Liquidation

Courtesy of Michael Batnick

Brokerage accounts are for investing. If you want an adrenaline rush, drink a couple of Four Lokos*.

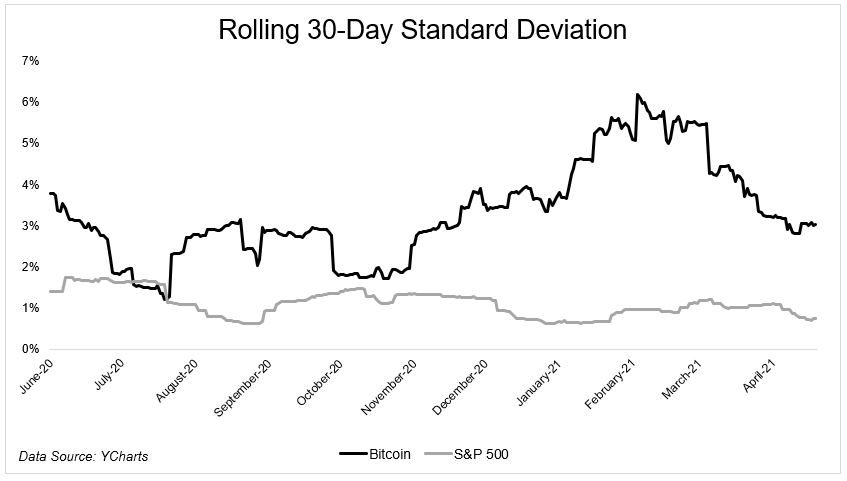

The volatility of Bitcoin makes the S&P 500 look like a short-term bond. Imagine investing in Bitcoin and thinking “I need 20:1 leverage.”

Evidently, there are people out there doing this with a lot of money. According to data provider Bybt, crypto traders lost $10.1 billion last Sunday to liquidations after Bitcoin fell 17% in 20 minutes.

The Wall Street Journal reported on this story over the weekend.

Offshore crypto-derivatives exchanges offer individual investors high degrees of leverage. At Binance, for instance, investors can get leverage of 125 to 1 for some futures contracts, meaning they can deposit just 80 cents to amass the equivalent of $100 of bitcoin. By comparison, an investor trading bitcoin futures on CME Group Inc., a regulated U.S. exchange, would need to deposit at least $38 and would likely be required to post more margin by their brokerage.

There’s nothing wrong with having a little excitement in a play account, but jeez, weekly options aren’t enough? And even though 125:1 is probably not the norm, this is absolute madness. Play stupid games, win stupid prizes.

*Please don’t