Is there such a thing as too much?

Is there such a thing as too much?

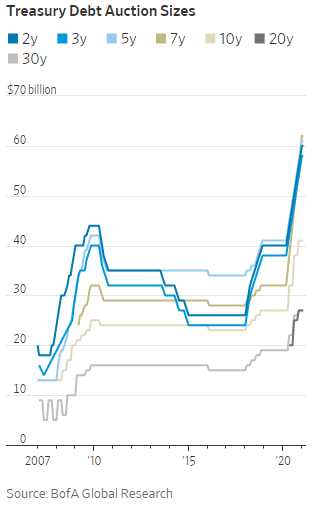

Our Government, so far, is looking to sell $2.8Tn worth of Treasury debt to unsuspecting victims in 2021 and that's up 64% from $1.7Tn in last year's record-breaker, which was almost double 2019s record $990Bn of debt issuance. America – F*ck Yeah! Too much is America's brand, so why should borrowing $2.8Tn bother us? Well, math – for one thing. $2.8Tn is bigger than the GDP of India or the United Kingdom, who are tied for 5th in the World at $2.6Tn. Germany is $3.7Tn, Japan is $4.9Tn, China $14.8Tn and we are sitting at $20Tn and running a 15% annual debt.

So the World is sitting down for their Easter Dinner and America says to it's family – I know I make more money than you guys but this year I need another 15% to cover my expenses – so I'm passing the hat. China has been bailing us out for years and they are busy hacking the WiFi, so we can't count on them. Japan is already 250% of their GDP in debt and also borrowing about 20% a year – so they are not going to be much help. Germany and the UK clearly have problems of their own in 2021 – especially Germany as mommy said she's leaving and the new mommy might be a fascist.

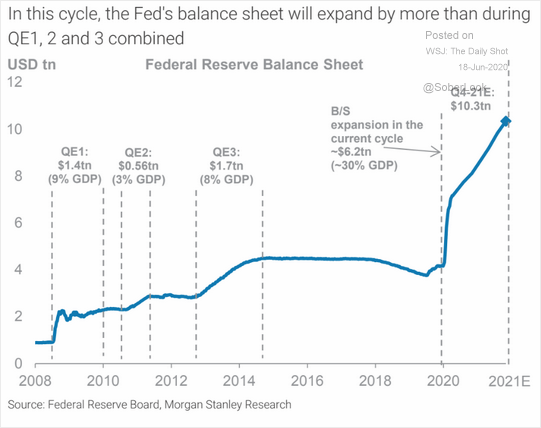

That leaves the UK, who is our ex. We used to be part of them but we rebelled and slaughtered them and took all their land but they got over it and used to be proud of us but we incinerated that goodwill over the past 4 years and, even if we hadn't – can they really afford to lend us 107% of their own GDP? That leave Uncle Fed, Jerome Powell and he's been a real darling these past few years and is still planning to lend us $960Bn in 2021 – but that's down from $2Tn he lent us last year so we still need $1.9Tn more from someone….

Supply may not be the primary factor driving yields higher. But it has been an accelerant, weighing on the market precisely because the economic outlook has already made investors hesitant to buy bonds. “It just makes everything so much worse,” said Daniel Mulholland, a senior bond trader at Crédit Agricole. The size of Treasury debt auctions “are completely out of control,” he added.

Supply may not be the primary factor driving yields higher. But it has been an accelerant, weighing on the market precisely because the economic outlook has already made investors hesitant to buy bonds. “It just makes everything so much worse,” said Daniel Mulholland, a senior bond trader at Crédit Agricole. The size of Treasury debt auctions “are completely out of control,” he added.

Investors, though, hardly expect any let up in government borrowing. In recent weeks, congressional Democrats and the Biden administration have signaled interest in another multitrillion-dollar spending package to update the country’s infrastructure. Investors get only short rests between auctions. The Treasury sold another $58 billion of three-year notes on Tuesday and is scheduled to issue $38 billion of 10-year notes Wednesday and $24 billion of 30-year bonds on Thursday. A year ago, auctions of the same bonds totaled $38 billion, $24 billion and $16 billion respectively.

