GDP estimates are down 40%.

GDP estimates are down 40%.

They never should have been at 10% in the first place but we can take the Fed's complete inability to accurately predict what will happen in the economy as a given and just focus on the trends. Other leading Economorons have been bringing their estimates down as well as the grand re-opening is not going as smoothly as first thought.

The range of predictions is staggering – from 2% to 7% among those surveyed – leaving a gap the size of Canada's entire economy in-between. Speaking of Canada, our neighbor to the North has re-locked down their most populous province (and, if you can name 3 you are a leading Canada expert) as their re-opening led to a disastrous resurgence of the virus – particularly the more contageous new strains. "That's just science" said the mayor of 100 towns and cities as their citizens drove past them on the way in and out of Canada for beer.

Hopefully we'll do better though that's like back last April when we HOPED the virus would stay in China and then we HOPED it would only be a few cases in the US, etc. Reality can be a real bitch sometimes – good thing we're ignoring it again. It's the timing of the virus that is killing us – it's too close to Summer to close the beaches again. Just a few kids eaten by sharks so far – nothing to worry about…

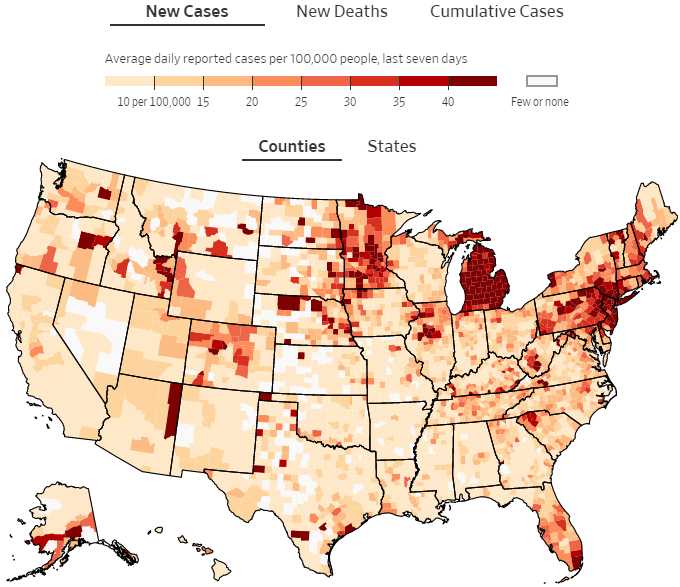

Five states: Michigan, New York, Florida, Pennsylvania and New Jersey account for some 42% of newly reported cases. In Michigan, adults aged 20 to 39 have the highest daily case rates, new data show. Case rates for children aged 19 and under are at a record, more than quadruple from a month ago. There were 301 reported school outbreaks as of early last week, up from 248 the week prior, according to state data. In addition to school sports, large outbreaks have been tied to the recent Easter holiday and spring breaks.

Five states: Michigan, New York, Florida, Pennsylvania and New Jersey account for some 42% of newly reported cases. In Michigan, adults aged 20 to 39 have the highest daily case rates, new data show. Case rates for children aged 19 and under are at a record, more than quadruple from a month ago. There were 301 reported school outbreaks as of early last week, up from 248 the week prior, according to state data. In addition to school sports, large outbreaks have been tied to the recent Easter holiday and spring breaks.

Driving the overall uptick among younger people in Michigan, and more broadly, is a confluence of fatigue from the pandemic, which is leading some people to engage in more close contact, and the spread of the more transmissible U.K. variant, known as B.1.1.7. “It used to be that we had clusters of the variant. The cases were in fairly contained situations. Now, we’re definitely seeing cases of the variant arise in the general community,” said Emily Toth Martin, an infectious-disease epidemiologist at University of Michigan School of Public Health. “It’s concerning that we see big explosive rises in groups where we can’t use the vaccine.”

Speaking of concerns, the Dollar is down 1.5% in April from 93.4 to 92 and the S&P has climbed from 3,950 to 4,114, which is up 164 points and that's 4%. We'll see what happens to the S&P when and if the Dollar starts to bounce but, who knows, maybe we'll get lucky and it will collapse completely…

