What are they so afraid of?

What are they so afraid of?

Gravity, I guess, as the S&P 500 is at 4,063 and the Dow is at 33,333, Nasdaq 13,561 and Russell 2,256. This isn't just high, this is insanely high. 14,000 on the Nasdaq is 6,000 points higher than 8,000, which wasn't even the March low but it is where Billions of Transactions valued the Nasdaq stocks between late 2018 and early 2020 – two years worth of traders didn't want to pay more than 8,000 for these Nasdaq stocks yet now, after a year of a Global Pandemic – they are racing to pay 75% more money?

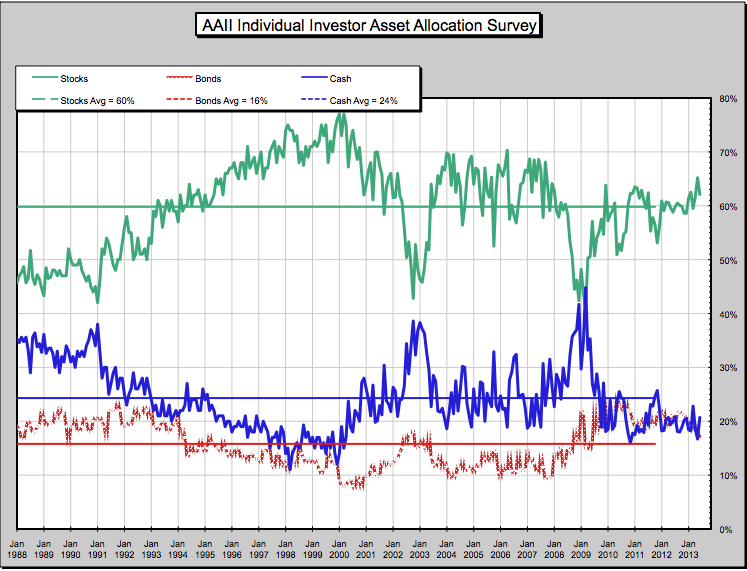

Yesterday we talked about the Fed and how they are manipulating the bond market to make it seem like there is demand for bonds and a side-effect of that is they are flooding the system with money. How? Well, in the old days, people used to EARN money and they would sometimes use it to buy bonds and the money would go out of circulation and be tied up in a T-Bill for 10 years – lowering the free money supply. The Government, of course, would spend the money but it's money they were going to spend anyway, whether you lent it to them or not – the money you put into the bond just helped to balance the budget.

Now that's out the window and the Government spends and you spend and Corporations spend and no one seems to worry about paying debt back and, since no one is really buying US bonds, the Fed simply prints money and uses that new money to buy bonds. That lowers the amounts of bonds in circulation, keeping their "value" up – which translates into low yields. Since the Fed buys bonds effectively from people who are rolling it over, the money goes into circulation, replacing the bonds and, since investors are not too keen on bonds – where does the money go? Stocks! See how easy economics is?

Now that's out the window and the Government spends and you spend and Corporations spend and no one seems to worry about paying debt back and, since no one is really buying US bonds, the Fed simply prints money and uses that new money to buy bonds. That lowers the amounts of bonds in circulation, keeping their "value" up – which translates into low yields. Since the Fed buys bonds effectively from people who are rolling it over, the money goes into circulation, replacing the bonds and, since investors are not too keen on bonds – where does the money go? Stocks! See how easy economics is?

Some goes to Housing, some goes to Commodities and some actually goes into the Economy but mostly money is looking for a return and we're sure not getting it in the banks or from bonds, so stocks win! The money going into the economy also causes inflation, of course, and that's still good for commodities and it's bad for bonds, which carry a fixed rate – so the cycle feeds itself – until it collapses.

