Down we go!

Down we go!

As you can see from the chart, the Russell 2000 is almost back to where we were in March, which is only a bit above where we were in January, which may mean that all this rallying on nothing at all has been a huge mistake and people may be waking up and realizing that it's not just Dogecoin that's a hustle but the entire stock market bubble. Are people beginning to realize that a truly good investment is one that returns profits that stay ahead of inflation over time and not just empty promises of an uncertain future? Nah….

I must apologize to Elon Musk for pointing out yesterday that Tesla (TSLA) is also a scam – that stock hasn't stopped selling since and it's dropping like Dogecoin, back at the March lows in pre-market trading. Aside from Mush admiting Dogecoin is "a hustle" on Saturday Night Live (see yesterday's report for full coverage), the catalyst for the sell-off is Tesla's very poor April performance in China (which accounts for 1/3 of TSLA's sales) with only 25,854 cars sold, down 27% from March AND they abandoned plans to expand the Shanghai plant – a sign TSLA doesn't see their sales bouncing back as electric car competition heats up in China (and globally).

At a recent Chinese Auto show, an unhappy customer clambered atop a Tesla to protest the company's handling of her complaints about malfunctioning brakes. Videos that went viral showed a woman wearing a T-shirt emblazoned with the words "The brakes don't work" and shouting similar accusations while staff and security struggled to restore calm. Police in Texas are investigating a fatal crash involving a Tesla Model S that hit a tree and burst into flames. Rescuers found victims in the passenger and rear seat, not the driver's seat but TSLA claims the car was not on auto-pilot. Federal regulators are investigating the crash, and have a total of 24 probes underway of accidents involving Teslas operating on Autopilot.

All these were known issues with TSLA but that hasn't stopped people from buying the stock for as much at $900, close to $1Tn in market cap which exceeds the market cap of every other auto maker combined – despite Tesla having just 0.5% of all auto sales and 0.25% of the profits. TSLA is a shining example of how irrational this market has become as it produces a 0.16% return on your investment with a p/e of 600.

Investments are supposed to MAKE money, not just in share price but in actual profits made by the company. The share price isn't your asset, the company's profits, client base, patents, plants, equipement, people – THAT is what you are investing in when you buy a stock. The PRICE of the stock only indicates what you paid for it and what others are paying today – it has very little to do with the actual VALUE of the company.

