Here we are again.

Here we are again.

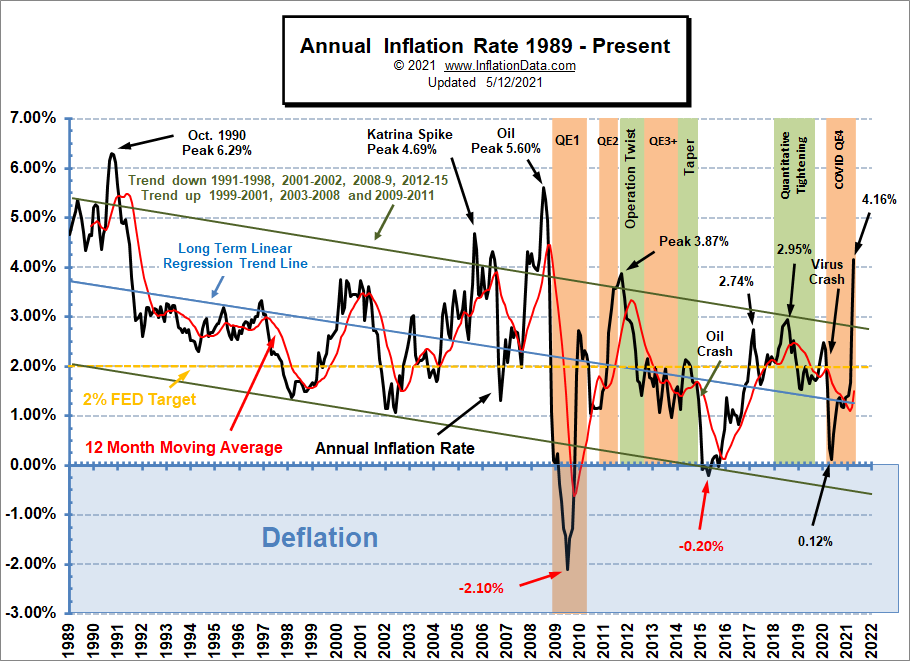

Last week, on "13,000 Thursday – Nasdaq Poised to Fail Critical Support" we talked about the non-transient inflation and how it will EVENTUALLY become an overriding concern for the markets. Based on that macro and getting into the 2nd half of earnings, where the small caps begin to tell tales of woe AND based on the ridiculous valuations in the leading stocks, I had this to say:

The Nasdaq faces a critical test of the 13,000 line and, after falling from 14,000, a weak bounce is at 13,200 and a strong one at 13,400. Finishing the week below 13,400 indicates we're likely to fail 13,000 next week – continuing the downtrend. In an early sign of a bursting bubble, tech stocks that don't actually make money yet (the kinds I keep telling you to stay away from) have fallen almost 20% this year.

As you can see from the chart, we tested 13,400 on Friday and again yesterday, before plunging back to 13,000 where, according to the 5% Rule™, we are likely to fail (after a bit more bouncing) and then on our way to 12,000 with a hopefull pause at 12,500 (the 200 dma) that will really excite the dip buyers. I will do my best to seem surprised when I write about it next week. I mean, who could have seen it coming?

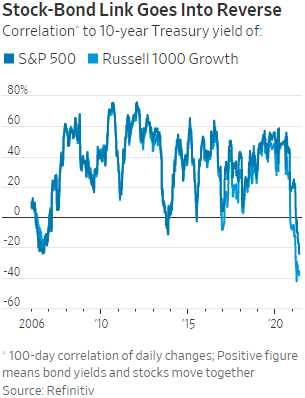

Yesterday we discussed our SQQQ hedge in our Earnings Portfolio and that is still probably the single best hedge you can have in this market. It's about to get a lot more expensive so do make sure you have some sort of protection in your portfolio – just in case. As we also noted yesterday, the economy is at a bit of an inflection point here, where the gains from the economy are offset by the threat from the Fed, and that seems to be about 4%. Higher bond yields switch from being good for stocks to being bad for stocks, and the market focuses on the danger of inflation.

Yesterday we discussed our SQQQ hedge in our Earnings Portfolio and that is still probably the single best hedge you can have in this market. It's about to get a lot more expensive so do make sure you have some sort of protection in your portfolio – just in case. As we also noted yesterday, the economy is at a bit of an inflection point here, where the gains from the economy are offset by the threat from the Fed, and that seems to be about 4%. Higher bond yields switch from being good for stocks to being bad for stocks, and the market focuses on the danger of inflation.