Last week's 7-year note auction was a disaster with low interest forcing the Government to offer higher rates to attract bidders. That raises the borrowing cost and de-values existing notes that have lower rates, which can trigger the worst-case scenario that the holders of our current $28Tn in debt (that's right, that chart above didn't even include the new Stimulus Bill) will begin SELLING their bonds early, flooding the market and competing with our Government to sell debt every week – which can drive the rates they have to offer even higher.

Higher rates on a bond are a bigger discount to the price you pay compared to the face value of a bond so if, for example, you have a $100,000 10-year note at 1% – you would pay $90,000 (more or less) for it and collect $100,000 in 10 years, giving you a 1% annual rate of return.

So, when rates go higher and you want to sell your bond, you have to sell it for less money than you paid for it. Many, many bondholders don't understand that they can take a loss on their bonds as it hasn't really happened in the last couple of decades. Watch people completely FREAK OUT when rates begin to rise.

That's why the Fed will do anything they can to keep rates under control but another thing that is now COMPLETELY out of control is the size of the Fed's balance sheet, which is now projected to hit $10.3Tn by the end of the year – even with the 50% cutback in bond-buying. That's up over 150% from where we were a year ago and about 1/2 of the Fed's balance is Treasury Notes so, if those notes drop 20% in value, guess what happens? It becomes a $1Tn loss that gets charged back to the taxpayers and – ADDS TO OUR DEBT!

That's why the Fed will do anything they can to keep rates under control but another thing that is now COMPLETELY out of control is the size of the Fed's balance sheet, which is now projected to hit $10.3Tn by the end of the year – even with the 50% cutback in bond-buying. That's up over 150% from where we were a year ago and about 1/2 of the Fed's balance is Treasury Notes so, if those notes drop 20% in value, guess what happens? It becomes a $1Tn loss that gets charged back to the taxpayers and – ADDS TO OUR DEBT!

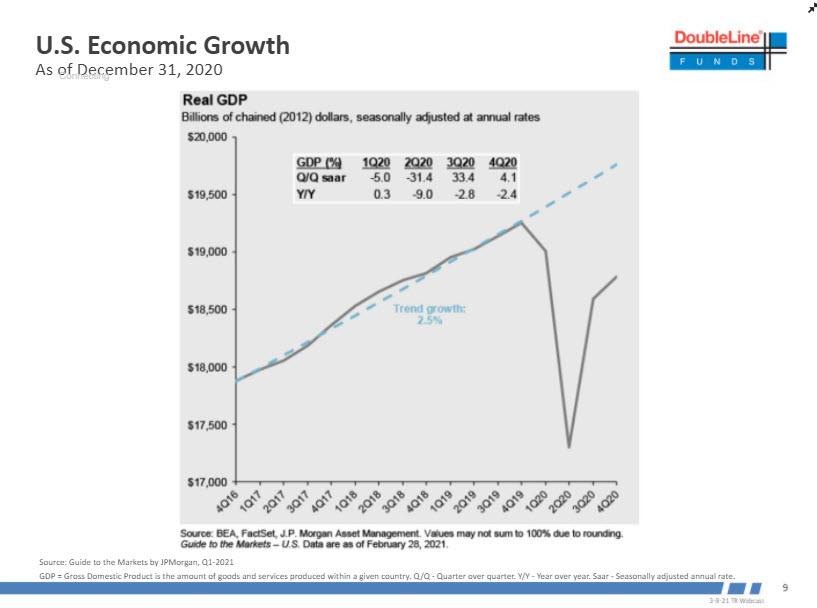

That's not something that might happen – that's something that is GOING TO HAPPEN. The question is, is it going to happen in a controlled manner – giving us the fabled "soft landing" as the US crosses 150% of our GDP in debt later this year or is it going to be the more awkward "hard landing" – the kind that is usually accomanied by bread lines?