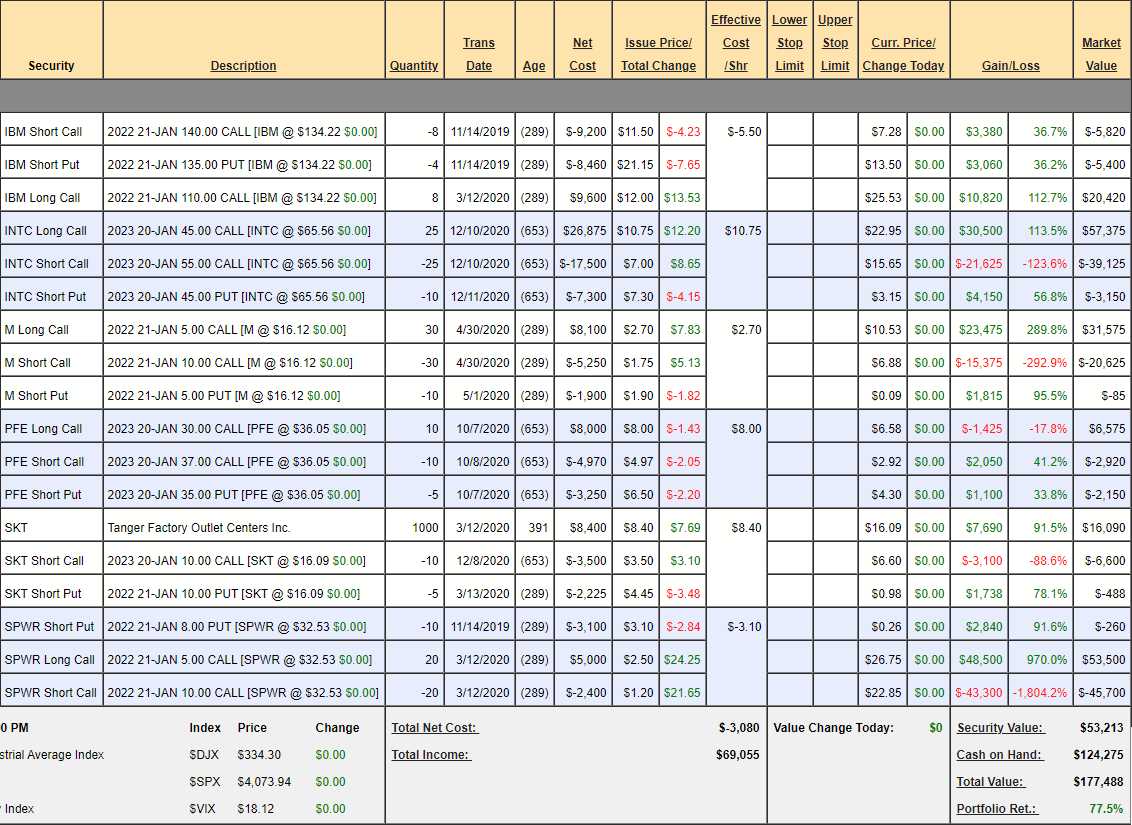

Still, we can enjoy the ride while it's still going. We just reviewed our Money Talk Porfolio on March 19th and we don't touch the positions unless we're on the show so it's a good example of how much money we're making just sitting around and, in just 19 days since – we've made another $7,325 (10%)!

Of course the economy seems fantastic to members of the Investing Class – we're making over 10% per month! Who cares how many restaurnts are shut or how many retail stores are out of business when our portfolios are looking good? And we're 75% in CASH!!! in that portfolio – we're not even trying and we're making 10% of the ENTIRE portfolio in a month, with only 25% of the money invested – how crazy is that?

