"Standing in the middle of nowhere,

Wondering how to begin.

Lost between tomorrow and yesterday,

Between now and then.And now we're back where we started,

Here we go round again.

Day after day I get up and I say

I better do it again.Where are all the people going?

Round and round till we reach the end.

One day leading to another,

Get up, go out, do it again." – Kinks

It feels like something happened this week but it didn't.

It feels like something happened this week but it didn't.

The S&P began the week at 4,170 and we're at 4,170 this morning. The Dow is 100 points lower, which is a 5-minute move these days, the Nasdaq is surprising us at 13,500 as we thought 13,400 (the strong bounce line) would be as high as it goes and the Russell is right back to 2,220 – also no change at all.

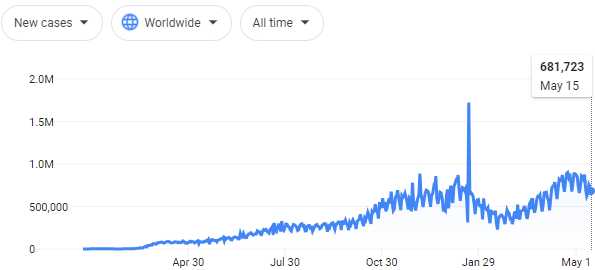

I guess we could say that means that earnings are coming right in-line with expectations and everything was priced right – more or less. Yeah, let's go with that…. I thought Robert Kaplan's comments on inflation would be of more concern to traders but nothing concerns traders – certainly not India breaking Donald Trump's record (4,400) for covid deaths in a single day with 4,500 killed by Modi's negligence. Like Trump, Modi decided ignoring the virus was the way to go but, unlike Trump, no one removed him from office before it was too late (Trump hit his record for killing US Citizens just before being dragged out of office in January).

In the US yesterday, "only" 675 people died of Covid and "only" 28,935 people were newly infected. While it's a huge improvement over the hundreds of thousands of new cases per day we had in January – it's still a little early to celebrate. We have lost our capacity to care about death and disease, apparently – as long as it doesn't happen to us we just move right along. India still hasn't caught up to the US with only 26M cases (vs 33M) and "only" 291,000 deaths (vs 587,000) but they'll get there pretty soon with 300,000 infections per day – next month, in fact, if things don't turn around soon.

In the US yesterday, "only" 675 people died of Covid and "only" 28,935 people were newly infected. While it's a huge improvement over the hundreds of thousands of new cases per day we had in January – it's still a little early to celebrate. We have lost our capacity to care about death and disease, apparently – as long as it doesn't happen to us we just move right along. India still hasn't caught up to the US with only 26M cases (vs 33M) and "only" 291,000 deaths (vs 587,000) but they'll get there pretty soon with 300,000 infections per day – next month, in fact, if things don't turn around soon.

I'm well aware no one wants to hear about the virus anymore but the Fed is still saying it's the top danger to the US and Global economy. Varients like we're seeing in India could make their way over here and less than half our population is vaccinated and about 1/3 of the population refuses to be vaccinated. Covid currently has infected 10% of the US population so, if 33% refuse to be vaccinated, then 1/3 people you come in contact with next flu season may have Covid – it will always be around – always a danger unless we change our policies and force vaccinations.

There are also Global Food Shortages and other things the US media barely covers, lest we take away from the "Everything is Awesome" narrative that's the backbone to the recovery – which starts with Consumer Sentiment. The Government is exhausted from borrowing all that money so now they want to make sure we take our turn getting back into debt restarting the economy.

There are also Global Food Shortages and other things the US media barely covers, lest we take away from the "Everything is Awesome" narrative that's the backbone to the recovery – which starts with Consumer Sentiment. The Government is exhausted from borrowing all that money so now they want to make sure we take our turn getting back into debt restarting the economy.

Food prices have jumped by nearly a third over the past year, according to the Food and Agriculture Organization of the United Nations, even as pandemic-related job losses are making it harder for families to afford basic staples. Corn prices are 67% higher than a year ago, the FAO says, while sugar is up nearly 60%, and prices for cooking oil have doubled.

“What is unique about this time is that prices are going up, and at the same time people’s incomes have been decimated,” said Arif Husain, chief economist at the United Nations World Food Program. “The combination of the two, rising prices and no purchasing power, is the most lethal thing you could deal with.”

Rising hunger in countries such as Honduras and Guatemala, meanwhile, is a big reason behind the wave of migrants arriving at the U.S. southern border in recent months, experts say. The number of people facing acute food insecurity jumped 20% in Guatemala and tripled in Honduras early this year compared with 2019, according to a report sponsored by the U.N.

Just another thing for us to ignore, right?

Have a great weekend,

– Phil