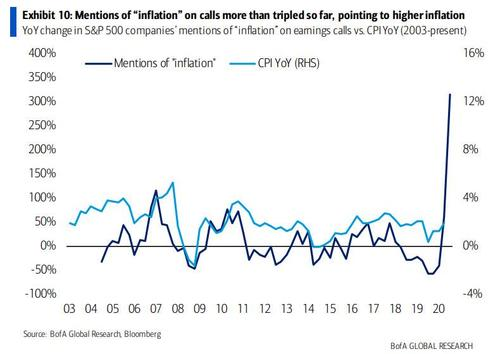

As you can see from the B of A chart on the right, 13% of the conference calls have mentioned inflation as a key factor going forward and that's up 300% from last year. Inflation has many problems for the market and one of them is uncertainty — markets don't like that. As long as we have the certainty of the Fed backing us up, we can ignore inflation but, of course, inflation is the one key factor that is most likely to force the Fed to stop printing money — as it can quickly get out of hand.

Home prices are up over 10% since last year, despite the Recession, and materials like lumber are through the roof, so don't expect that to ease up any time soon. Core Inflation would have to persist above 2%, perhaps for several quarters, to spur policymakers to move. With its policy shift, the Fed now also promises to aim for 2% inflation on average over a period of time, rather than using 2% as a hard annual target, as it has since 2012.

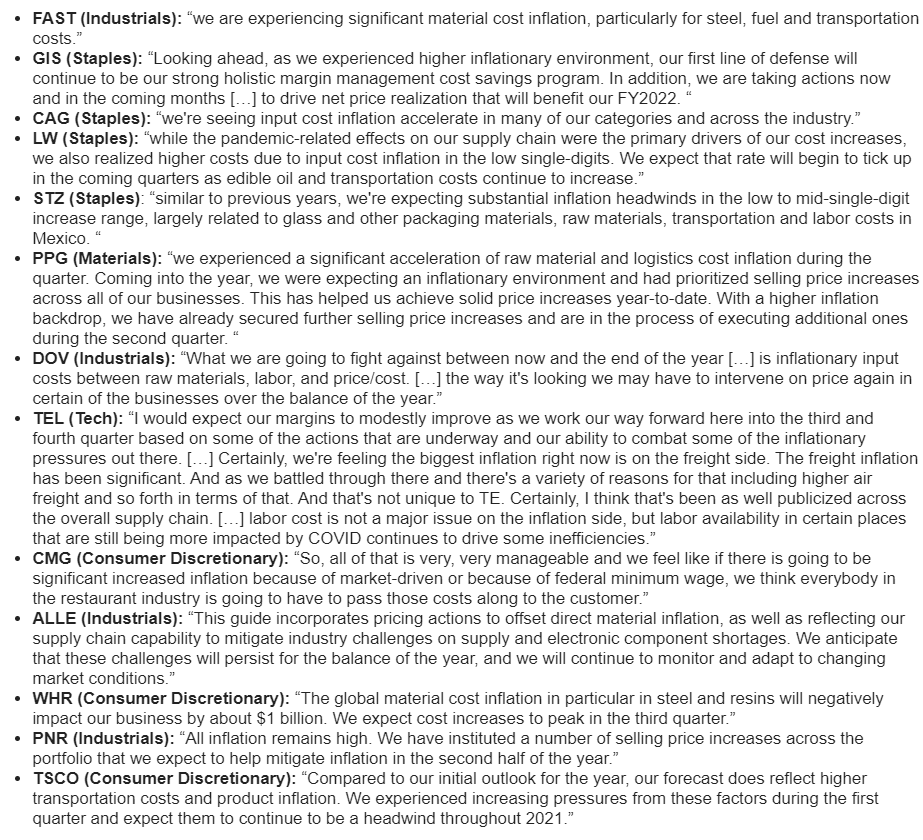

Still, as we know, the CPI is just so much BS, and you can see how our CEOs see inflation as a real problem that's impacting their industries already from these earnings report comments:

:max_bytes(150000):strip_icc()/inflation_FINAL-5c8975c946e0fb0001a0bf75.png) These are well worth considering when making investments in 2021 — it's not just about whether or not your portfolio companies will experience inflation but whether or not they will easily be able to pass those increased costs along to their consumers. If they can't – it's the profits that get squeezed. Rising commodities prices are driving up costs, especially for manufacturing sectors. At least some of this pressure from higher commodities prices then flows downstream to industries such as Autos, Capital Goods, and Building Materials.

These are well worth considering when making investments in 2021 — it's not just about whether or not your portfolio companies will experience inflation but whether or not they will easily be able to pass those increased costs along to their consumers. If they can't – it's the profits that get squeezed. Rising commodities prices are driving up costs, especially for manufacturing sectors. At least some of this pressure from higher commodities prices then flows downstream to industries such as Autos, Capital Goods, and Building Materials.

Services Sectors, on the other hand, are more concerned with labor costs. For Media and Entertainment, the price of talent keeps rising. The health care-services sector has been short of skilled nurses to meet the staffing needs. As the lodging industry starts to rebound from its deep dip, it will likely grapple with higher property and room taxes as cities try to fill budget holes. Companies in the sector may also have to raise wages to attract labor, since many hospitality workers have left the industry since the pandemic began. Furthermore, a potential boost in the federal minimum wage to $15 an hour could be a risk for retail, restaurants, and gaming operators, especially smaller ones.