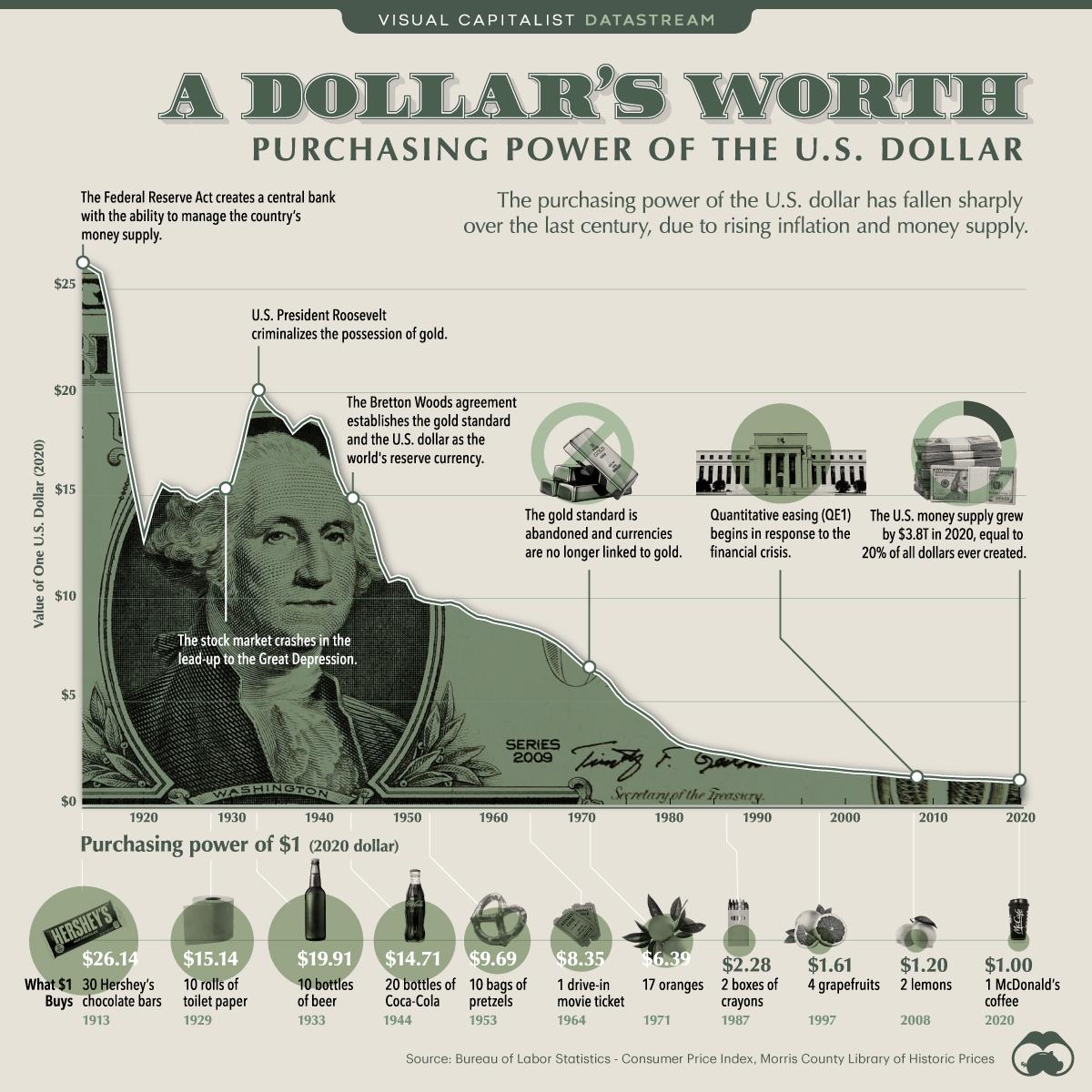

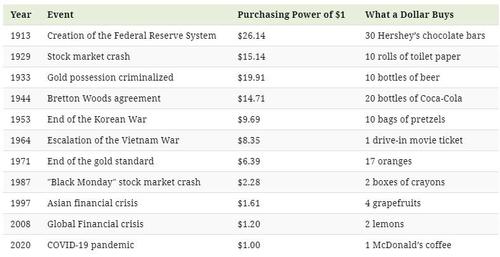

Money supply (M2) in the U.S. has skyrocketed over the last two decades, up from $4.6 Trillion in 2000 to $19.5 Trillion in 2021. The effects of the rise in money supply were amplified by the financial crisis of 2008 and more recently by the COVID-19 pandemic. In fact, around 20% of all U.S. dollars in the money supply, $3.4 Trillion, were created in 2020 alone. A roll of toilet paper used to cost a dime, as did a bottle of beer – coke was a nickel!

Money supply (M2) in the U.S. has skyrocketed over the last two decades, up from $4.6 Trillion in 2000 to $19.5 Trillion in 2021. The effects of the rise in money supply were amplified by the financial crisis of 2008 and more recently by the COVID-19 pandemic. In fact, around 20% of all U.S. dollars in the money supply, $3.4 Trillion, were created in 2020 alone. A roll of toilet paper used to cost a dime, as did a bottle of beer – coke was a nickel!

