"Out of college, money spent

See no future, pay no rent

All the money's gone, nowhere to go" – Beatles

Well, we got our $1.9Tn – that should hold us over for a month or two, but then what?

Hopefully most of us will have been vaccinated by the end of May and, according to the new CDC guidelines – it's party time! The new CDC guidance says fully vaccinated people ( those who are two weeks past their second dose of the Moderna and Pfizer Covid-19 vaccines or two weeks past a single dose of the Johnson & Johnson vaccine) can:

- Visit other vaccinated people indoors without masks or physical distancing

- Visit indoors with unvaccinated people from a single household without masks or physical distancing, if the unvaccinated people are at low risk for severe disease.

- Skip quarantine and testing if exposed to someone who has Covid-19 but are asymptomatic, but should monitor for symptoms for 14 days

Wear a mask and keep good physical distance around the unvaccinated who are at increased risk for severe Covid-19, or if the unvaccinated person has a household member who is at higher risk

Wear masks and physically distance when visiting unvaccinated people who are from multiple households.

So yes, you can have an orgy, just be careful who you invite. This is great news, on the whole but you know no one who is vaccinated is going to worry about infecting unvaccinated people so there will be some chaos during the transition but, overall, it does sound like America should be back to normal by the end of summer at the latest.

So yes, you can have an orgy, just be careful who you invite. This is great news, on the whole but you know no one who is vaccinated is going to worry about infecting unvaccinated people so there will be some chaos during the transition but, overall, it does sound like America should be back to normal by the end of summer at the latest.

And now we have $1.9Tn from Uncle Joe to hold us over until then. Our quarterly GDP is $5Tn so that's 40% of a Quarter in FREE MONEY!!! – so I think that SHOULD be enough for the moment but is it going to be enough to keep the markets are all-time highs when, going forward? It may be hard to justify giving them another $2Tn. Well, there's always infrastructure, right?

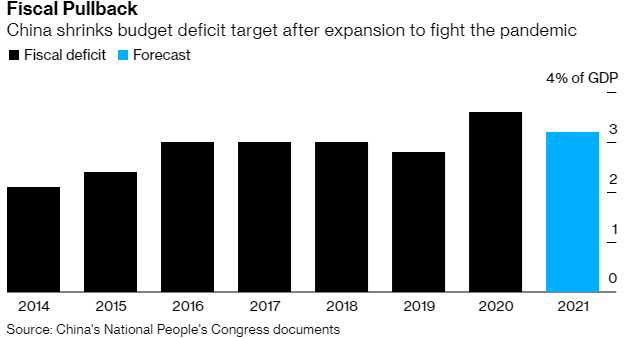

Even China thinks we are going overboard with our stimulus with the Chinese perspective on our stimulus being:

One of the takeaways from the annual National People’s Congress under way in Beijing is a conservative growth goal, with a tighter fiscal-deficit target and restrained monetary settings. That’s a big contrast with Washington, where President Joe Biden is preparing a second major fiscal package after he gets final approval for his $1.9 trillion stimulus.

The widening policy divergence is putting strains on exchange rates and could potentially reshape global capital flows. It stems, in part, from different policy lessons from the 2007-09 crisis with the US pursuing a "Go big or go home" policy towards stimulus while China overdid their stimulus back in 2009 and that left them with unused airports and railways built around ghost towns and massive excess Industrial Capacity and the unpayable debt that goes with it.

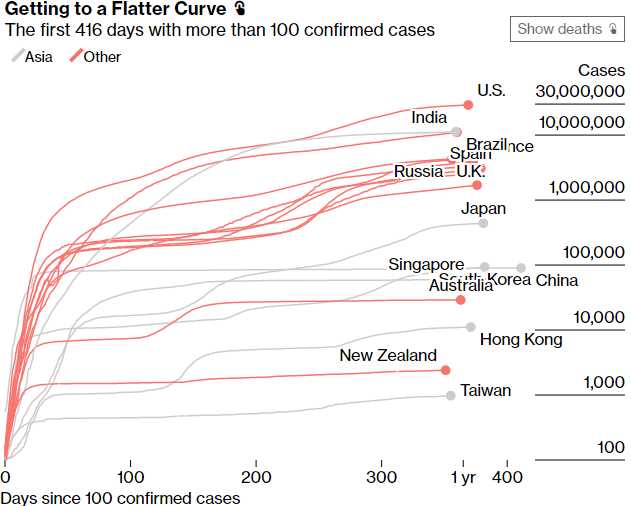

And, of course, keep in mind that China moved quickly to rapidly contain their pandemic so their economy wasn't as destroyed as our was thanks to Trump's denial of the virus and the problems it was causing. China still hasn't had their 100,000th infection despite hitting 80,000 last June while the US had 50,237 new cases yesterday.

