Here we are again.

Here we are again.

Back on May 3rd, our self-explanatory headline for the Morning Report was: "Monday Market Movement – Dow 34,000, S&P 4,200, Nasdaq 13,900 – Again" and, this morning, we're at 34,346, 4,169 and 13,385 respectively. The Dow is up 1%, S&P flat and the Nasdaq is down 3.7% respectively. The Dollars those indexes are priced in, however, have lost 1.5% of their buying power during the same two weeks as our currency is teetering on the cliff of the May lows.

This is the stealthy way the market can take your money when you don't realize it – especially in an inflationary environment – so we need to keep on our toes. For example, I could have traded a $32 shares of AT&T (T) for 10 gallons of Gasoline (/RB) on May 3rd but now I'd be lucky to get 9 gallons for the same share. I would have needed 55 shares of T to trade for an ounce of gold at $1,760 but now I need 58.33 shares at $1,867.

You can delude yourself that your portfolio hasn't lost any money but losing buying power is the same thing.

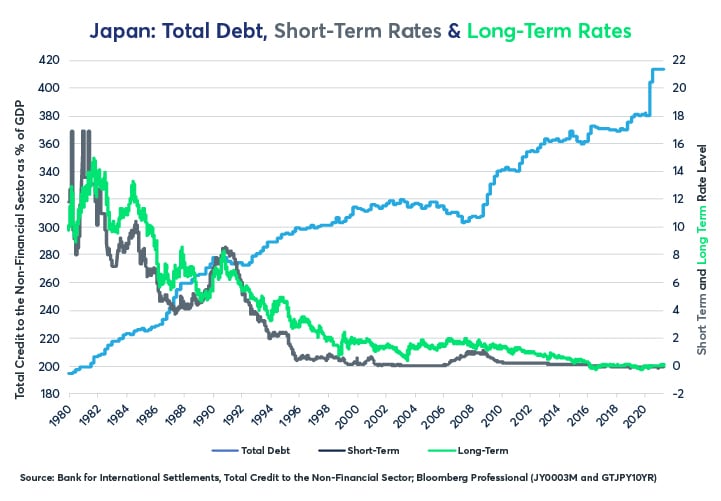

Japan's unstimulated (in Q1) GDP fell 5.1% and that's very likely where we'd be without $2Tn being added to ours in March. Japan is the World's 3rd largest economy at $5Tn but they are the king of debt at $13.5Tn, which is 270% of their GDP after adding 20% last year alone. As long as people are still willing to lend Japan money, I'm not too worried about the US as our own $28,000,000,0000,000 in debt, which is "only" 140% of our own GDP. Japan will be our canary in the Debt coal mine but take that warning seriously when it does come.

Japan's unstimulated (in Q1) GDP fell 5.1% and that's very likely where we'd be without $2Tn being added to ours in March. Japan is the World's 3rd largest economy at $5Tn but they are the king of debt at $13.5Tn, which is 270% of their GDP after adding 20% last year alone. As long as people are still willing to lend Japan money, I'm not too worried about the US as our own $28,000,000,0000,000 in debt, which is "only" 140% of our own GDP. Japan will be our canary in the Debt coal mine but take that warning seriously when it does come.

Of course, the reality Japan does have to face is that they can't really afford to add more stimulus as they get dangerously close to the 300% mark in debt to GDP (and already past it in Total Debt) and only the fact that they are getting away with paying 0% on their bonds is keeping that island nation afloat on their sea of debt. Imagine if they paid 5% interest on $22Tn in total debt – that would be over $1Tn in Debt Payments – which would be 20% of the GDP just going to pay interest on the debt.

The US GDP is $20Tn and our debt is $28Tn so 5% would be $1.4Tn but don't forget taxes are only $3.5Tn, or 17.5% of GDP so, at 5%, 1/2 of all US Taxes collected would just go towards interest payments on our debt. What are the choices at that point? The Government can cut spending, but Discretionary Spending is less than $1Tn so that still wouldn't be enough, which brings us to: Raise Taxes.

Since taxes are now $3.5Tn and we currently spend $400Bn servicing our debt, an increase of $1Tn would require a 33% increase in taxes. Joe Biden is trying to address this problem now – before we get into the situation where we're paying 5% on our debt while the Republicans, of course, want to ignore the problem and continue not paying taxes until the crisis is so terrible that it won't be possible to deal with so we'll just give up and not try – like Climate Change!