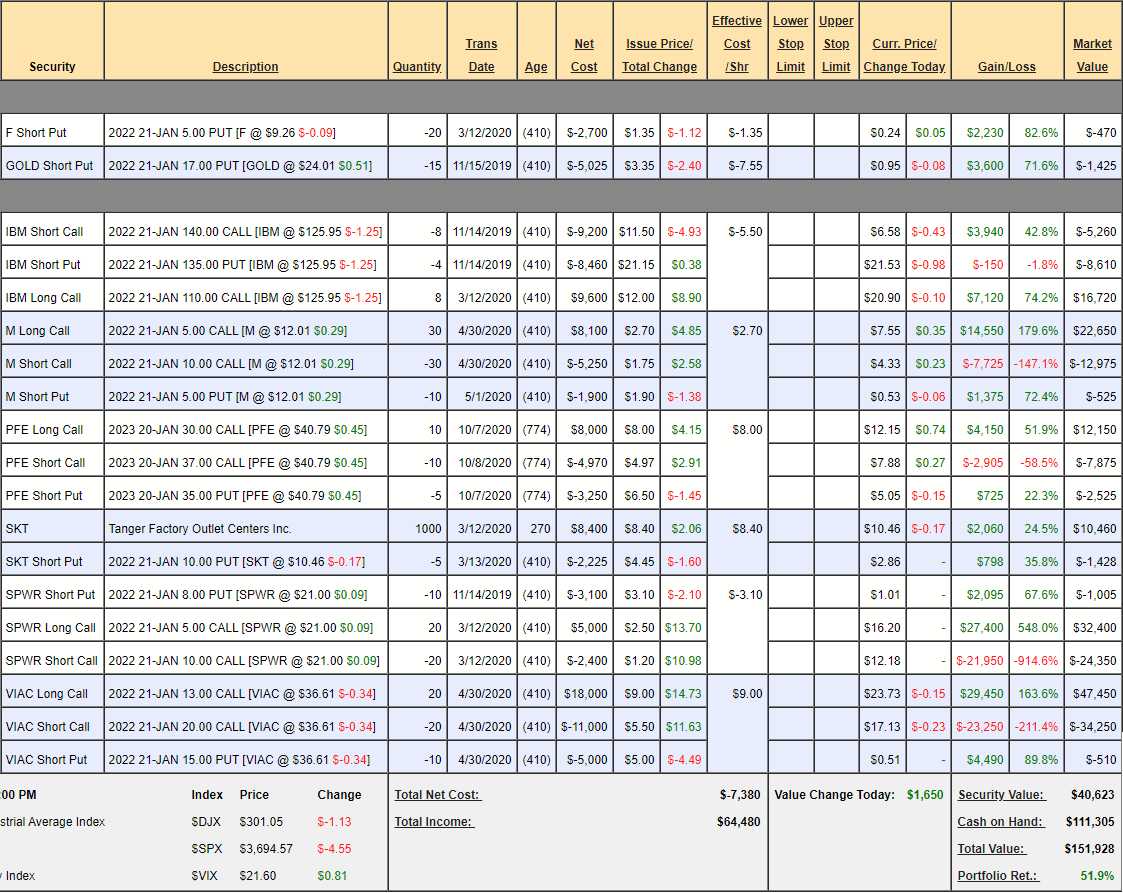

That brings us to our Money Talk Portfolio, which has been concentrating on value stocks since we only trade or adjust it quarterly, on the show. I'll be on tomorrow night but we'll be taping this afternoon and the last time I was on was December 11th, when we added our Trade of the Year, Intel (INTC) to the portfolio, which looked like this at the time:

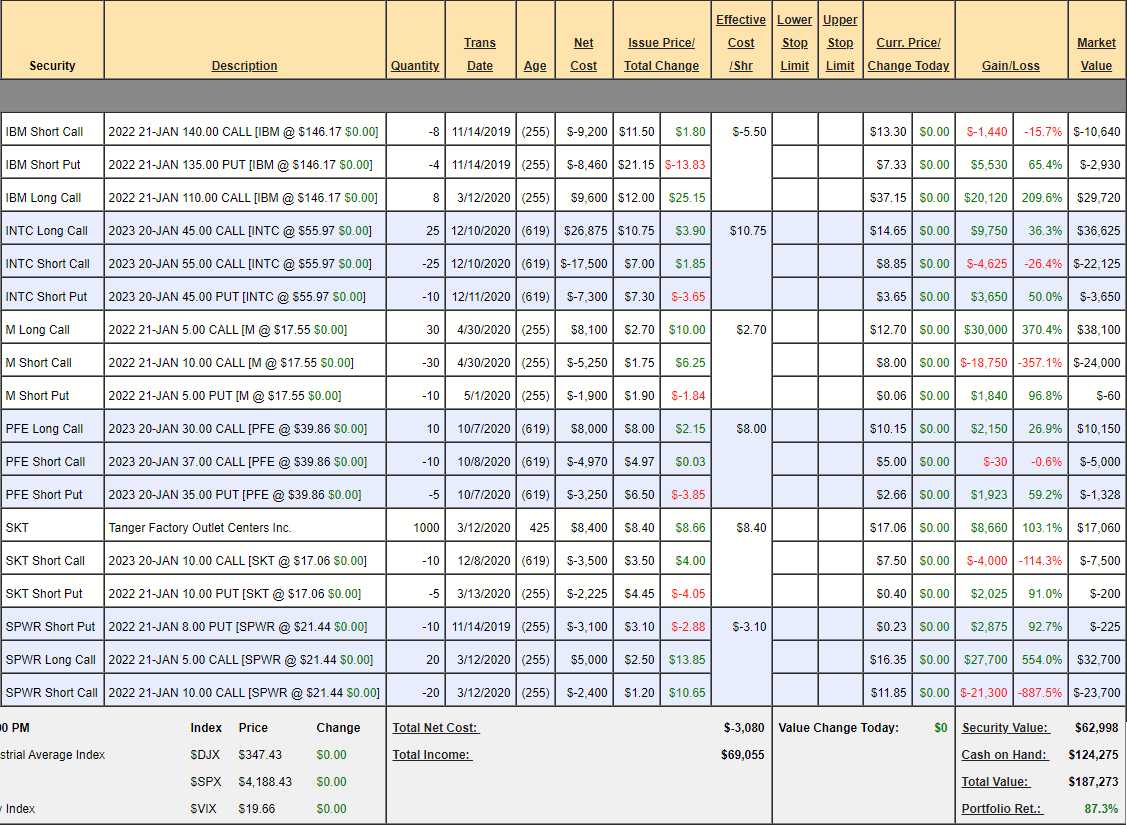

We cashed out GOLD and VIAC and sold 10 SKT 2023 calls – those were all the moves we made for the quarter along with adding the Intel trade. I didn't want to hold any risk into the holidays, so we trimmed down and raised CASH!!! – just in case. It turned out just in case wasn't required but the positions were solid and, as of yesterday's close, the Money Talk Portfolio is at $187,273 – up $35,345 (23.3%) since December, which is really great as we only have 1/3 of our cash deployed. Overall the portfolio is up 87.3% from our $100,000 start in November of 2019.