And, of course, keep in mind that China moved quickly to rapidly contain their pandemic so their economy wasn't as destroyed as our was thanks to Trump's denial of the virus and the problems it was causing. China still hasn't had their 100,000th infection despite hitting 80,000 last June while the US had 50,237 new cases yesterday.

Globally, 312,051,418 of our 8,000,000,000 people have been vaccinated or, less than that – since that's the number of DOSES that have been administered, not the actual number of people. That's only about 3% for those of you keeping score (or planning on sending out orgy invitations).

There's another few Trillion Dollars that have to be spent. Figure at least $100 x 8Bn people is $800Bn right there and, since it's a Government project, triple that cost at least but it has to be done and it has to be done globally or all we will end up doing is wiping out the easy to kill strains of Corona and leaving the super-strains to fester in other parts of the World until they come back here to infect us again. No one's even talking about the next stage of the vaccination program because we don't have enough doses for our own orgies yet but it does need to be done – and soon!

That's why Pfizer (PFE) is still a bargain at $34.35 – the WHOLE WORLD needs to be vaccinated, not just the US. And we'll probably need to be re-vaccinated next year too. Yes, JNJ and MRNA are good too but it's PFE that's stupidly cheap at $34.35, which is a market cap of $191.5Bn for a company that made $16Bn in 2019 and $9.6Bn last year and projects $18Bn in earnings this year – and that doesn't even take into account the massive vaccine sales that are still a wild card.

We already have a play on PFE in our Long-Term Portfolio and, frankly, it's not doing well so far:

| PFE Long Call | 2023 20-JAN 30.00 CALL [PFE @ $34.35 $-0.04] | 50 | 9/28/2020 | (682) | $40,000 | $8.00 | $-1.95 | $8.00 | $6.05 | $0.38 | $-9,750 | -24.4% | $30,250 | ||

| PFE Short Call | 2023 20-JAN 37.00 CALL [PFE @ $34.35 $-0.04] | -50 | 9/28/2020 | (682) | $-23,000 | $4.60 | $-1.25 | $3.35 | $0.37 | $6,250 | 27.2% | $-16,750 | |||

| PFE Short Put | 2022 16-SEP 35.00 PUT [PFE @ $34.35 $-0.04] | -15 | 9/28/2020 | (556) | $-9,900 | $6.60 | $-0.85 | $5.75 | – | $1,275 | 12.9% | $-8,625 |

We invested net $7,100 in that $35,000 spread and we're down $2,225 but that means, as a new trade, it's only net $4,875 for the $35,000 spead with $31,125 (638%) upside potential if PFE can get back to $37 by 2023 and the worst case is you end up owning 1,500 shares at $35 ($52,500) plust the $4,875 invested comes out to about $38/share but those are only Sepember puts and they are now $5.75 and mostly premium and the 2023 $33 puts are $4.50 so we'd lower our basis by rolling them if we have to. The margin on the short puts is just $5,379, so it's a very efficient way to make $31,125.

We have a similar spread in our Money Talk Portfolio and, like the LTP, we're going to leave it alone for now but, in our Dividends Portfolio, we don't have PFE – even though they pay a nice $1.56 (4.54%) dividend – and we know how to enhance that with a simple options strategy. So, for the Dividend Portfolio, let's add:

- Buy 1,000 Shares of PFE for $34.35 ($34,500)

- Sell 10 PFE 2023 $30 calls for $6 ($6,000)

- Sell 10 PFE 2023 $33 puts for $4.50 ($4,500)

That drops our net entry to $24,000 or just $24 per share. If we are assigned 1,000 more at $33, our average cost per share would be $28.50, still 17% below the current price. That makes the $1,560 dividend we expect to collect a very nice 6.5% dividend while we wait to be called away with a $6,000 (25% profit) but, of course, we intend to roll our short puts and calls and keep the stock for the long run.

It's not very sexy with "just" an anticipated return of $9,120 (38%) against our $24,000 investment in two years but, if PFE is safely over $37 early next year, we can then release the allocation block for another trade. That's why, even with conservative targets like these, our Dividend Portfolio is up 70.2% since Oct 25, 2019. As we discussed in last week's Live Trading Webinar, you don't have to swing for the fences to make very nice returns and, if you keep getting hits – some of them are going to be home runs anyway.