You know the markets need a lift when they schedule Powell to speak but what kind of catastrophe are we trying to avoid when he's scheduled 3 days in a row? As I've said, the Fed is out of ideas and out of money, so all they can do now is talk up the markets but, WOW!, 3 times in 3 days from the Chairman and 20 MORE speeches from the minions – all jammed in by Thursday, ahead of the 7-year note auction – the same auction that failed last month and sent the markets tumblin' down.

.jpg)

There's also some data on the calendar this week, but who can tell with all the noise coming from the Fed. GDP on Thursday is the final reading for Q4, which was last estimated at 4.1% and is not likely to be a surprise, so clearly it's the 7-Year Auction they are worried about with 3 speakers Wednesday afternoon and 3 before lunch on Thursday followed by Evans speaking during the auction and then Daly will wrap it up that evening with the post-game report.

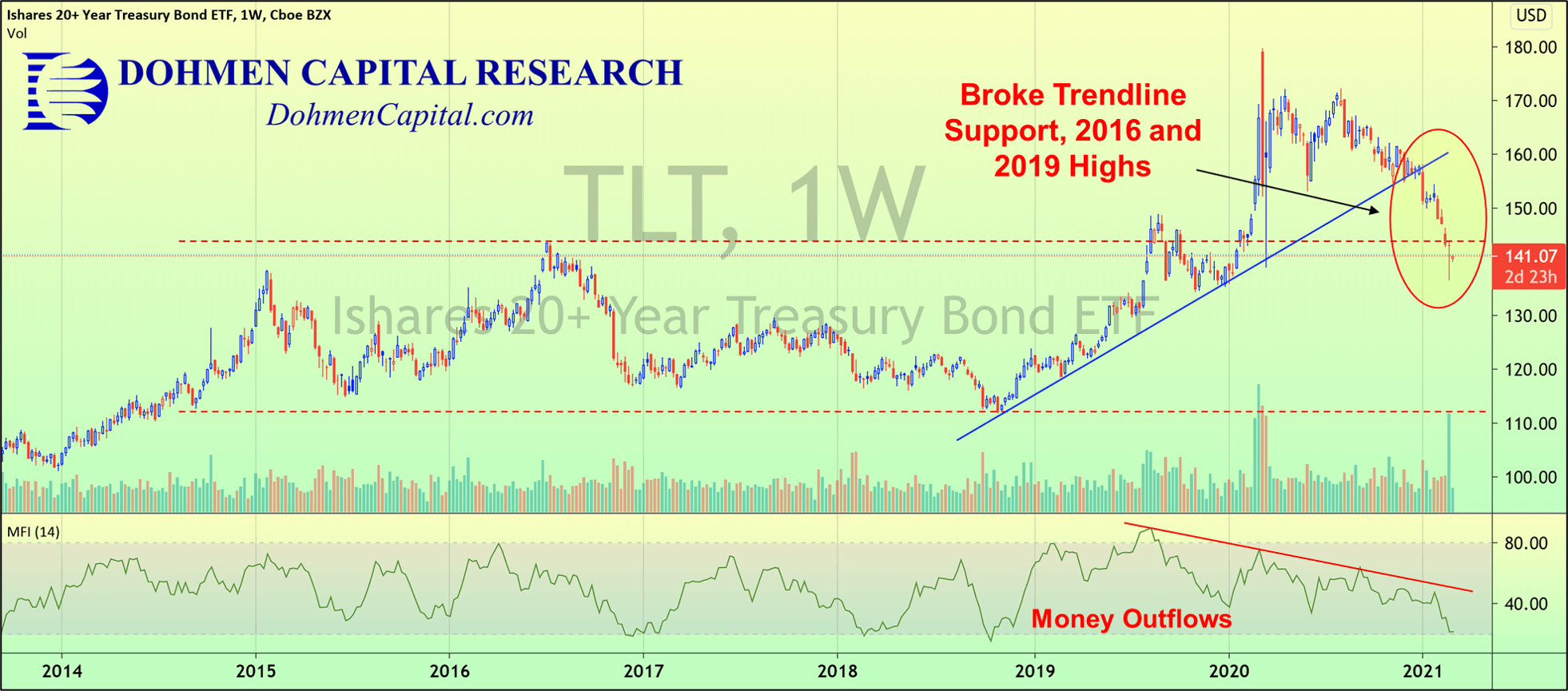

As you can see from the chart above, we're only in the middle of a panic in the bond market and no, it isn't over just because we've been distracted since last month. Was the 2007/8 crisis over in 2008? It wasn't even over in 2009 – these things take time to play out.

On top of all the auction nonsense that's going on this week, we still have earnings dribbling in – including GameStop (GME) who is currently at $200/share, which is $14Bn in market cap for a company that made $400M in it's best year – and that was 4 years ago. Sales were $8Bn then, they were $6.5Bn last year and heading lower – not higher. Best Buy (BBY), in contrast has a $30Bn market cap with $47Bn in sales and $1.8Bn in profit. GameStop is essentially a SECTION in Best Buy – yet it's valued at 1/2 of that company's market cap – that is just INSANE!

Due to Reddit and a very poorly regulatated market, you can't short GME – no matter how logical it is but it will be fun to watch. Q1 earnings don't really kick off until Thursday, April 15th, so a long way to go before they start to matter again, which is why we get to focus our attention on the Fed and they are able to manipulate the market so easily – there's not a lot of contrary data to call them out with – yet.

It's not just the Fed that's doing their best to pump up the market. Just this morning, Cathie Wood of Ark Investments gave Tesla (TSLA) a $3,000 price target – a 5-bagger from their current $650Bn valuation so north of $3Tn seems realitistic to Cathie – by 2025, no less. Of course, Cathie says there's only a 25% probability of TSLA being at $3,000 in 4 years – she also says it's just as likely they hit $4,000/share because – why not?

That makes the forgotten Jonas brother, Adam of Morgan Stanley seem stingy with his $800 price target.