- IBM – This is a $24,000 spread currently at net $16,150 so $7,850 left to gain and we're confident in our target.

- INTC – Our Trade of the Year so we're confident and it's a recent $25,000 spread that's currently net $10,850 so $14,150 left to go is still nice for a new trade but much nicer if you caught our original net $2,075 entry.

- M – Though I'm very confident we'd collect the full $15,000 potential on this spread, it's currently at $14,040 so there's really no sense in waiting 7 more months to collect – we'll cash this out.

- PFE – This trade pays $7,000 at $37 and we're already over target and the spread is currently net $3,822 and we're very confident in PFE with $3,178 left to gain.

- SKT – Blasted higher on us so no worries and our best upside case is $10,000 and it's at net $9,360 but they are also paying us a $177.50 dividend on April 29th, so there's no reason to sell it as we don't need the cash. So it's $640 + 3x $177.50 = $1,172.50 left to gain.

SPWR – Came down a lot but still deep in the money for us. It's a $10,000 spread at net $8,775 but let's cash this one in and reposition as follows: Sell 5 2023 $20 puts for $6 ($3,000). Buy 15 2023 $15 ($8.50)/25 ($5) bull call spreads at net $3.50 ($5,250). That's net $2,250 on the new $15,000 spread so a much better use of our $8,775 than just waiting to make $1,225 more. Upside potential is now $12,750 AND we put $6,525 back in our pockets.

Our existing positions then, have $39,103.50 in profit potential but we'd like to make a bit more than that so let's look at a couple of great value plays we can add and, in this case, we're adding them back in as we've already had them in our portfolio – they've simply become cheap enough to re-enter. We have $124,275 in CASH!!! and some more we're adding from the changes above so lot's of room to add positions.

Viacom (VIAC) has been on a wild ride and became insanely over-valued in March and then collapsed and is now back to being a bargain at $38.66, which is only $25Bn in market cap for a company making about $2.5Bn a year in profits so a p/e of 10 is very comfortable in an industry (broadcasting) that's fairly inflation and recession-proof. To play this one, we're going to go with:

- Sell 10 2023 $35 puts for $7 ($7,000)

- Buy 20 2023 $30 calls for $13.50 ($27,000)

- Sell 20 2023 $45 calls for $7.25 ($14,500)

That's net $5,500 on the $30,000 spread so we're adding $24,500 (445%) in upside potential. Keep in mind that, should VIAC fall below $35, we are obligated to buy 1,000 shares at $35 if assigned so, only if you really, Really, REALLY want to own 1,000 shares of VIAC for net $40.50 (more than the current price as we sold aggressive puts), you should not sell 10 short puts. We like the stock enough to not mind owning it long-term using about 10% of our portfolio's buying power.

Our next stock was our 2020 Trade of the Year, which did so well we exited early but now Barrick Gold (GOLD) has come back down to the $20s and we love them long-term as a great inflation hedge. $23.80 is $42.3Bn in market cap and GOLD made $2.3Bn last year so 20x earnings but the price of gold is going up and also, ABX has 13Bn pounds of copper ($52Bn) and 68M ounces of gold ($122Bn) so that, less the cost of pulling it out of the ground, is a lovely asset backing up the value.

- Sell 10 GOLD 2023 $23 puts for $3.75 ($3,750)

- Buy 25 GOLD 2023 $20 calls for $5.75 ($14,375)

- Sell 25 GOLD 2023 $27 calls for $3 ($7,500)

Here we're using net $3,125 in cash for the $17,500 spread so there's $14,375 (460%) of upside potential and our obligation is to own 1,000 shares of GOLD at $23 and, if we also lose the $3,125, our net cost would be $26.13, 10% above the current price.

So our two new trades have used just $8,625 or our $125,000(ish) in cash and we've given ourselves another $38,875 in profit potential along with the $39,103.50 from our existing positions so that $77,978 in upside potential over the next 18 months or roughly $4,000 per month of expected gains if we're going to be "on track". December was 5 months ago and we made $35,000 so it's been a good start to the year but it's not likely to continue at this pace – which is why we have a very healthy amount of cash left to deploy.