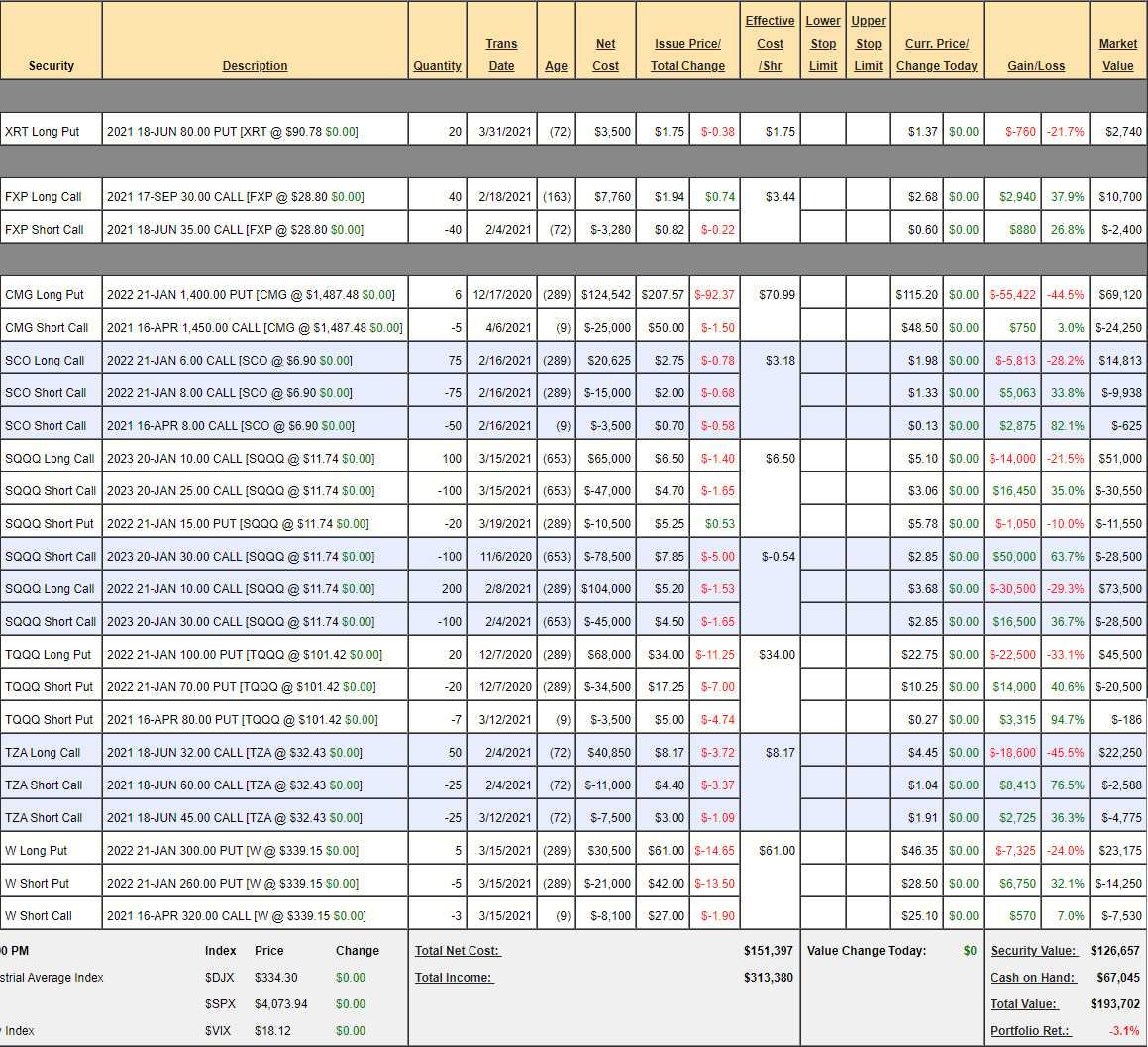

And we're not swinging for the stars here, it's IBM, INTC, M, PFE, SKT and SWPR – a nice, balanced collection of 6 stocks but everything is AWESOME in this market and they only go up every day. Aren't you comfortable with that as an investing premise? Our Long-Term Portfolio (LTP) has blasted up to $1,772,893 (up $70,950 since our March 18th review), which is up 254.6% in our aggressive long portfolio and our aggressively short, Short-Term Portfolio (STP) is down $26,771 and that's down 3.1% overall.

In our March 18th Review, we determined that our STP positions were giving us $503,924 of downside protection against a 20% drop and, since we only have $644,293 invested in the LTP (the rest is CASH!!!), we're very comfortable with our balance at the moment. If anything, we're looking for more long positions – though good ones are very hard to come by in such an overbought market so we'll have to pay close attention during earnings season to see what's still undervalued.

Stocks we have already are still good like T, WBA, GILD, TOT, GOLD and WPM – we could just buy more of those but it's more fun to look for new stuff – so we'll be doing that – but cautiously….

Fed Minutes are out at 2pm but Powell doesn't speak until tomorrow at noon, which indicates they think they need to talk up the markets for some reason. Jaimie Dimon of JPM is talking things up today, saying the economy is in a "Goldilocks" moment and telling Retail Investors to BUYBUYBUY what his clients are dumping – just like in 2008.

We'll check out the Fed Minutes at 2pm during our Live Trading Webinar – JOIN US HERE at 1pm, EST!