We held up well last week.

We held up well last week.

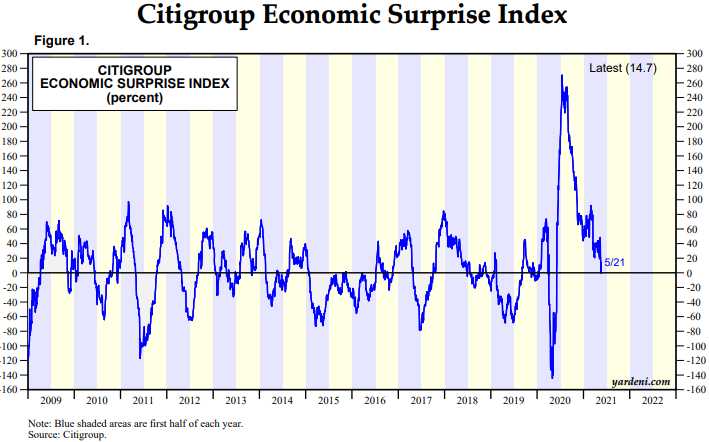

We thought the Fed would talk down the markets but it was pretty much the opposite with the Fed minutes indicating that they are nowhere near tightening policy, despite concerns about inflation. Also, it should be noted that, since that last Fed meeting, we've had terrible Payroll, Retail Sales and Housing Reports, with the Economic Surprise Index dropping to 1-year lows.

Nothing is beating expectations at this point – all the good news is baked in (hence, no "economic surprises") and that goes back to my toppy market theory – despite all the easing and all the stimulus – things that are already accouted for in our 35x Earnings average valuations for the S&P 500.

Should we be paying 40x or 50x for the average stock? Of course not but, if we're paying 35x now, then 40x is only 14% away – that's not a lot of growth ahead before even the most die-hard investor would have to admit that things have gotten way too expensive.

Should we be paying 40x or 50x for the average stock? Of course not but, if we're paying 35x now, then 40x is only 14% away – that's not a lot of growth ahead before even the most die-hard investor would have to admit that things have gotten way too expensive.

We spent last week reviewing our Member Portfolios and those are overwhelmingly invested in value stocks – the very few that remain in the market. If the overall market doesn't crash, we think we are in excellent shape to outperform the broader S&P 500 in 2021 – and 2022!

The markets are holding up amazingly well and inflation is really kicking in (and the Fed is doing nothing about it) so the markets could go higher simply because the buying power of the Dollar keeps declining and stock certificates are priced in Dollars but that doesn't change the Fundamental Rule that, at some point, those earnings need to inflate as well, in order to justify those sky-high valuations. We'll be sticking to stocks that have "pricing power" – the kind of companies that don't have a lot of trouble passing along their inflated costs.

It's going to be a slow, pre-holiday week but we're off to a great start as I said on Thursday afternoon to our Members:

Flip-floppy as it seems, I like oil (/CL) long at $62 with tight stops below and gasoline (/RB) long at $2.05 with tight stops below.

We ended up with 4 longs on each and we just hit goal at $65 but a very nice $11,500 gain on 4 long /CL contracts and $9,600 gained on 4 long /RB contracts – congratulations to all our Members who played along over the weekend!

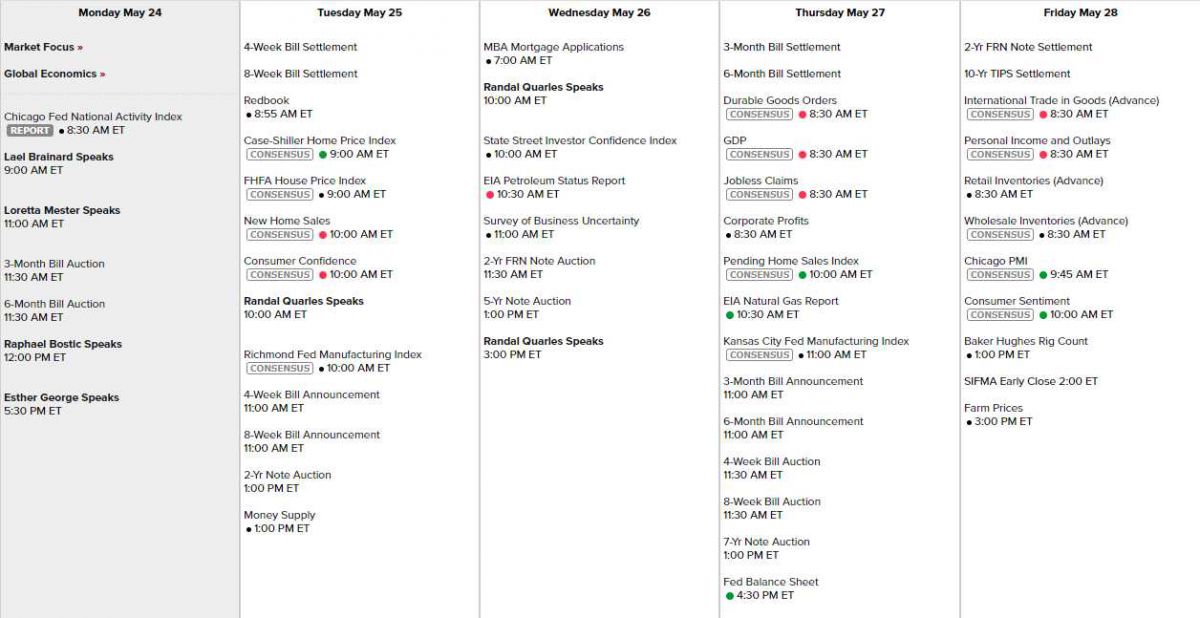

On the calendar this week, we have 7 Fed Speeches front-loaded through Wednesday and we have the Chicago Fed Report this morning followed byt Housing Numbers and Consumer Confidence tomorrow, along with the Richmond Fed followed by Investor Confidence Wednesday. Thursday it's the 2nd estimate of Q1 GDP (yawn) with Durable Goods and the KC Fed and Friday we've got Personal Income and Outlays, Consumer Sentiment and the Chicago PMI – we'll see if any of those are going to be a surprise into the Holiday Weekend.

There's still a lot of earnings reports ahead and lots of retail coming down the pike at this point. We're short the Retail ETF (XRT) in our Short-Term Portfolio, as we think many of the retail names have gotten very far ahead of themselves in expectations. Now we'll see.

| XRT Long Put | 2021 18-JUN 80.00 PUT [XRT @ $91.03 $0.00] | 70 | 3/31/2021 | (25) | $6,020 | $0.86 | $-0.23 | $0.86 | $0.63 | $0.00 | $-1,610 | -26.7% | $4,410 |