The 4% logic isn’t written in stone, but it has reasonable historic support. Since the S&P 500 was created in 1957 U.S. inflation has risen above 4% nine times, and in eight of those cases stocks were lower three months later. The exception, in 2005, saw inflation fall back below 4% again almost immediately, calming investors. There is also the problem of stocks being extremely expensive. When bond yields finally started to rise and the 1960s boom ended, there was hell to pay for investors: The S&P lost more than a third of its value over the next 18 months. In 1987 the extreme run-up in stocks ended in a crash shortly after inflation passed 4%. In 2007 the bubble was in commodities, housing and debt rather than stocks, but the start of the decline in the S&P coincided almost exactly with inflation passing 4%, before turning into a financial crisis.

When is the last time we had record-high market values and rising inflation? That's right, early 2008 – and they told you all was well then too – even after it clearly wasn't. I bring up that clip (link) often as it's something we should never forget. The analysts were all wrong, the media was flat-out lying to you – as were the politicians and people kept their money in the markets way too long – despite obvious signs of a bubble. Be smarter this time.

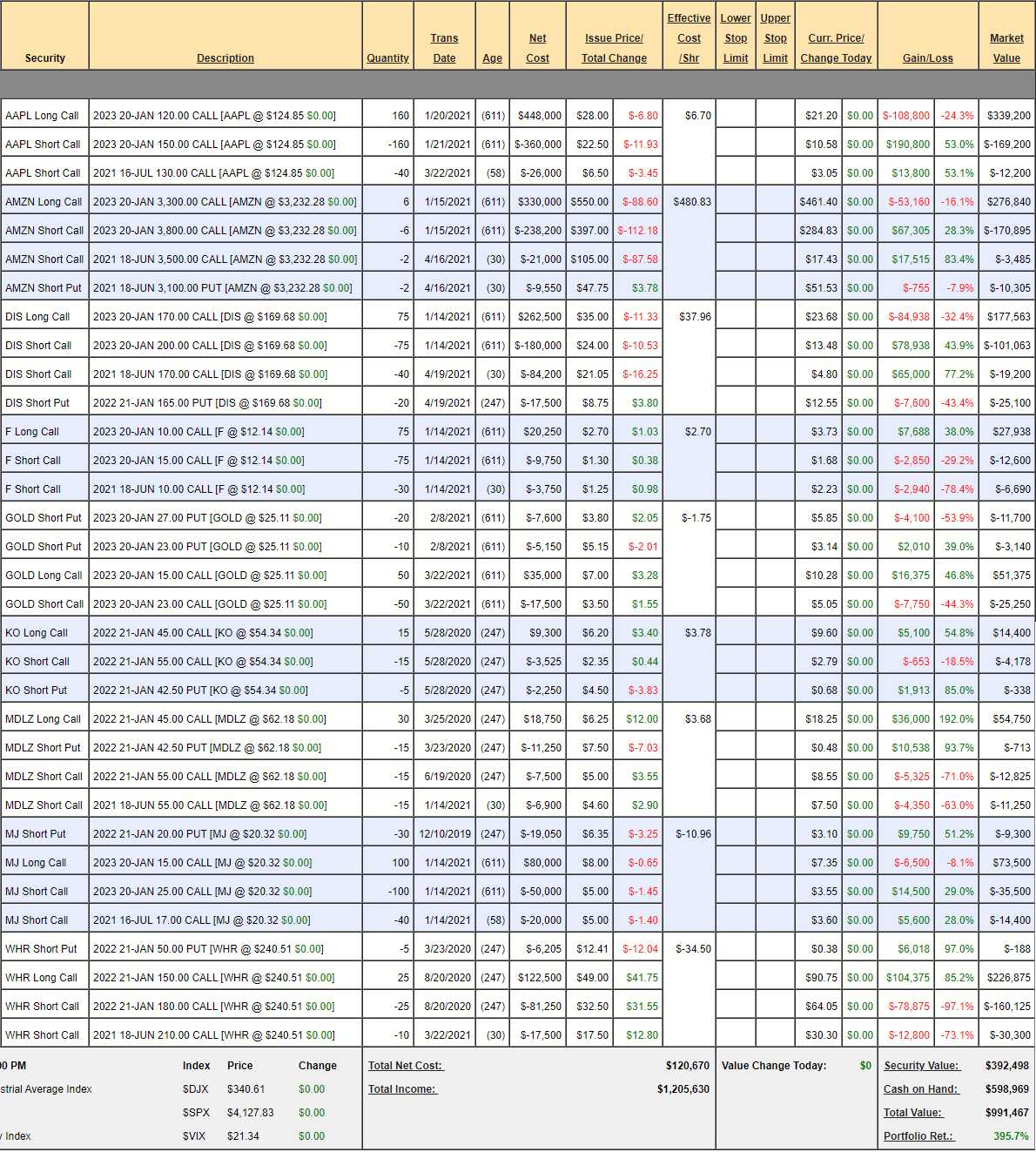

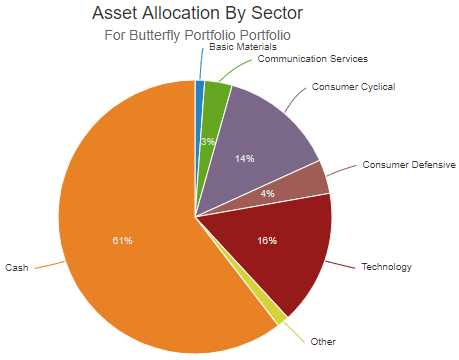

Let's do a review of our Butterfly Portfolio, which should be easy as we didn't change a thing last month, when we were at $958,287 and, as of yesterday's close, we're at $991,467 so up $33,180 for the month – not bad for a low-touch portfolio – or no touch in this case:

- AAPL – Looks like selling the July $130 calls was a good play. If we get a better dip, we might sell some 2023 $100 puts as well. They are currently $7.75 and the $110 puts are $11.30 and the $120 puts are $16 so let's say $15 for the $100 puts would net us in at $85 – that's a great target (if we get there). Selling 40 of those for $60,000 would be enough money to roll our $120 calls to the $110 calls and then we could get a bit more aggressive with our short call selling (when it bounces back). So that's the plan!

- AMZN – We're threading the needle on our short puts and calls and we're going to roll the losing side so I'm not worried though I won't be suprised if AMZN can't hold $3,000. It should at least be bouncy and we'll sell more short calls if we get worried.

- DIS – We wisely did not sell too many short puts and the short calls finally paying off would be fantastic.

