Wheeeee!

Wheeeee!

Yesterday was fun, wasn't it? The Dow dropped 400 intra-day points – a 1.25% pullback as interest rates once again ticked higher – FREAKING investors out completely. Clearly the Fed is losing control of the narrative and that is really spooking investors and, with Fed rates currently set at 0.25%, there's a whole lot of spooking to come…

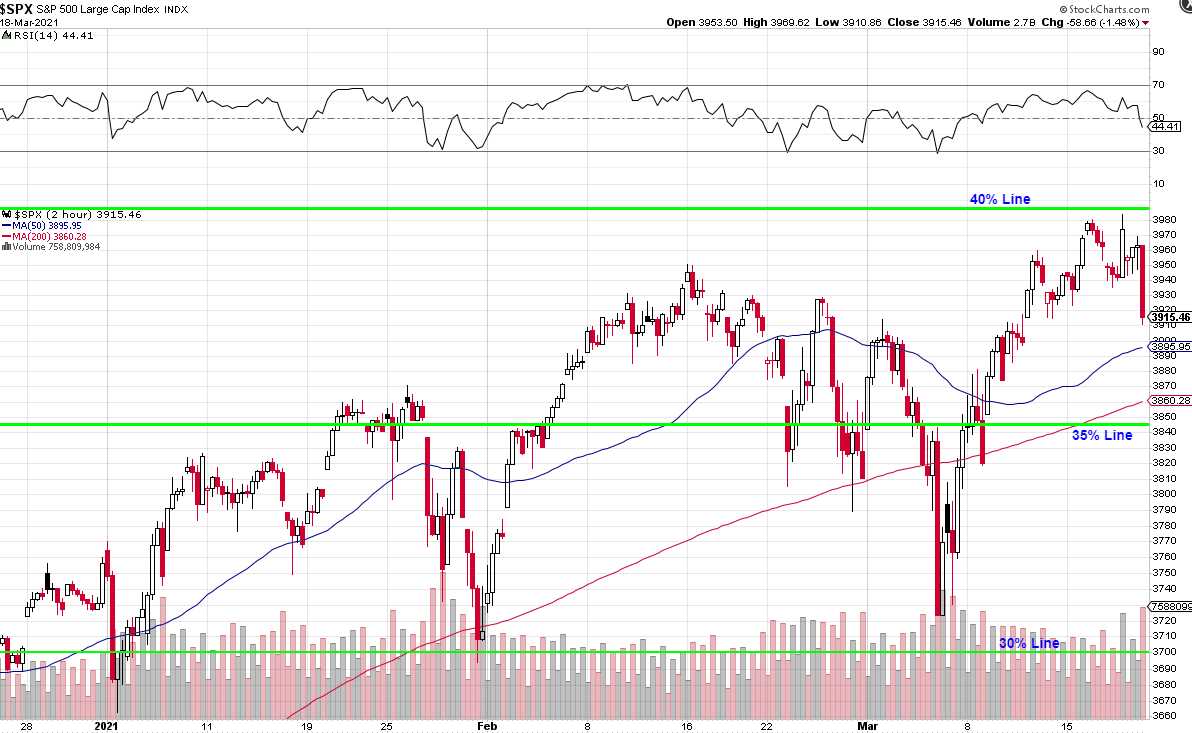

We're now negative for the week on the S&P 500 but of course we were going to be rejected at the 40% line (above 2,850) at least on our first attempt to cross over. From 30 to 40% has been just under 300 points so a 60-point (20% of the run) weak rejection (back to 3,930) was the least we'd expect and 3,870 would be the stronger rejection and is also the rising 200-day moving average, so it has a good chance of holding the first time as well, which means we didn't feel compelled to do anything drastic as we're certainly well-hedged enough to deal with a 5% correction – back to 3,845 (the 35% line).

As you can see, overall we're back to where we were mid-February – so no progress in the past month yet, to hear the pundits on TV – you would think this rally is going strong, wouldn't you? And, keep in mind this was the month we officially passed a $1.9 TRILLION spending bill. I wonder what we'll do to support the market next month? As I noted on Monday – we're likely into the post-Fed blues and soon we get our Q1 earnings reports and I don't think they are going to look like 6% GDP growth, will they?

