We're down for the week.

We're down for the week.

You wouldn't think so, listening to the pundits but we started the week at 3,916 on the S&P 500 (/ES) and this morning we're at 3,910. Keep that in mind while you read your Financial Propoganda – does that FACT correlate to what you are seeing and hearing in the media. Last week we passed a $2Tn Stimulus Bill, this week Powell and Yellen testified that the Fed and the Treasury are prepared to boost this economy forever and Biden just doubled the number of vaccinations they plan to distribute by the end of May to 200M AND the Democrats vowed to pass a $3Tn Infrastructure Bill, even if they have to do it over Mitch McConnell's dead body (preferably).

What has all that done for the market? NEGATIVE 6 ponts!

So, what will it take to get us UP 6 points next week? Colonize Mars? Water into wine? Straw into gold? I think they are truly running out of ideas to stimulate the economy and, unfortunately, all of our hopes and dreams for a better, brighter, lower-interest future are already baked into these record market valuations and there really isn't anywhere else to go but down.

"Keep on (love keeps lifting me)

Lifting me (lifting me)

Higher and higher (higher)

Listen, Now once, I was down-heartedDisappointment, was my closest friend" – Jackie Wilson

Jackie Wilson is right, without a constant flow of love (or money) from the Fed, disappointment will be our only friend. Perhaps the Fed will truly love us forever – they certainly promised to do so this week but again – how much MORE in love can they be? I know people like to say "I love you more and more each day" and that's fine with an emotion but it's not real love the Fed is doling out so much as MONEY and money can be measured and how much more than this year's promised $6Tn ($500Bn/month) can they really love us?

And if we measure our relationship with the Fed in terms of Market Value, this one may have run its course and now investors are starting to look at Housing, Commodities and TIPS and other fresh investments as potential places to seek their thrills, rather than this old, tired bull market. And what will happen to the market if they leave us in search of some young, fresh thing? What will it do then?

And if we measure our relationship with the Fed in terms of Market Value, this one may have run its course and now investors are starting to look at Housing, Commodities and TIPS and other fresh investments as potential places to seek their thrills, rather than this old, tired bull market. And what will happen to the market if they leave us in search of some young, fresh thing? What will it do then?

You know the answer – it's just too sad to think about but, like a pre-nup – it's something you should plan for. So make sure you have a break-up plan with your portfolio in place – just in case things do turn uglier!

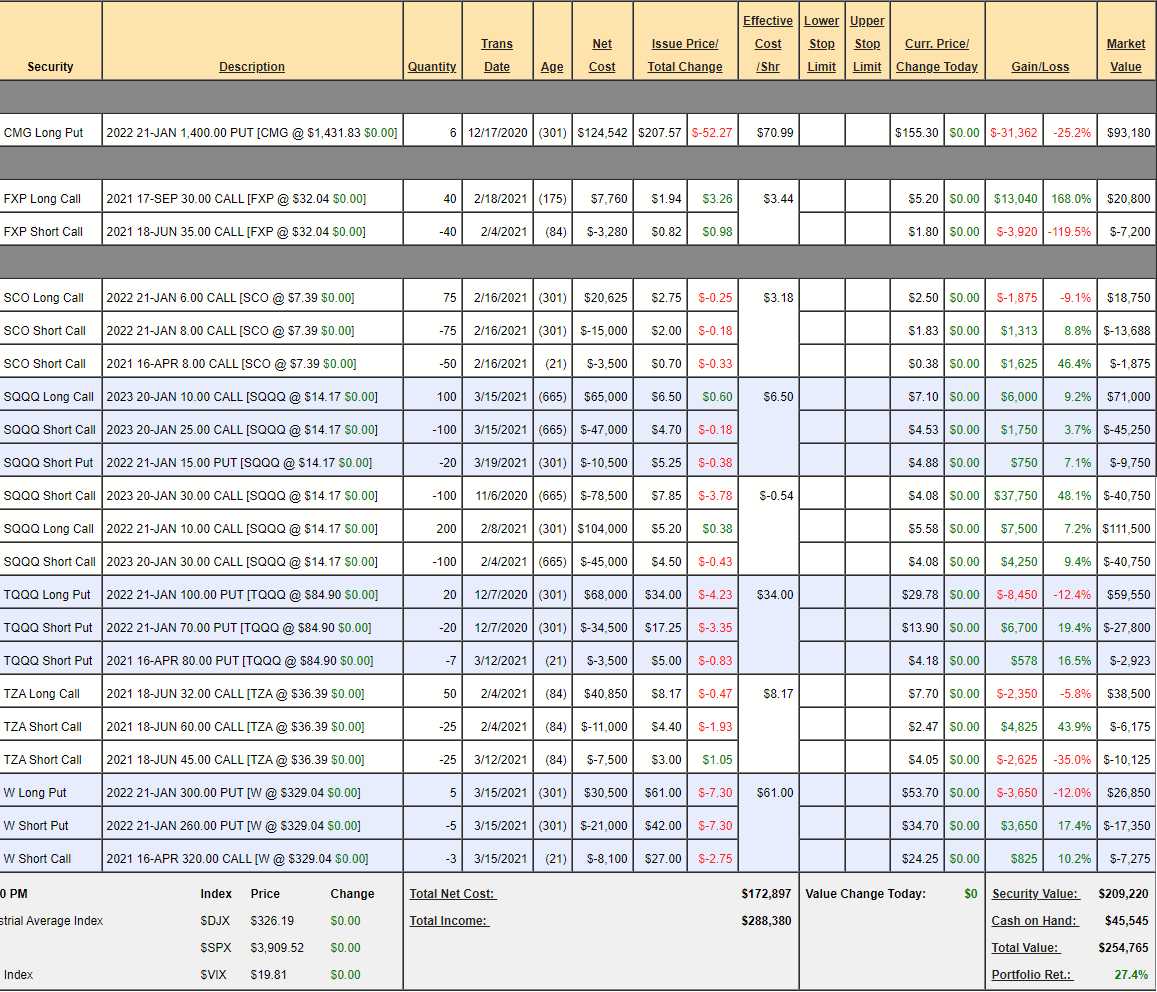

Our Short-Term Portfolio is up $34,000 for the week and, in last Thursday's Portfolio Review, we determined we had about $500,000 worth of protection against a 20% drop in the market (not including our BETS on CMG and W, which should pay us more in a crash as well). So, I think we are well-protected into the weekend with our current pre-nuptual and we haven't yet gotten up the nerve to end the relationship in our Long-Term Portfolio, which is sitting at $1,713,505 so our paired portfolios are now at a combined $1,968,270 – and $2M is where we killed our previous Long and Short-Term Portfolios out of principle in the fall of 2019.

$2M is more than a 200% gain off our $600,000 start – as with the market – there's simply a limit as to what you should expect to make. It's very, Very, VERY unlikely we repeat that performance in 2021 because there simply isn't enough money in the known Universe to goose the market up another 100% like they have in the past 12 months. So KNOWING that we can't keep up this pace – as it was last time – it simply makes sense to take $1.4M off the table and start fresh portfolios with $600,000 ($500K + $100K) where we feel more comfortable taking risks as we know our $1.4M in profits can't be touched.

That's what I'd prefer to do and that's what I will do if this market does begin to roll over but, for the moment – we are very well-balanced and keep making progress each week so this week's progress becomes next week's buffer and we can keep going forward until we see our combined portfolios begin to move backwards.

Until then, please be careful out there.

Have a great weekend,

– Phil