- F – The short calls blew us out but fortunately we're 150% over-covered so we'll be fine. At the moment, they are simply protecting the gains on our bullish spread, which has a lot more room to run.

- GOLD – You would think they'd be doing better. Earnings are on the 27th and we're agressively bullish here with no short-term short calls.

- KO – Earnings were good but not good enough to top $55 so let's do our job and sell 10 July $55 calls for $1 ($1,000) while we wait for next earnings.

MDLZ – A bit over our target but nothing to worry about as our longs are only half-covered. In fact, this is a good time to sell 5 June $60 calls for $2.65 ($1,325) as I expect a pullback.

- MJ – We were getting burned on the short July calls but things have calmed down. This is why we don't panic. Patience is key to this strategy.

WHR – Earnings were great but not $250 great. Still $210 is a bit low so let's take advantage of today's dip and buy back the 10 short June $210 calls for $27(ish) and sell 20 of the June $330s for $13(ish) so a near-even roll but pushes the strike $20 higher. If WHR does break over $250, we'll add another bull call spread to cover (that's how we ended up with so many AAPL spreads).

Well, a few changes this time but I think we're in pretty good shape. Hard to complain after such a good run. Unlike our other portfolios, we don't really have targets for gains as our goal here is to simply sell a lot of premium and collect our money as it expires because the decay of all premium to zero is the one sure bet you can make in the markets. This portfolio currently has $101,140 of short-term short puts and calls that will mostly expire in June. Think about that…

Well, a few changes this time but I think we're in pretty good shape. Hard to complain after such a good run. Unlike our other portfolios, we don't really have targets for gains as our goal here is to simply sell a lot of premium and collect our money as it expires because the decay of all premium to zero is the one sure bet you can make in the markets. This portfolio currently has $101,140 of short-term short puts and calls that will mostly expire in June. Think about that…

We don't make 100% on every short but we don't have to, not when we're doing that every quarter. This portfolio began in Jan, 2018 so this is year 4 and that means we've won about 50% of our premium bets to end up $800,000 ahead. Since we sell puts AND calls – that kind of makes sense, doesn't it?

Join us later for our Live Trading Webinar (1pm, EST), where we'll discuss this strategy further.