It was a nice try.

As we discussed in Monday Morning's PSW Report (and if you want to know what's going to happen before it does – SUBSCRIBE HERE), Fed Chairman Powell spoke 3 times this week and each time he (with help from Janet Yellen) attempted to reassure us that the Fed has things under control and inflation is transitory and all sorts of sunshine and lollipops but yesterday, at the 1pm 5-year Bond Auction – also as expected – the investors clearly were not buying the BS and rates shot up to 0.85. 0.85 doesn't seem like a lot but they were 0.2% last July, so it's a pretty steep inversion of the Yield Curve – a very worrying sign for the economy.

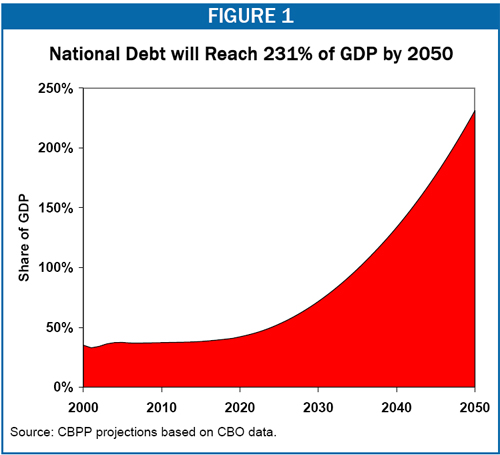

Our $30Tn Debt Load is starting to worry people, especially when we're running a $1Tn deficit already and we're planning to spend another $3Tn on Infrastructure and don't forget the planet is melting and it's going to cost AT LEAST $1Tn/year to fix that – we haven't even had that discussion yet! So I'd say, conservatively, we'll be adding $5Tn in debt this year and that will bring us to about $34Tn in total debt and we are likely to hit $50Tn in 10 years – the length of the primary notes the Government sells. Do you want to get $100,000 back in 10 years after collecting 2% ($20,000) in interest over that period? Do you think that's a wise investment?

Yes, all this FREE MONEY does have a price – it's a price we all pay in the future. As the great economist, Pink Floyd said about deficit GDP financing:

Yes, all this FREE MONEY does have a price – it's a price we all pay in the future. As the great economist, Pink Floyd said about deficit GDP financing:

"And when you lose control you'll reap the harvest you have sown

And as the fear grows the bad blood slows and turns to stone

And it's too late to loose the weight you used to need to throw around

So have a good drown as you go down all alone

Dragged down by the stone"

But the Fed won't go down all alone – they are going to take us with them. The Government is borrowing money on your behalf, this is YOUR unsustainable debts we're talking about and I know rich people love to fantasize that they owe the same $224,455 (yes, that is the real, current, per taxpayer number) as the poor people they step over on the way to work but that's not the case as you can't get blood, or money from a stone yet, somehow, the money has to be gotten. If the US defaults, that's YOUR default – ask Greece how well that goes….

/cdn.vox-cdn.com/uploads/chorus_asset/file/3836000/Europe_Bond_Yields.0.0.png) That's right, those who forget the past are condemned to repeat it and we've all seen this movie before – 14 years ago when the housing market collapsed and the illusion of profits for the banks began to unravel (also predicted by yours truly) certain countries (like Greece) came under a microscope for the unsustainable debt levels and people simply stopped bying their debt – forcing them to offer higher and higher rates to fund it – effectively forcing the country into a crisis.

That's right, those who forget the past are condemned to repeat it and we've all seen this movie before – 14 years ago when the housing market collapsed and the illusion of profits for the banks began to unravel (also predicted by yours truly) certain countries (like Greece) came under a microscope for the unsustainable debt levels and people simply stopped bying their debt – forcing them to offer higher and higher rates to fund it – effectively forcing the country into a crisis.

As part of the European Union, unlike the US, Greece did not have their own Central Bank to print money and buy their own debt – which doesn't make the debt go away but it maintains the illusion that "people" are still willing to lend you money. Greece was not so lucky and rates went up very quickly and Global Markets quickly collapsed and that was our first big Global Bailout – and we haven't really stopped since.

We've seen a big boom in the Dow recently and that's because we're slowing down and people are, once again, defensively putting money into large-cap stocks. The constant money-pumping has the hands on this clock spinning a lot faster than normal but it's still a good indicator of where we are and where we are is the beginning of the end of the bull market – even with another $3Tn of deficit spending around the corner.

We've seen a big boom in the Dow recently and that's because we're slowing down and people are, once again, defensively putting money into large-cap stocks. The constant money-pumping has the hands on this clock spinning a lot faster than normal but it's still a good indicator of where we are and where we are is the beginning of the end of the bull market – even with another $3Tn of deficit spending around the corner.

Think of what's happened in March: We passed a $1.9Tn Stimulus Bill AND we're talking about another $3Tn in Infrastucture Spending AND both the Fed Chairman and the Secretary of Treasury just told Congress they are going to continue their easy money policy for as long as it takes (without causing inflation) and we STILL only hit the same 3,950 we hit on the S&P in February and the Nasdaq didn't come close to 13,850 (now 12,720) and the Russell's February high was 2,300 (now 2,100).

If that's all $5,000,000,000,000 buys us, we are in BIG TROUBLE!

China took their foot off the stimulus gas pedal this month and the CSI 300 dropped 15% as concern about tighter monetary policy replaced optimism about the economic recovery. Like elsewhere, the rally had been led by investors chasing a small number of stocks, many of whom piled in at the top as a frenzy grew. Now the gauge is trailing MSCI Inc.’s global benchmark by the most since 2016 this month and the most popular mutual funds are getting crushed.

China took their foot off the stimulus gas pedal this month and the CSI 300 dropped 15% as concern about tighter monetary policy replaced optimism about the economic recovery. Like elsewhere, the rally had been led by investors chasing a small number of stocks, many of whom piled in at the top as a frenzy grew. Now the gauge is trailing MSCI Inc.’s global benchmark by the most since 2016 this month and the most popular mutual funds are getting crushed.

The Shanghai is also 15% off in the past 30 days and the Hang Seng is off 10% and all still trending down but, as usual, Western Traders tend to ignore Chinese Markets until the results spill over into our local markets – then we blame China for the problem.

China's Ultra-Short ETF (FXP) is a relatively new hedge in our Short-Term Portfolio and we sold the March $40 calls ($6,000) and they expired worthless and that has left us with the September $30 calls ($7,760) covered by the June $35 calls ($3,280) for a $20,000 spread that's on track. We've already collected $1,520 more than we paid for the longs so anything above $30 is just bonus money now and we can't lose. That's a good way to take a long position on an ultra-short ETF.

| FXP Long Call | 2021 17-SEP 30.00 CALL [FXP @ $32.28 $0.00] | 40 | 2/18/2021 | (176) | $7,760 | $1.94 | $2.51 | $3.44 | $4.45 | $0.00 | $10,040 | 129.4% | $17,800 | ||

| FXP Short Call | 2021 18-JUN 35.00 CALL [FXP @ $32.28 $0.00] | -40 | 2/4/2021 | (85) | $-3,280 | $0.82 | $0.86 | $1.68 | $0.00 | $-3,420 | -104.3% | $-6,700 |

It should also be noted that the Sept $40 calls are $2 so, if FXP does go over $35, we can roll this into a $40,000 spread at no cost – that's great flexibility! Keeping it tight for now hedges us against the possibility that China passes another stimulus measure as well – but I doubt that as China still thinks debt is something you have to pay back one day – Old-Time Monetary Theory they call that these days….

Be careful out there and stock up on toilet paper.