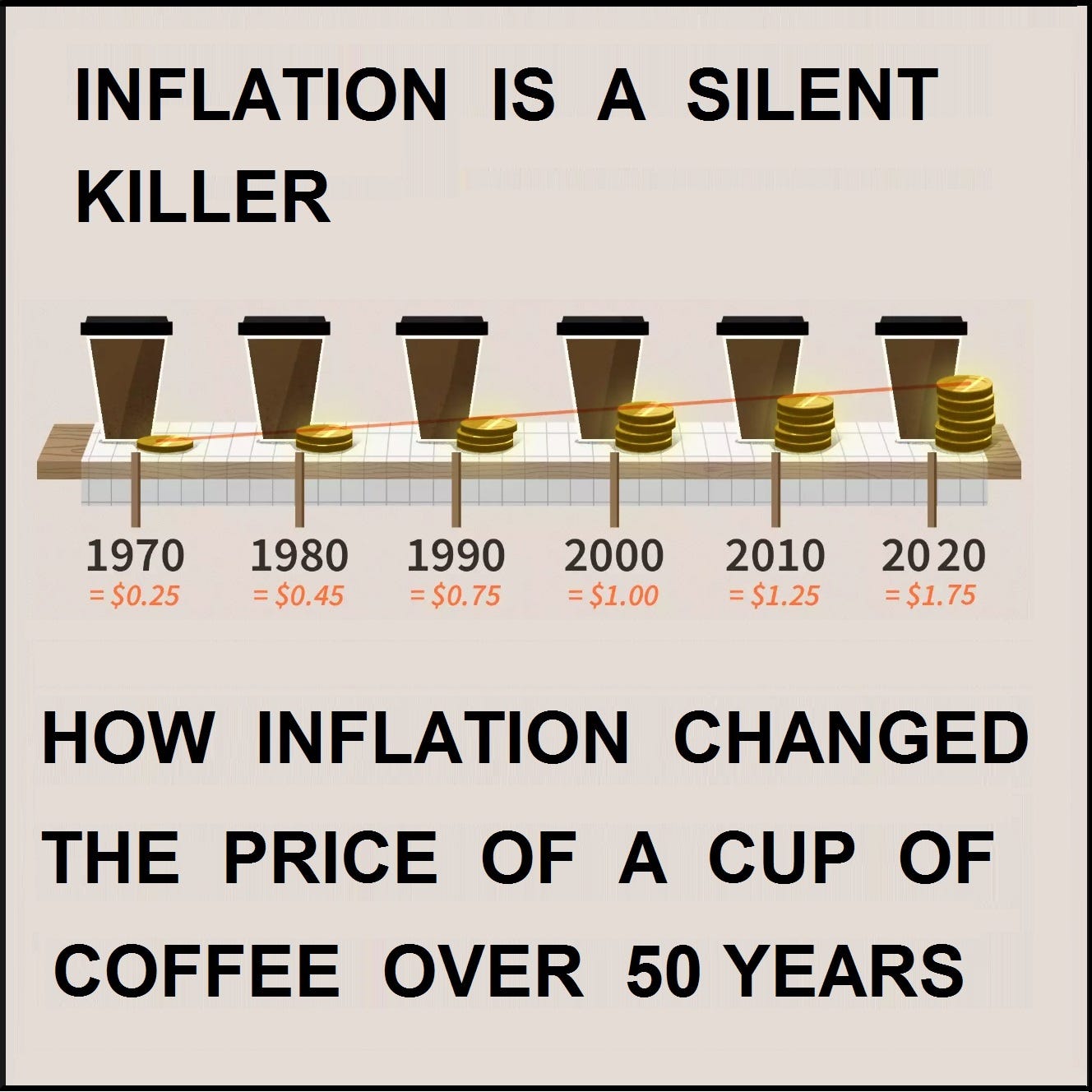

Lots of changes are coming and we'll need to adjust our investing strategies accordingly. We have been spoiled over the past 20 years as the price of a cup of coffee has only gone up 75%, less than 3% a year compounded. From 1970 to 1980, it went up 80% in 10 years and from 1980 to 1990 it went up 66% in 10 years but then 33% through 2000 and 25% into 2010 but 40% in the last 10 and we'll be well over 10% this year alone – inflation is accelerating and things are getting more expensive.

Lots of changes are coming and we'll need to adjust our investing strategies accordingly. We have been spoiled over the past 20 years as the price of a cup of coffee has only gone up 75%, less than 3% a year compounded. From 1970 to 1980, it went up 80% in 10 years and from 1980 to 1990 it went up 66% in 10 years but then 33% through 2000 and 25% into 2010 but 40% in the last 10 and we'll be well over 10% this year alone – inflation is accelerating and things are getting more expensive.

That doesn't matter much if wages are rising to keep up but it doesn't happen in lock-step so there are many periods of dislocation and that causes all sorts of economic disruptions – especially when savings begin to make negative returns – like they are now with the real rate of inflation (even with the Fed's BS-low count) outpacing the 5 and 10-year note yields by about 20% which means every dollar you invest in US Bonds loses 20% of the interest per year in buying power. How long can that go on?

That's why the Fed is playing a very dangerous game and they start their meeting this morning and tommorrow we'll get a rate announcement (it takes them 2 days to change 10 words on their statement, for some reason) and it's not likely anything drastic will happen – or anything at all, for that matter. It's just going to be people reading the tea leaves to consider how long the Fed is going to ignore the crisis they causes which is rapidly spreading throughout the land – very obvious to everyone but the guy who writes the word "transitory" to describe it.

Do investors want a Fed that ignores reality or one that faces up to it with a clear plan of action. Unfortunately – we don't get to choose and we know which Fed we are going to get tomorrow.

Be careful out there.