Last weeks was: "Toppy Tuesday – What More Can Powell Say or Do at this Point?"

Last weeks was: "Toppy Tuesday – What More Can Powell Say or Do at this Point?"

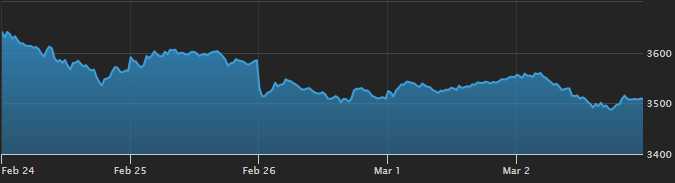

Today I can take the day off becuase here we are again, back at S&P 3,900 along with Dow 31,500, Nasdaq 13,250 and Russell 2,270 all trending lower than their previous two Tuesday's. Why Tuesday? Because Monday markets are very low-volume and easily manipulated with M&A Rumors and Analyst Upgrades along with Government Happy Talk and, of course, a healthy dose of 401K deposits rolling in from Friday's Payrolls.

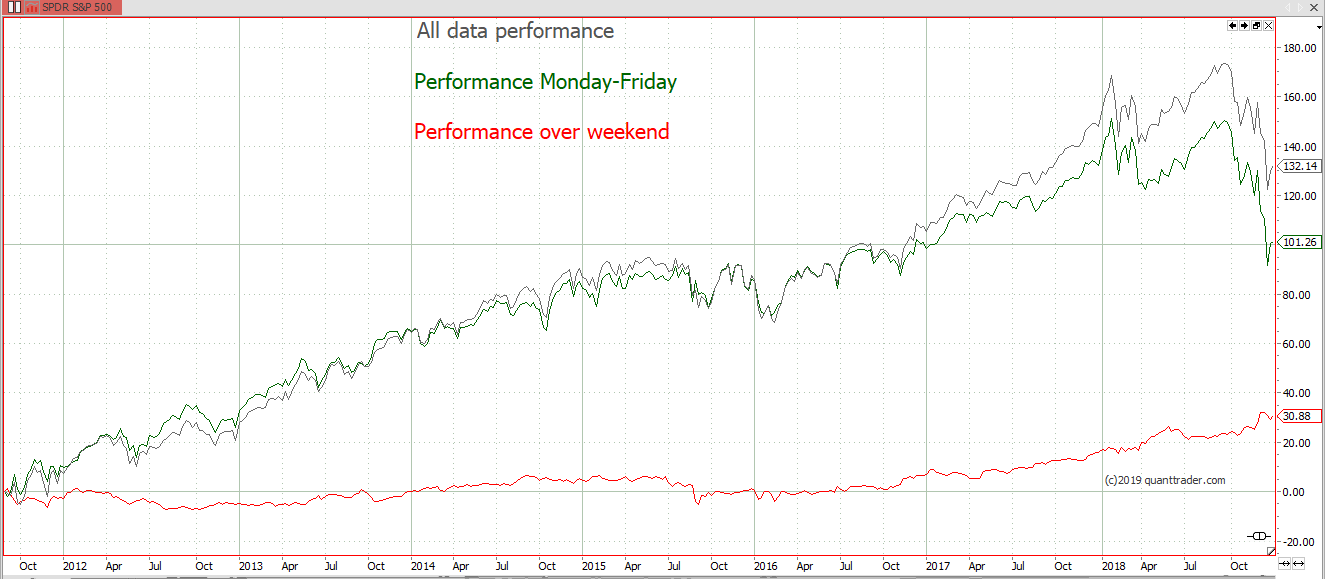

That allows "THEM" to take advantage on a weekly basis and overcharge long-term savers for their positions as they drip-feed their retirement accounts, In fact, Randers pointed out last week that the weekend performance of the S&P 500 (when no one is trading) accounted for about 25% of all gains over the past 10 years.

