We're under attack.

We're under attack.

At this very moment, a Chinese Government-backed hacking group has used Microsoft's EMail software to infect 60,000 Corporate Clients. Yes, it sounds like the plot of a movie and that we should be sending a tape to Tom Cruise or something but this is really happening – NOW. The European Banking Authority became one of the latest victims as it said Sunday that access to personal data through emails held on the Microsoft server may have been compromised. Others identified so far include banks and electricity providers,

The rapidly escalating attack came months after the SolarWinds Corp. breaches by suspected Russian cyberattackers, and drew the concern of U.S. national security officials in part because the latest hackers were able to hit so many victims so quickly. Researchers say in the final phases of the attack, the perpetrators appeared to have automated the process, scooping up tens of thousands of new victims around the world in a matter of days. The Chinese hacking group, which Microsoft calls Hafnium, appears to have been breaking into private and government computer networks through the company’s popular Exchange email software for a number of months,

The attacks were so successful — and so rapid — that the hackers appear to have found a way to automate the process. “If you are running an Exchange server, you most likely are a victim.”

In other news this morning:

- Oil Jumps Above $71 After Key Saudi Crude Terminal Attacked

- Saudis Raise Crude Prices to Asia, U.S. as OPEC+ Extends Cuts

- Powell’s Dashboard Shows How Far U.S. Economy Has to Go on Jobs

- Covid-19 Changed New York City: A Story of Six Lives

- China Targets AI, Chips in Tech Race With U.S.

- Schumer: Congress might consider more Covid relief depending on pandemic.

- Another Market Paradox: Wall Street Struggles To Explain Record Equity Inflows Amid Stock Turmoil

- Mega Squeeze Coming: Last Week Saw Biggest Hedge Fund Shorting Since May

- Morgan Stanley: 3 Reasons Why The Correction Has Further To Go Before It’s Over

- Today's Stock Market Is A Casino Powered By Easy Money And Boredom

- China Exports Jump By Most Ever As Global Economy Redlines

- "It's Systemic" – Coffee Consumers Face Soaring Prices As Shipping Costs Surge

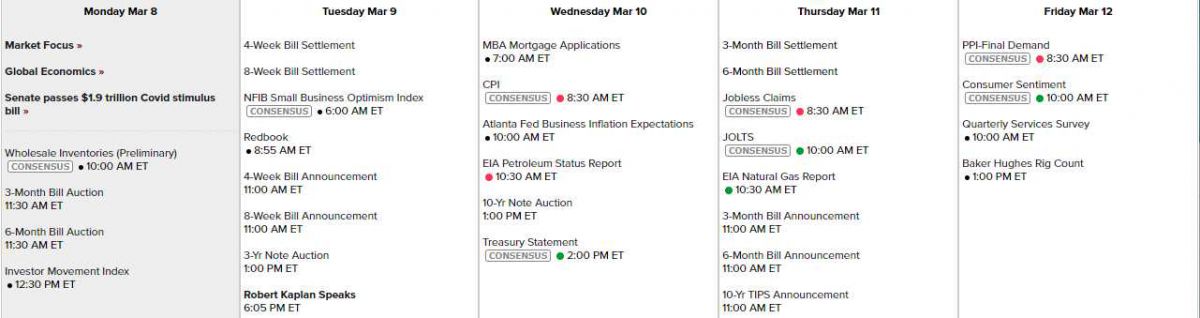

We have a quiet week ahead of next week's Fed meeting with just Kaplan speaking on Tuesday and very little data to worry about so it's a good week for the market to drift. 3.820 is the strong bounce line on the S&P 500 and we need to see 13,000 on the Nasdaq to be back on a bullish track which is, of course, ridiculously high – so I'm not betting on that.