We are likely at the beginning of another long-term inflationary surge and, as I discussed in a recent interview, we need to be as it's the only logical way to reduce our Debt ($30Tn) to GDP ($20Tn), which is now 150% of GDP – not including entitlements (because that would make it look very, VERY bad). Adding $2Tn per year to our debt for 10 years would double it to $60Tn but 10% annual inflation (like we had in the 70s) would bring our GDP up to $52Tn – a much better ratio. Going the other way would, of course, be catastrophic. The debt will grow to $60Tn no matter what you try to do – so getting the economy to keep up is the only logical choice.

All this is great for the market, as long as things don't go too terribly wrong. Powell was on TV last night saying the Economic Outlook is "substantially brighter." "We feel like we're at a place where the economy's about to start growing much more quickly and job creation coming in much more quickly. The outlook has brightened substantially." The main risk to the outlook, Powell stressed, is a new spread of the disease. That last part will be basically ignored as the media chooses to accentuate the positive.

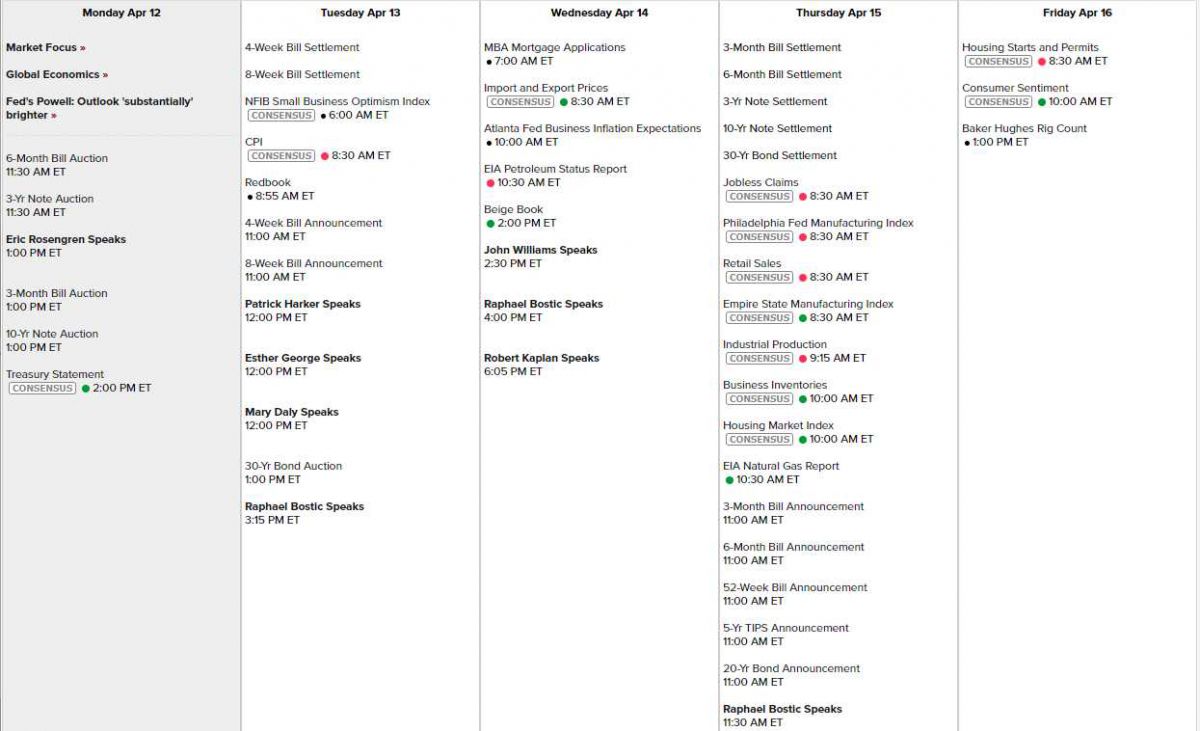

11 Fed speakers will back Powell up this week with very little Economic Data until the Atlanta Fed on Wednesday along with the Beige Book. There's CPI and Business Optimisim tomorrow, Philly & NY Fed Thursday and Consumer Sentiment and Housing Starts on Friday.

As you can see here, earnings season gets going on Wednesday and by Thursday we're already packed with big names and lots of banks. The Banking Sector is the only sector with EVERY SINGLE STOCK higher than last quarter. If they can hold it together – it bodes well for the rest of the S&P 500 as well and 20% of the XLF reports this week:

Things are going to heat up fast – I hope Q1 earnigns will not disappoint but, if they do – we do have our hedges (see Friday's Report).