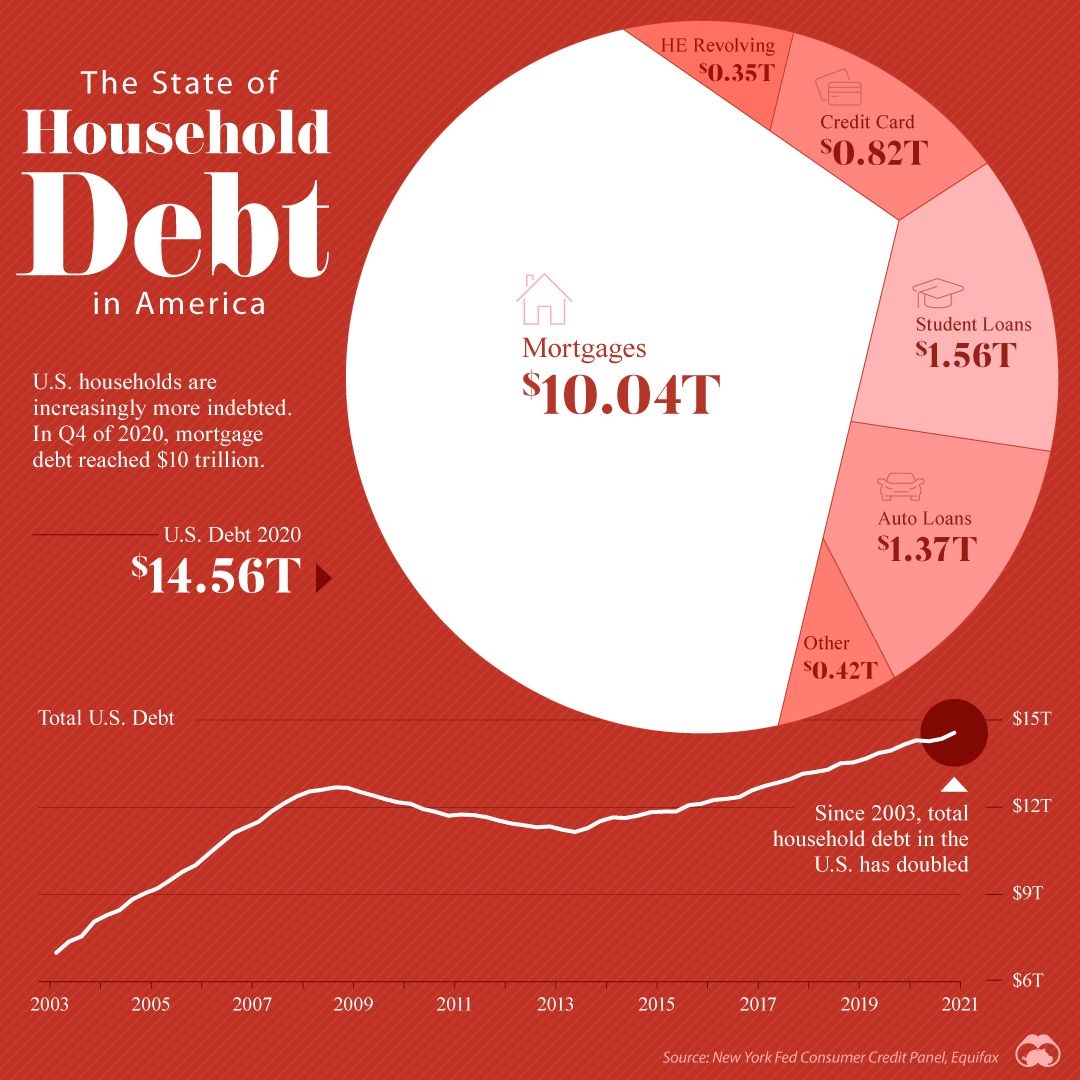

Meanwhile, how screwed are US Families going to be of rates start ticking higher? Low interest rates have also sent Household Debt flying to the moon, just under $15Tn now and 5% of that would be $750Bn, enought to reverse ALL of the stimulus checks handed out in 2020. How do you think the economy would do with a reverse-stimulus in place?

As I said though, we can ignore this until Japan and Italy begin to explode – then I'd get concerned. For now, it's just best to keep this in the back of your mind – like a pilot light – so you remember not to over-commit to things you can't unwind in your portfolio and general investing because Greece was fine, with an A-level credit rating, paying 5% on 10-year bonds – until suddenly it wasn't – and then things fell apart very rapidly and rates went as high as 45% until the bondholders agreed to take cuts to resolve the crisis.