Of course hope will spring eternal for Q2 and our $1.9Tn spending spree as all those stimulus checks hit people's bank accounts but most of that money will go to paying off rents and credit card bills – not into shopping and services. That makes the Retail ETF (XRT) a fun short at $90 as that's FRIGGIN' INSANE since 50 was normal pre-crisis so XRT is probably a little ahead of itself here:

Do you think Retail Sales and profits are up 100% from 2019? Probably not. I love betting that reality will re-assert itself as it often does over time and, if you can make money betting on reality – why not? In this case, our catalyst will be Q1 earnings so our timeframe is April/May and let's say that even if we get to $100 from $50, there should be at least a 10% and probably 20% correction back to $80 so that's our target and the June $80 puts are $1.75 and the June $85 puts are $4 so it seems we can double our money on a $5 drop in XRT while the June $75 puts are $1 – so we risk losing $1 if we're wrong vs making $2.25 if we're right.

Good options trading is all about finding positive risk/reward scenarios to bet on. If you have a 2.25/1 advantage if you are right – you only have to be right half the time to do very well. So a combination of good logic and good money management can make you rich!

To that end, in our Short-Term Portfolio, let's buy 20 of the XRT June $80 puts for $1.75 ($3,500) and see how that goes. Our target is $7,000 ($3.50/contract) but we are more likely to re-position than stop out if it goes higher – and we'll deal with that if we have to. It also makes a nice hedge for our long retail positions and there's nothing I like better than a dual purpose position.

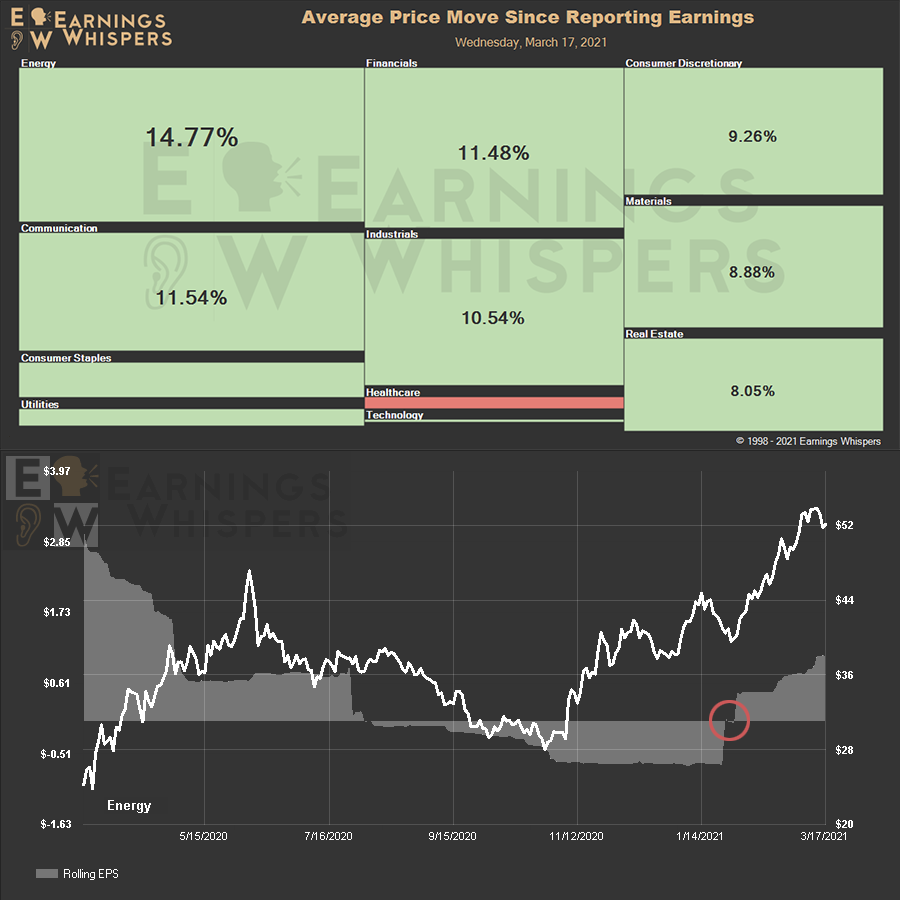

We'll see what kind of bounce we get off yesterday's sell-off but let's keep in mind that the AVERAGE company has gained 10% since their Q4 earnings reports were released – the AVERAGE! We already know GDP Growth is projected, optimistically, to be 6% for 2021 so, even if 100% of that growth went into corporations and even if they profits went up in-line with revenues with no inflationary pressures and no impact from material shortages or wage increases – they would STILL be 4% short of expectations.

Have a great weekend,

– Phil