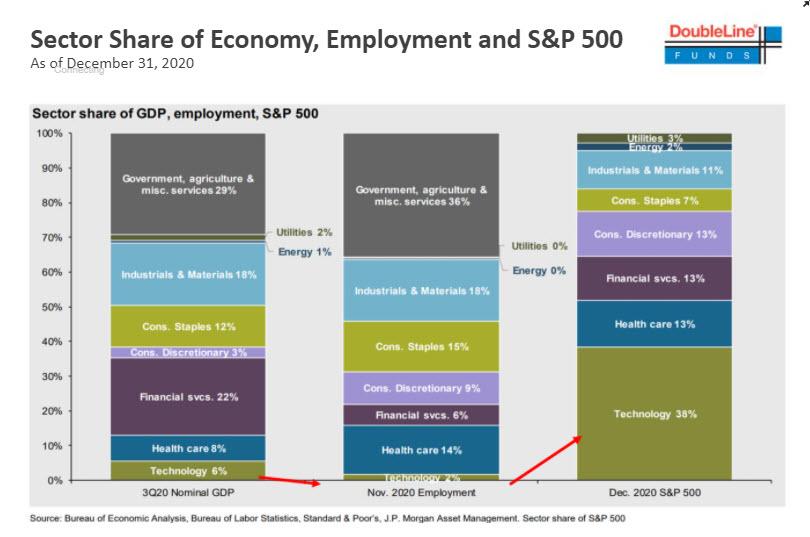

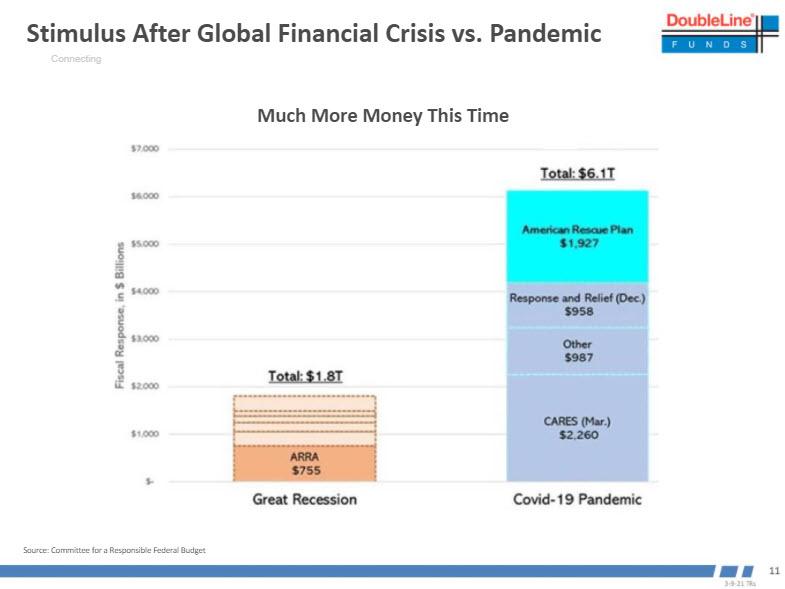

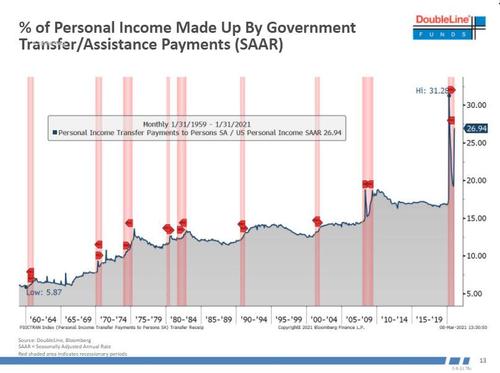

Jeff Gundlach did a presentation yesterday that requires a stiff drink before, during and after in which he does an excellent job of breakign down our economic situation. 30% of our Nation's Personal Income now comes from Government Transfers and Assistance – we have become the World's biggest welfare state under GOP leadership and Biden is going to double down on that. Our budget deficit is 16.2% of our GDP and, as Gundlach notes:

“The biggest problem is we’ve become totally addicted to these stimulus programs while people may be starting to believe that stimulus is permanent, we can see some real need for endless stimulus."

None of this really matters at the moment because, at the moment, we're getting $1,900,000,000,000 to play with and the market is happy about that but then what? Can we hold these record highs as we wait for a $3Tn Infrastructure Bill? After that, will we get a $5Tn Bill for whatever they think of next? How long can this keep going on?

Well, your friends with their fancy persuasion

Don't admit that it's part of a scheme

But I can't help but have my suspicions

'Cause I ain't quite as dumb as I seem – Ace