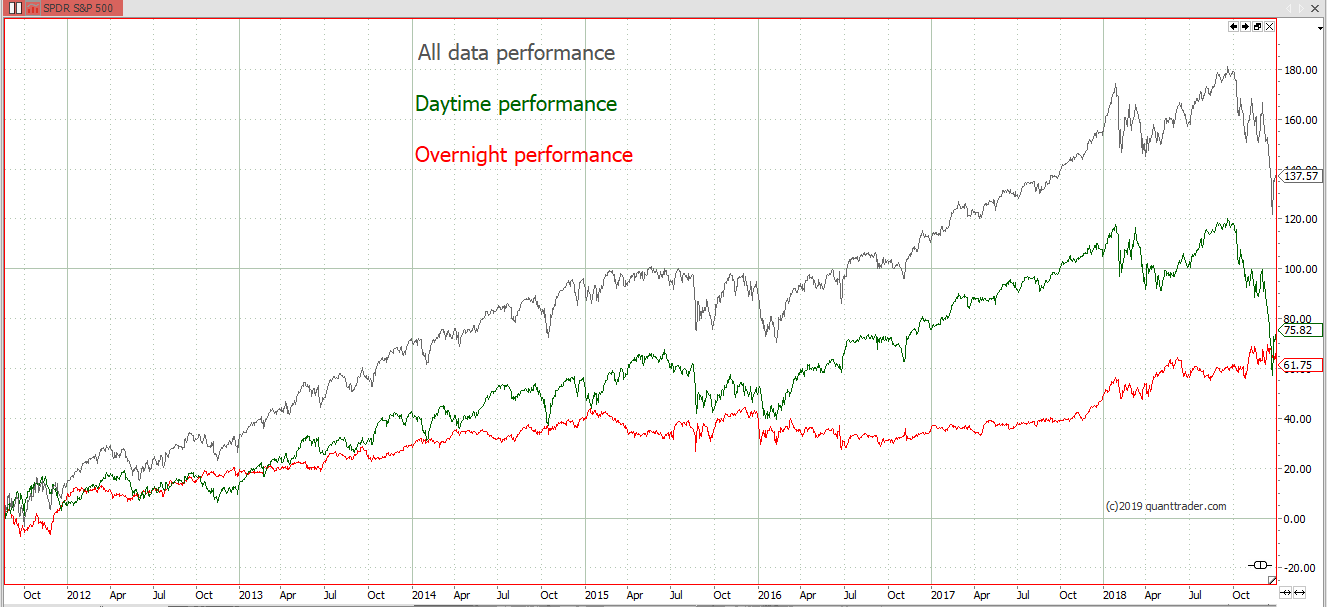

Even "better", overnight trading (when no one is looking) accounted for OVER 50% of the total market gains. So nights and weekends are when all the real money is being made, apparently.

That's why shorting on Tuesdays has been good to us – by Tuesday people are trading and, when there is volume in the market, it usually turns lower because there aren't that many real buyers out there – certainly not at these elevated prices! Guo Shuquing agrees with me and he's the Communist Party Boss at the People's Bank of China. Guo (last name) said this morning: "We are really afraid the bubble for foreign financial assets will burst someday." Guo is also the Chairman of China's Banking and Insurance Regulatory Commission – kind of a right wing Elizabeth Warren...

Investors, hedge fund managers and former central banking officials have all expressed concerns too, as Wall Street trades near record highs even as the United States continues to grapple with the effects of the coronavirus pandemic. Guo echoed such fears, adding that the rallies in US and European markets don't reflect the underlying economic challenges facing both regions as they try to recover from the brutal pandemic recession.

Guo's remarks shook markets in the region. The Shanghai Composite (SHCOM) and Hong Kong's Hang Seng Index (HSI) were both trending upward before Guo's speech, building on Wall Street's rally Monday. But both indexes reversed course soon after. Shanghai's benchmark was down 1.2%, while the Hang Seng fell 1.3%. Of course, it was Tuesday for them too!

Guo's remarks shook markets in the region. The Shanghai Composite (SHCOM) and Hong Kong's Hang Seng Index (HSI) were both trending upward before Guo's speech, building on Wall Street's rally Monday. But both indexes reversed course soon after. Shanghai's benchmark was down 1.2%, while the Hang Seng fell 1.3%. Of course, it was Tuesday for them too!