Fortunately for the US, we haven't dealt with a 5% interest rate on our 10-year note since 2007 since, unlike Greece, we have our own Central Bank who can control our interest rates (until they can't – see "Armageddon") but the price we pay for controling rates is inflation – which is simply another way of taxing away your money – it just doesn't seem like a tax, so people don't complain as much or, more importantly, vote you out of office for it.

Fortunately for the US, we haven't dealt with a 5% interest rate on our 10-year note since 2007 since, unlike Greece, we have our own Central Bank who can control our interest rates (until they can't – see "Armageddon") but the price we pay for controling rates is inflation – which is simply another way of taxing away your money – it just doesn't seem like a tax, so people don't complain as much or, more importantly, vote you out of office for it.

Of course, once inflation is no longer "transitory", the bondholders do demand a rate of return that matches inflation and that's where things begin to fall apart – especially when our plan for 2021 is to be about $2Tn more in debt – getting to that $30Tn mark early next year. The Fed is already buying 50% of our debt and we like to pretend that the Fed's $10.3Tn balance sheet is not just more debt but the "asset" on that balance sheet is mainly US notes and what happens to the value of notes when rates rise?

If you have a 10-year note that pays 2% you are going to get $120 back on your note over 10 years and you can sell that note for $100 BUT, if you are holding that 2% note and inflation is 5%, then you are actually losing 3% per year and the value of your note if you have, for example, 7 years left, will drop by 3% x 7 years or 21%. The Fed is not exempt from that math problem and, if their $10.3Tn in notes take a 20% hit – that's a $2Tn hit to Treasury which means more debt for US and it will make it more difficult for us to borrow more money – right when we need another $2Tn!

So let's watch our canaries and keep one hand firmly on the exit as we review our Member Portfolios this week. We need to make sure we love our stocks enough to ride out a 20% correction and we already bumped up our Short-Term Portfolio (STP) hedges in Friday Morning's Report ("TGIF – Hedging for Disaster with our Short-Term Portfolio Review") to make sure we don't get caught. This morning we have nice earnings from WalMart (WMT), Home Depot (HD), Macy's (M) and Bidu (BIDU) also knocked it out of the park as people spent those stimulus checks in Q1.

