Well we had our first Financial Disaster this weekend.

The Financial press is painting over it as we don't want to upset people at the end of the quarter but Archegos Capital Management had to (for reasons unknown) liquidate $30Bn worth of holdings, one of which was Viacom (VIAC) which dropped 50% in last week. While $100 was too high for a stock we loved at $40, $50 is back to being too low and we bottomed out at $40 in Friday before bargain-hunters finally moved in.

VIAC all by itself lost $30Bn in market cap last week and now it's at $30Bn at $48.50/share for a company making $2.5Bn a year – it's a great time to jump into this blue chip holding and, for our Long-Term Portfolio, we're going to play it this way:

- Sell 10 VIAC 2023 $40 put for $12 ($12,000)

- Buy 15 VIAC 2023 $40 calls for $18.50 ($27,750)

- Sell 10 VIAC Jan ('22) $60 calls for $7.50 ($7,500)

This is an aggressive net $8,000 into what is technically a $30,000 spread but we can easily sell 5 more short calls to recoup 1/2 of our cash but, more importantly, we can roll the 2022 $60 calls out to 2023 $80 calls (for example), which are $7.50 too and sell 5 more and we'd drop our basis to about $4,000 on a $60,000 spread that would be at least half in the money or we wouldn't have rollled it. That's our plan if VIAC goes higer and, if it's flat, we'lll sell the 2023 $60 calls for another $7,500 and engineer a free spread and, if it's lower, we're very happy to add to the position as our worst-case scenario is being forced to own 1,000 shares of VIAC at net $48 – the current price.

That's a lovely trade to start the week off with, Archegos may not want VIAC anymore but we sure do! Another stock that was trashed by Archegos is Discovery Financial (DISCA) – also losing about half their "value" though value is in quotes because it was never worth $80 in the first place. DISCA too is getting interesting down here but not quite as compelling as VIAC so, in this case, we can just sell the puts in our LTP as our promise to buy the stock – if it goes lower:

- Sell 5 DISCA 2023 $40 puts for $12 ($6,000)

We are collecting $6,000 in exchange for our promise to buy 500 shares of DISCA for $40 so our net entry would be $14,000 or $28 per share – a 33% discount to the current price is our worst case and, if DISCA stays over $40, we simply keep the $6,000. On the whole, we'd almost rather it go lower so we can have a cheap stock for the long-haul!

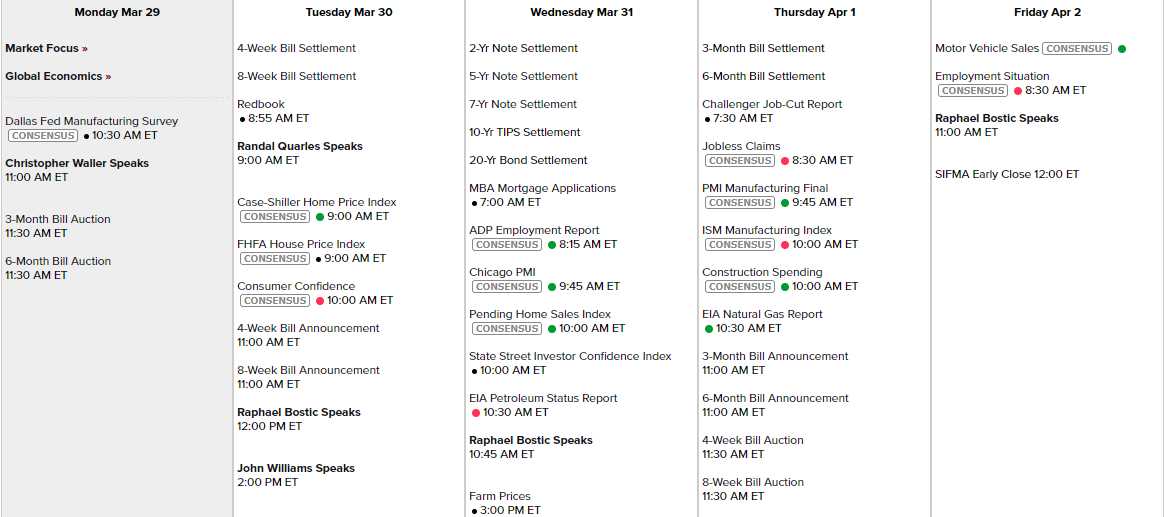

That ship is still stuck in the Suez Canal and Oil (/CL) is still $61.50 but it's going to be a great short here. The Dollar is super-strong near 93 and that can boost the market if it comes down so we can mask a lot of selling into Quad-Witching Wednesday to close out the month. Friday will be our Non-Farm Payroll Report and we have 8 Fed speakers along with Dallas Fed this morning, Case-Shiller and Consumer Confidence tomorrow, Chicage PMI & Investor Confidence on Wednesday and PMI & ISM Thursday, so it's a busy data week for sure.

There's always something to buy in the market if you wait patiently. We had no idea we'd have an opportunity to get back into Viacom but having cash on the side allows us to act and pick up the bargains that are presented to us. We still have to be patient and see how the re-opening goes but Biden's very aggressive vaccine schedule (I get my shot on Saturday!) is giving us hope that things could be sort of normal in the 2nd half of the year – just in time for people to go out and spend the next round of stimulus checks!