Gathering steam?

Gathering steam?

“The recovery has progressed more quickly than generally expected and looks to be strengthening,” Powell said in prepared testimony to be delivered today to the House Financial Services Committee. “But the recovery is far from complete, so, at the Fed, we will continue to provide the economy the support that it needs for as long as it takes.” Powell will be appearing before the committee along with Treasury Secretary Janet Yellen as part of congressional oversight of the government’s response to the pandemic.

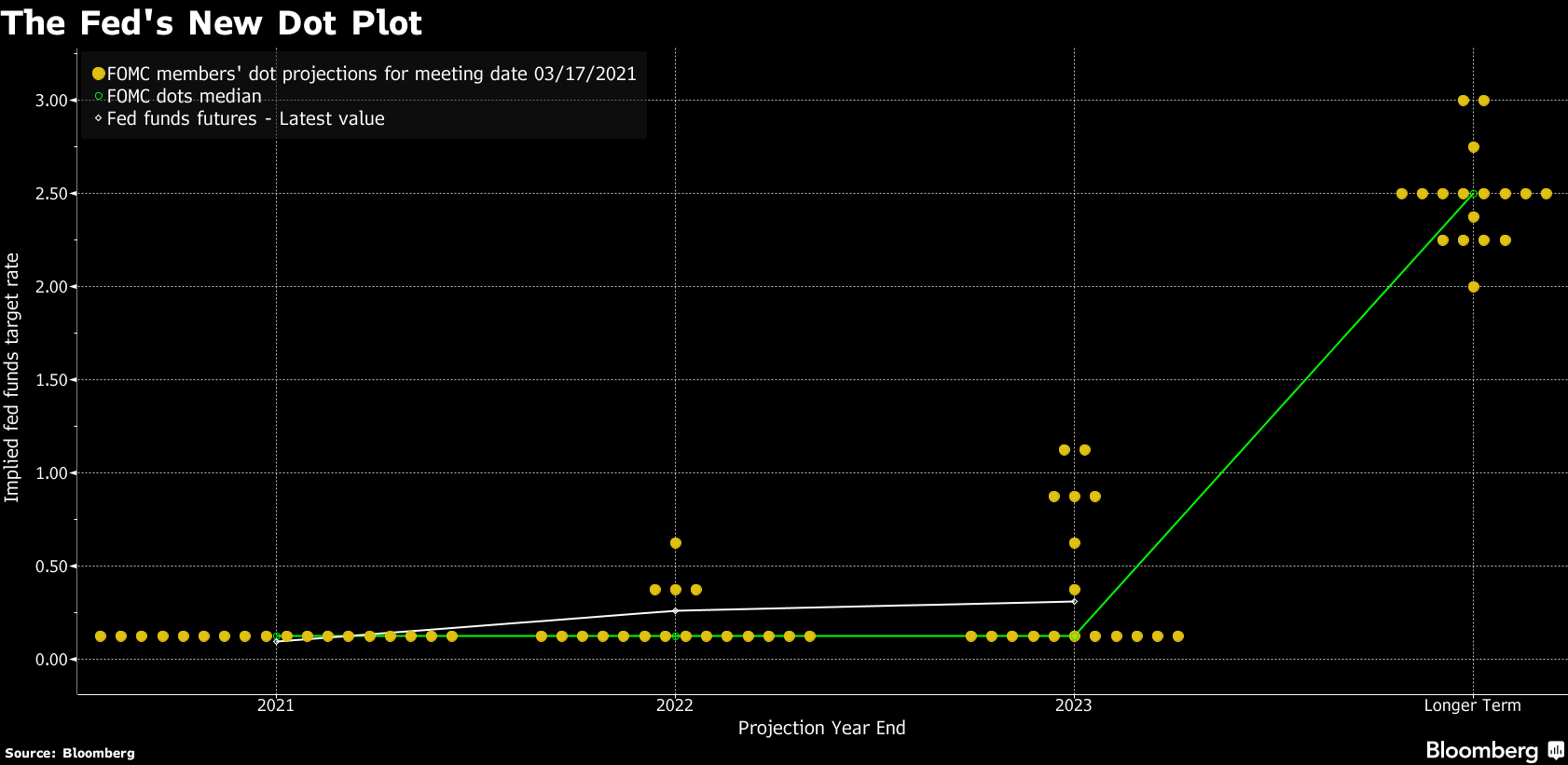

In forecasts released last week, Fed policy makers projected that the economy will grow 6.5% in 2021. That would be the fastest pace since 1983 when measured fourth quarter over the same three months a year earlier and would follow a 2.4% contraction in 2020 as a result of the pandemic. Inflation, as calculated by the personal consumption expenditures price index, is seen in the Fed’s median forecast as ending 2021 at 2.4%.

That all sounds great but already we're seeing some recovery issues in Europe, where Germany is imposing a hard lockdown over the Easter Holiday in an attempt to reverse a new wave of infections. Progress in fighting the crisis is showing signs of stalling. While fatalities in the U.S. and U.K. ease, places like India and eastern Europe are seeing a resurgence. Globally, we have only vaccinated 458M people – just 5% of the people. You can't "win" in vaccines – the whole World needs to eradicate the disease or it can keep coming back in different variants.

That makes Booking Holdings (BKNG), the old "Priceline", an interesting short as their recovery very much depends on global travel and global travel looks like it might end up being a bit of a disappointment this summer as nowhere near enough people are vaccinated to responsibly lift travel restrictions and countries that have been too lax are already being forced to lock back down.

At $2,232, it's an expensive stock to short and we could just buy the Jan $1,000 puts at $15 – not because we think it will go down to $1,000 but because it's not likely BKNG goes over $2,400 and the Jan $800 puts are $7 so figure our loss shouldn't be more than 50% while a $200 drop should put us around where the Jan $1,200 puts are, which is $24 for +$9 and, of course, we can do a lot better.

Another way to play is to buy 2 Jan $2,200 calls for $300 ($60,000) and sell 3 July $2,200 calls for $200 ($60,000) and that's net $0 so if BKNG is below $2,200 in July, whatever value is left on the long calls is profit and over $2,200, we have 6 months to roll and adjust the position. It's a bit too risky and too large for our portfolios – but a fun trade to watch and see how it goes.

Expedia (EXPE) is also silly at $172, which is just under $25Bn for a company that makes $500M in a good year so 50 times earnings in the best case, which is unlikely. Let's play EXPE short in our Short-Term Portfolio with the following:

- Buy 10 EXPE July $190 puts at $28.50 ($28,500)

- Sell 10 EXPE July $165 puts at $14.50 ($14,500)

- Sell 5 EXPE July $190 calls for $10 ($5,000)

That's net $9,000 on the $25,000 spread that's $20,000 in the money to start so we only lose money if EXPE can get back over $180 into the summer. In a Portfolio Margin account (and you shouldn't be doing naked short calls in an ordinary account), it only requires $6,663.40, so it's actually an efficient way to make $16,000 – hopefully.

Meanwhile Powell is still spinning today and Biden is talking $3-4Tn in Infrastructure so don't count the market down yet – but the Russell is getting kind of ugly, so watch that 2,200 line – as a breakdown there could be big trouble for the indexes as well as, of course, 13,000 on the Nasdaq, 32,000 on the Dow and 3,850 on the S&P – none of which are in danger this morning.