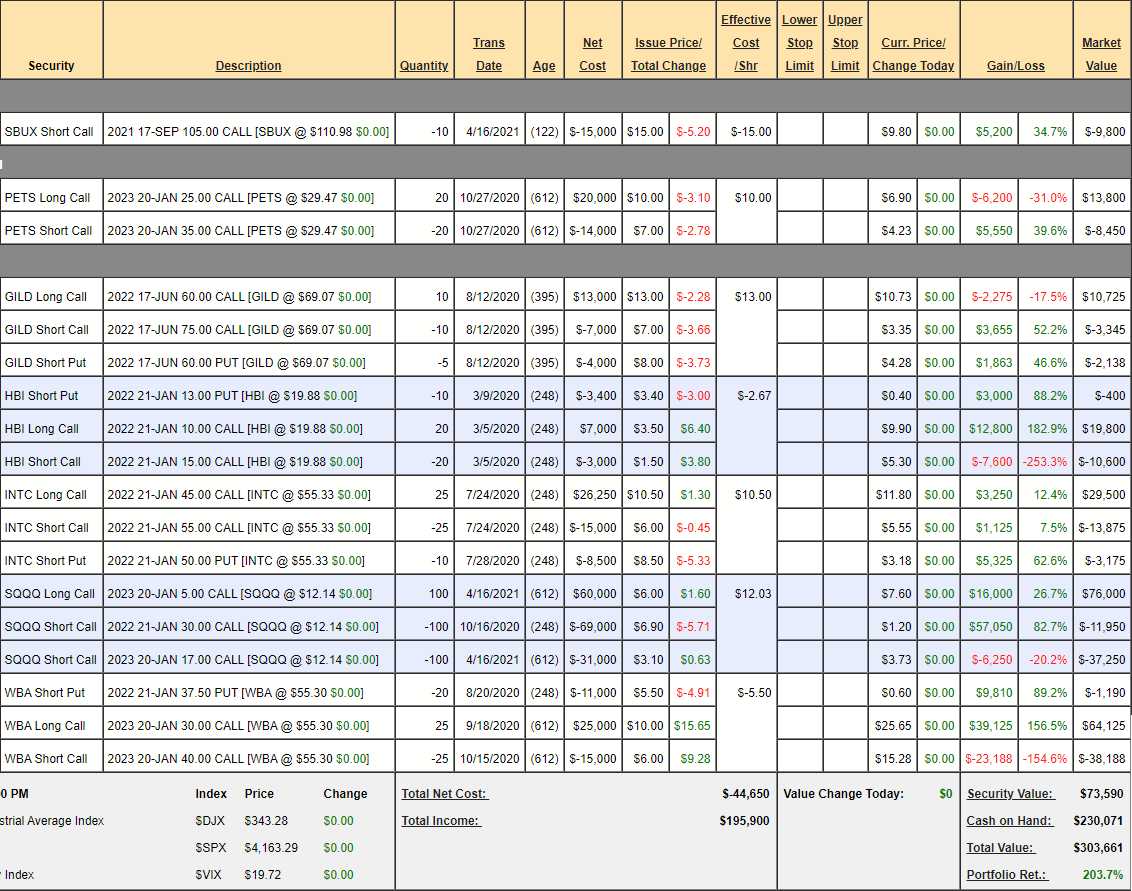

We can start this morning with our Earnings Portfolio Review, which we last looked at on April 16th at $287,486 (no changes since) and now stands at $303,661 which is up $16,175 for the month – that's the way to keep up with inflation! We cashed out some positions last time and now have $230,071, more than 2/3 of the portfolio in CASH!!!, so we are very comfortable here and ready to buy if we see some notable bargains this earnings season.

- SBUX – As noted last time, if the earnings were great, we'd add a bull call spread to protect ourselves but SBUX actually missed on revenues despite the stimulus and the re-opening and $110 is still unrealistic as that's $130Bn for a company that will be lucky to make $3.5Bn this year and made $4.5Bn in it's best year (2018), so this is a RIDICULOUS 28.8x best possible earnings – and not one is projecting those again this year or next. So this is a bet on reality with $9,800 in potential gains.

- PETS – May as well take advantage of the dip and sell 10 of the 2023 $30 puts for $8 ($8,000) as that's net $22 and puts more cash in our pockets. That leaves us with a net $2,650 credit on the $20,000 spread so $22,650 upside potential if we can get back over $35 in 18 months. Obviously good for a new trade (I hope!).

- GILD – This one is right on track for our full $15,000 and currently net $5,242 so $9,758 (186%) left to gain would be the trade of the year for most newsletters but, at PSW – it's just the leftovers from our $2,000 net entry, which is already up $3,242 (162%) in our first 9 months.

- HBI – Here we have a $10,000 spread that's already net $8,800 but, if we don't buy back the puts and close the bull spread at $9,200, we have that cash and another $400 left to gain, so let's do that!

- INTC – Our Trade of the Year pulled back to our goal but that goal is for January, so no worries. It's a $25,000 spread currently at net $12,450 so $12,550 (101%) left to gain.

- SQQQ – This is a self-balancing portfolio with it's own private hedge and this one is a $120,000 spread at net $26,800 AND half in the money. so pretty cheap protection – very good for a new hedge. Just be warned we're using a trick of selling 2023 calls against 2022 longs – but look how well it's working so far!

- WBA – I can't believe how hard I used to work to convince people to buy this thing! Very strong now and miles over our target. It's a $25,000 spread at net $24,747 so let's take the bull call spread off the table and leave the short puts with $1,190 left to gain.

So we've raised another $42,200 in CASH!!! and we still have $56,348 left to gain on our longs using less than 15% of our cash and about 20% of our buying power. We're also very well protected with our $100,000 (upside) hedge so we'll be looking for things to add in this portfolio like VIAC, who we may as well add now:

- Sell 10 VIAC 2023 $30 puts for $5 ($5,000)

- Buy 20 VIAC 2023 $35 calls for $10.70 ($21,400)

- Sell 20 VIAC 2023 $50 calls for $5.60 ($11,200)

That's net $5,200 on the $30,000 spread so $14,800 (285%) of upside potential gives the whole portfolio 25% more upside for just $5,200 in cash along with the promise to buy 1,000 shares of VIAC for $30, which is 25% below the current price.

This is how you build a portfolio that outperforms the market. NOT by chasing after momentum stocks but by taking sensible positions in blue chip companies that are undervalued and using our options to hege and leverage the position, minimizing our cash exposure, increasing our diversity and keeping ourselves flexible for changing market conditions.

By knowing exactly how much money we expect to make from each position, we always know at a glance whether our portfolio on the whole is on or off track. That's a nice, relaxing way to play the market – and stay ahead of inflation.