened on only 5 other occasions over the last 50 plus years.

This market is truly unbelievable. The S&P 500 has been within 5% of its all-time high for almost 4 straight months. So you would think that we would use any excuse to sell-off, even if there is no “news” to drive prices lower. But nope. Not today.

I don’t like focusing too much on the market’s day-to-day vagueries, but this seemed noteworthy.

Tomorrow is another day.