Mr. Guo’s chief worry concerned the possibility of a steep drop in home prices in the world’s second-largest economy. In recent decades, buying an apartment in a big city has come to be regarded as a surefire investment by many Chinese people. Roughly one-fifth of Chinese banks’ loan books consist of home loans, according to calculations based on central bank data. And most bank credit in China—even beyond the housing market—is collateralized by real estate, making stable property prices an underpinning of the nation’s financial stability. Chinese banks had disposed of 3.02 trillion yuan, equivalent to $470 billion, in bad debt last year and a total of 8.8 trillion yuan between 2017 and 2020, roughly equivalent to the total for the 12 previous years combined.

You think we don't have these problems in the US but, one year later, where has $9 TRILLION of the Fed's money gone? Our own Fed has very quietly been bailing out our own banks and they are doing it without any Congressional oversight at all. Beginning on September 17, 2019 – months before there was any report of a COVID-19 case anywhere in the world – the Federal Reserve turned on its money spigot to the trading houses on Wall Street. By October 23, 2019 the Fed announced that it was upping these loans to $690 billion PER WEEK. Again, this was months before any report of COVID-19 anywhere in the world.

Within a span of six months, the Fed had pumped out a cumulative $9 trillion in loans to Wall Street’s trading houses, according to its own spread sheets, with no peep as to which Wall Street firms were getting the bulk of that money. It’s more than a year later and the American people still have no idea what triggered that so-called “repo loan crisis” or which Wall Street firms were in trouble or remain in trouble.

The only difference is, we don't have any Communist Party Chairmen honest enough to actually warn us there's a crisis, do we?

- The Federal Reserve, as is typical, outsourced this money spigot to the New York Fed, which is literally owned by some of the largest banks on Wall Street. We wrote at the time the New York Fed was making these massive repo loans that this action was unprecedented in Federal Reserve history for the following reasons:

- No Wall Street crisis has been announced to the public to explain these massive loans and Treasury buybacks;

- Not one hearing has been held by Congress on the matter;

- Not one official elected by the American people has authorized these loans;

- The loans are not being made to commercial banks (which could re-loan the money to stimulate the U.S. economy). The loans are going to the New York Fed’s primary dealers, which are stock and bond trading houses on Wall Street who count hedge funds among their largest borrowers; (See list below. There is only one bank among the 24 primary dealers.)

- Many of the primary dealers are units of foreign banks whose share prices have been in freefall. The Fed is making these loans at approximately 2 percent interest – an interest rate these firms could not come anywhere close to obtaining in the open market;

- These same foreign banks are counterparties to mega U.S. banks’ derivative trades – raising the suggestion that this is another bailout of Wall Street’s derivatives mess as occurred in 2008;

- The Dodd-Frank financial reform legislation of 2010 was supposed to rein in this exact type of abuse by the New York Fed and, in fact, it states that Congress must be informed as to which banks are receiving the money to be sure it’s not going, once again, to failing financial institutions as happened in the last crisis;

- The Government Accountability Office (GAO), when it released its audit of the Fed’s bailout programs of 2007 to 2010 chastised the Fed for failing to document the reasons it was flinging trillions of dollars to Wall Street and foreign banks. Notwithstanding the GAO’s report, the New York Fed is back to its old tricks again;

- The New York Fed is owned by its members banks in its region. Representatives of these banks sit on its Board of Directors. It is thus too conflicted to be in charge of this bailout money spigot which is ultimately backstopped by the U.S. taxpayer if the New York Fed fails;

- The New York Fed is the regulator of the largest bank holding companies in the U.S. But its failure as a regulator is why these same banks needed to be massively bailed out in 2008 and, apparently, again now. This system lacks any semblance of checks and balances;

- The parent organizations of five of its primary dealers have admitted to criminal felony counts brought by the U.S. Department of Justice for frauds against the investing public. Bailing out felons and Wall Street firms with serial histories of wrongdoing perpetuates moral hazard and, thus, more wrongdoing and bailouts.

The House Financial Services Committee has announced that it will hold a hearing on March 23 titled: “Oversight of the Treasury Department’s and Federal Reserve’s Pandemic Response.