How much is enough?

How much is enough?

Yesterday, Fed Chairman Jerome Powell essentially said the Fed will continue their Free Money Policy until 2023, which seems like a long way away until you think about how far away Christmas of 2019 was, when we were with our families and friends and not at all worried about catching a virus and dying. Does seem like a lifetime ago, doesn't it?

Yet, only 12 hours after Powell's speech and press conference yesterday, the markets began to sell off as the Dollar begain to recover from it's post-Fed drop of 0.75%, which boosted the indexes 1% and made it LOOK like the Fed had caused yet another rally but it's all BS – just theater-staging by the Banksters, who need to convince the Retail Investors to come in and BUYBUYBUY the stocks they are unloading at ridiculous prices.

Remember, the Dollar does not have a medium-term effect on the market – it has a strong short-term effect, almost no medium-term effect but then a strong long-term effect again – it's wierd. Anyway, of great concern is how easily the Nasdaq fell below the 13,000 line this morning. You would think there would be support but there was none. 10-year notes flew up to 1.737% as Powell gave us no confidence that the Fed was going to control inflation (more likely will cause it) and, as we pointed out in our Live Trading Webinar – they failed to adjust their inflation expectations which, as we predicted, caused investors to lose confidence in their ability to give us a "soft landing". When the pilot clearly can't see the dangers in front of him – it's time to grab your parachute!

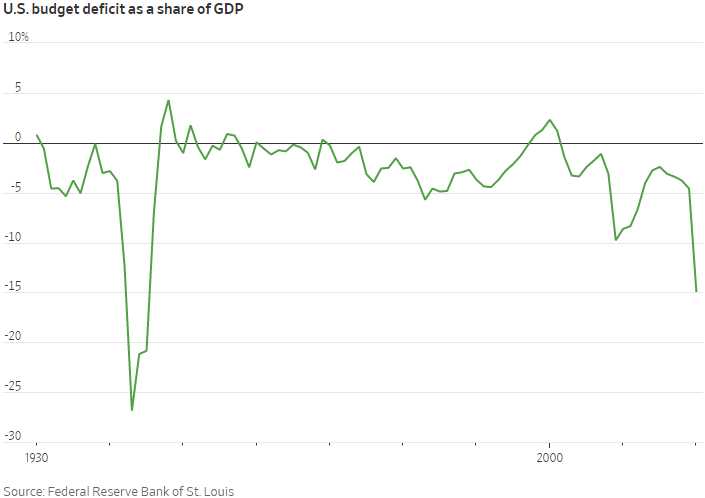

Investors who are wary about inflation returning are looking at the scale of spending and borrowing combined. The budget deficit hit 14.9% of gross domestic product in 2020, the highest level since 1945. It was forecast to fall to about 10% in 2021 by the Congressional Budget Office, but that excludes the Covid-19 aid package – which is 10% of our GDP by itself – and the Infrastructure Bill is pending. Another $2Tn and we pass 1942s budget deficit – the year we put the whole country on a war footing.

Investors who are wary about inflation returning are looking at the scale of spending and borrowing combined. The budget deficit hit 14.9% of gross domestic product in 2020, the highest level since 1945. It was forecast to fall to about 10% in 2021 by the Congressional Budget Office, but that excludes the Covid-19 aid package – which is 10% of our GDP by itself – and the Infrastructure Bill is pending. Another $2Tn and we pass 1942s budget deficit – the year we put the whole country on a war footing.

And what happens in a war, when the normal cycle of supply and demand are distorted by a surge in Government spending? Why you get shortages, of course. That's right, the ultimate limiter on these stimulus bills is that, no matter how much money you throw at us – we can only build so many cars and boats and planes and houses in a year.

Before the 737 disaster, Boeing was backed up 10 years in orders (still 7 years). What does it do for the economy if we order another 3 years worth of planes? Nothing. No one is hired, no factories are built – just a lot of deposits made for planes to be built next decade. Meanwhile, we have very real issues of Global Supply Chain disruptions that is now so severe that Toyota (TM), Honda (HMC) and Samsung all made comments this morning that they will be CUTTING production due to supply chain issues. Honda pointed to a combination of port issues, the semiconductor shortage, pandemic-related problems and the crippling U.S. weather.

The disruptions underscore how several forces are coming together to squeeze the world’s supply chains, from the pandemic-driven rise in consumer demand for tech goods to a backlog of imports at clogged California ports to U.S. factory outages caused by weather woes. They are creating cost increases and delays for numerous industries, company executives and analysts say, affecting profit margins and the prices that companies and consumers ultimately pay for many goods.

The disruptions underscore how several forces are coming together to squeeze the world’s supply chains, from the pandemic-driven rise in consumer demand for tech goods to a backlog of imports at clogged California ports to U.S. factory outages caused by weather woes. They are creating cost increases and delays for numerous industries, company executives and analysts say, affecting profit margins and the prices that companies and consumers ultimately pay for many goods.

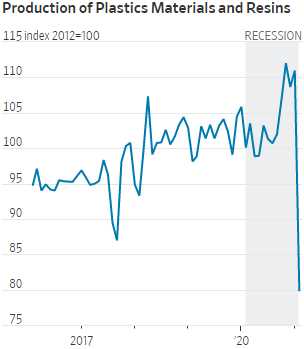

Those of us who have worked in manufacturing can tell you how devasting these disruptions can be and the market has taken NONE of this into account when pricing out stocks over the next 12 months. Yesterday Powell said he expects supply chains to "adjust" and there will be bottlenecks over time and yes, that's true but, if you were supposed to make 110M chips (see chart) and you only made 80M chips for 6 months and the demand is for 110M chips – how long will it take you to catch up?

The answer is "forever" because, until you can produce more than 110M chips to meet current demand and fill the gap – you will always have left a shortage. The "adjustment" is that prices go up until demand decreases enough that people don't want the missing 30M chips and THEN things eventually get back to normal. It's also possible that you build new factories but why would you if you think the boost in demand is only temporary. Then you would be permanantly left with very expensive excess capacity – no one wants that either.

Economics is tricky. Business is tricky. Yet the Fed acts like it's some machine you can flip a switch on and that's becuase, out of 18 Board Members, maybe 2 of them have had real jobs in their lives.

Be careful out there!